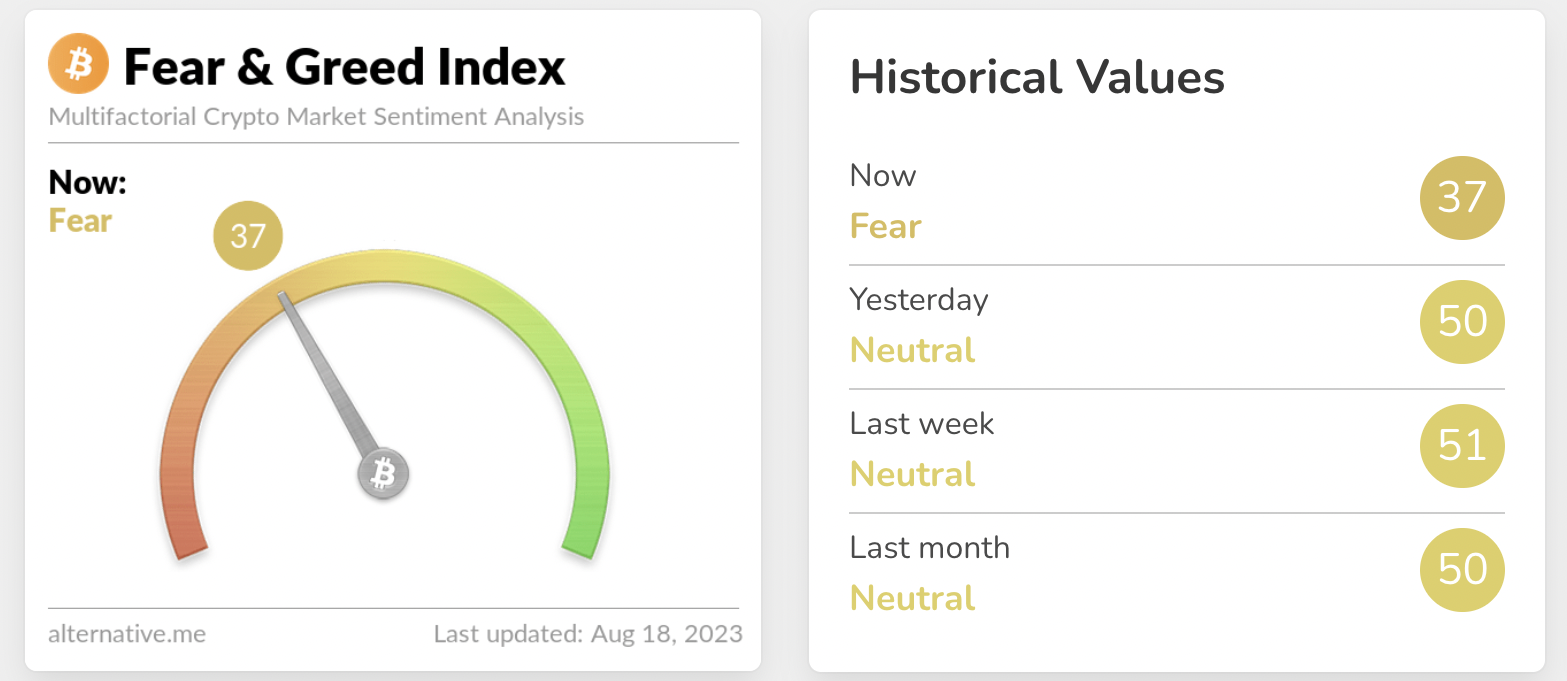

Bitcoin, the biggest cryptocurrency on this planet, has plummeted considerably prior to now 24 hours, resulting in a ripple impact amongst different cryptocurrencies. On August 18, the value of BTC abruptly dumped 8% in a matter of minutes, as rigidity from buyers elevated promoting strain.

Bitcoin has endured many crashes of this magnitude prior to now, and market corrections of this magnitude don’t come out of nowhere. So the latest plunge in BTC’s worth might be as a consequence of a number of elements within the crypto trade and the worldwide economic system. Listed below are some theories concerning the elements that will have exacerbated the latest crash.

SpaceX Reportedly Sells Off Its Bitcoin Holdings

SpaceX, Elon Musk’s aerospace firm, had reportedly offered off practically all of its Bitcoin holdings. SpaceX, along with Tesla, was one of some corporations that purchased Bitcoin in the course of the bull run in 2021. In line with studies, SpaceX held $373 million price of Bitcoin on its steadiness sheet in 2021 and 2022 however has now offered the cryptocurrency.

Though it’s unclear when and the way SpaceX offered its Bitcoin holdings, the information appears to have triggered promoting strain from buyers.

it’s humorous how them promoting final 12 months or no matter causes a crash now

— Shibetoshi Nakamoto (@BillyM2k) August 17, 2023

Fears Of Curiosity Fee Hikes By The Fed

The US is likely one of the largest markets for Bitcoin and up to date revelations from the minutes of the Federal Reserve’s July assembly trace at the opportunity of one other improve in rates of interest. The Fed controls rates of interest within the US, and after they hike charges, it may have a big influence on dangerous belongings like BTC.

Greater rates of interest result in elevated borrowing prices and better returns on protected investments like bonds, which can discourage buying and selling in dangerous leveraged positions inside the crypto house.

BTC worth suffers huge crash | Supply: BTCUSD on TradingView.com

Futures Liquidations And Crypto Whales Promoting Large

Knowledge from CoinGlass exhibits that the futures market has seen a flurry of liquidations prior to now 24 hours. The market witnessed the biggest futures liquidation this 12 months, as BTC witnessed liquidations of $498.88 million.

The information suggests many of the liquidated positions had been longs, which means merchants had been betting on Bitcoin’s worth to rise. Up to now 24 hours, the whole liquidations are available at $1.04 billion, with $308.89 million and $27.56 million additionally coming from ETH and XRP liquidations.

The Coinbase premium is up by +3%, implying some whales are dumping BTC on Binance. And when crypto whales promote giant quantities of BTC, it may flood the market and additional drive the value down.

Bankrupt Chinese language Property Big

China Evergrande, China’s second-largest property developer, lately filed for US chapter. This appears to have had some form of domino impact on the value of Bitcoin, because the chapter information got here on the cusp of the latest decline.

Do you assume that is in concern of evergrande and a domino impact or what may we be lacking?

— besadam.lens (@besada_m) August 17, 2023

Does This Indicate A New Wave Of Prolonged Bearish Sentiment For Bitcoin?

When Bitcoin crashes, it typically brings the remainder of the crypto market down with it. As such, the latest Bitcoin wipeout has led to a lower within the worth of different cryptocurrencies as effectively. Knowledge from Coinmarketcap exhibits that Bitcoin is at the moment down by 7.06% prior to now 24 hours. Main altcoin ETH, BNB, and XRP are additionally down by 5.77%, 5.19%, and 13.20%, respectively.

Bitcoin has had a unstable few months and has been struggling to cross over $30,000 this 12 months. However, its worth may rapidly rebound once more, significantly if the SEC grants approval to the newest purposes for Spot Bitcoin ETFs.

Featured picture from iStock, chart from TradingView.com