Be a part of Our Telegram channel to remain updated on breaking information protection

A just lately launched report from Santiment revealed a major accumulation development amongst wallets holding between 10,000 to 100 million Curve Finance (CRV) tokens.

This new revelation might have the potential to amplify the already current shopping for stress for CRV, thereby contributing to its upward trajectory, analysts state.

Whales Now Maintain 41% of the Complete Token Provide

CRV whales, who’ve traditionally held a good portion of the tokens, have capitalized on the latest value dip to extend their CRV holdings even additional. In a mere span of some weeks, their collective possession has surged from 33% to a powerful 41% of the entire provide.

Regardless of a substantial value drop since February, with CRV plummeting from round $1.2 to the present $0.58 vary marked by intermittent fluctuations, main token holders remained unfazed. Santiment’s report sheds gentle on the intriguing dynamics of this uncommon exercise.

Whereas it’d elevate issues of undue whale management, it’s price noting the optimistic facet of sturdy growth exercise on CRV’s GitHub repository. A median of 10-14 substantial GitHub submissions per day signifies a wholesome degree of engagement.

As of the current, CRV’s market capitalization exceeds $505 million, with roughly 10% of this determine being traded inside the final 24 hours. CRV features because the native token for the Curve DAO, a distinguished governance system within the present crypto panorama. Facilitated by the Ethereum-based creation device Aragon, the DAO interconnects a number of sensible contracts, which collectively handle customers’ deposited liquidity.

Subsequently, it turns into obvious that though there is likely to be a brief pause in shopping for exercise, ongoing help from the neighborhood will play a pivotal function in driving the continued enlargement of the native token and the broader ecosystem.

Value Might Dump within the Upcoming Weeks

The buildup of the CRV token by whales won’t bode properly for the ecosystem, as highlighted within the report. Santiment cautioned that the potential for CRV dumping stays a priority, particularly given the latest consideration drawn to information and ongoing actions inside the blockchain. The truth is, over the previous week, there have been 5 substantial transactions totalling greater than $10 million.

Notably, two of those transactions occurred between change addresses, a sign that additional dumping is likely to be on the horizon. Curve Finance has been mired in controversy, notably since Michael Egorov’s involvement in securing a $100 million stablecoin mortgage utilizing CRV tokens as collateral, which has led to authorized actions in opposition to the undertaking’s founder. Whereas the repercussions of this occasion have already impacted CRV’s value, developments like this accumulation by whales might probably contribute to further value drops sooner or later.

Main Transactions have been Made in August

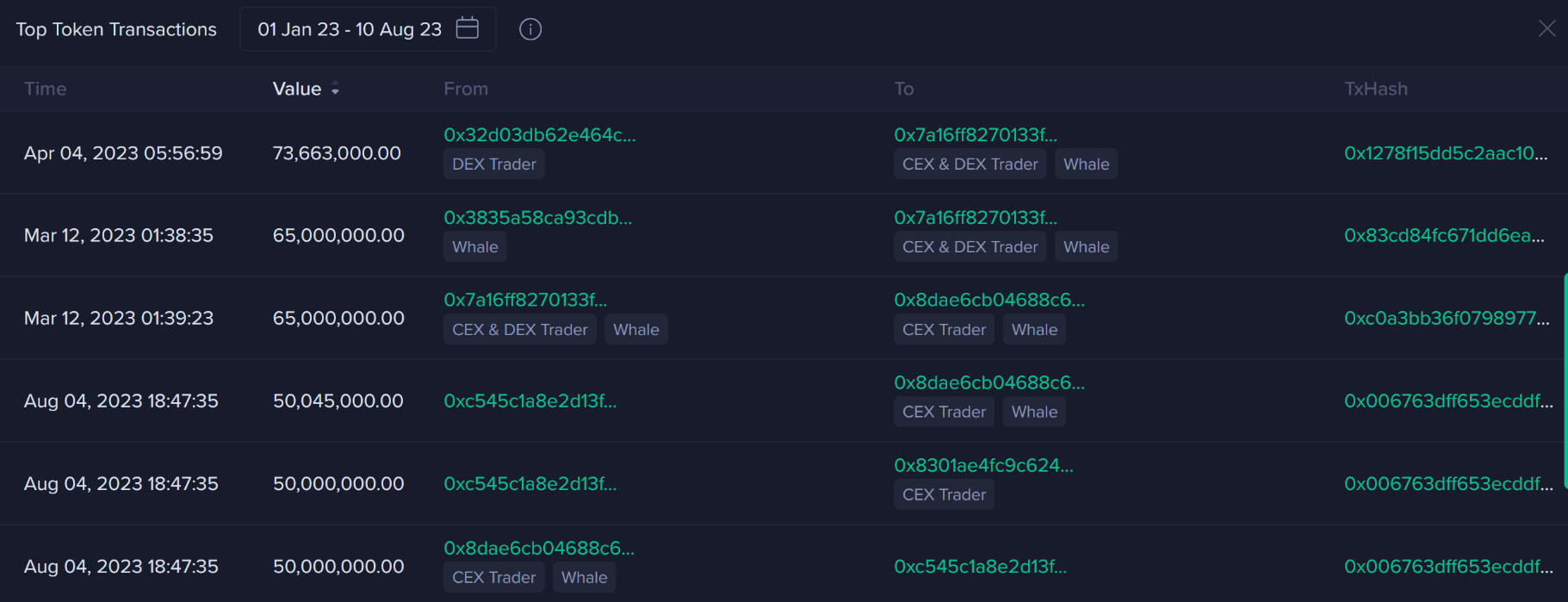

Santiment additionally reported a noteworthy remark concerning the latest token transactions on Curve. Surprisingly, three out of the six most important token transactions made all through 2023 befell on August 4th, all synchronously.

Intriguingly, two of those 5 transactions have been performed between change addresses, hinting at the potential for some promoting stress creeping in, regardless of the optimism conveyed by the earlier chart developments.

The truth is, this isn’t the primary time in latest weeks that Curve discovered itself grappling with appreciable promoting stress following a disconcerting revelation. An announcement from the group in July had emerged indicating a vulnerability inside the ecosystem, with potential penalties for over $100 million price of cryptocurrency. This unsettling state of affairs was attributed to a “re-entrancy” bug embedded in Vyper, a pivotal programming language powering sure elements of the Curve system.

A lot of stablepools (alETH/msETH/pETH) utilizing Vyper 0.2.15 have been exploited because of a malfunctioning reentrancy lock. We’re assessing the state of affairs and can replace the neighborhood as issues develop.

Different swimming pools are secure. https://t.co/eWy2d3cDDj

— Curve Finance (@CurveFinance) July 30, 2023

Regrettably, this bug had already been exploited by malicious hackers, resulting in the compromise of a considerable quantity of funds. The community, nonetheless, swiftly swung into motion to handle and rectify the problem. Regardless of these efforts, the broader neighborhood voiced their apprehensions, manifesting via quite a few feedback and posts throughout numerous social media platforms.

The incident, coupled with the latest revelation of whale exercise has absolutely served as a stark reminder for buyers of the undertaking to be conscious and up to date about their investments as a lot as they’ll on this ongoing bear market.

Associated Information

Wall Road Memes – Subsequent Massive Crypto

Early Entry Presale Reside Now

Established Group of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Greatest Crypto to Purchase Now In Meme Coin Sector

Workforce Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection