Introduction

A gaggle of shareholders of the Grayscale Bitcoin Belief (GBTC) have banded collectively within the first-of-its-kind activist marketing campaign organized by X (previously Twitter). Their purpose: bringing authorized motion in opposition to Grayscale in an try and power them to permit redemptions for buyer cryptocurrency held throughout the trusts it operates and to repay “exorbitant” administration charges.

Although initially a grassroots marketing campaign, one of many largest GBTC and Grayscale Ethereum Belief (ETHE) shareholders, Alameda Analysis, has filed a lawsuit in opposition to Grayscale with quite a few funds becoming a member of as plaintiffs: Fir Tree Companions, Saba Capital, Owl Creek Asset Administration, UTXO Administration and Aristides Capital. The criticism was filed in Delaware’s Chancery Court docket, with the assertion that Grayscale has breached its “contractual and fiduciary duties to Alameda and different belief buyers.” The particular trigger for criticism accuses Grayscale of charging extreme charges along with its refusal to permit for the redemption of bitcoin and ether. In line with the court docket paperwork, Grayscale has charged over $1.3 billion in charges within the final two years alone. The plaintiffs are in search of to claw again these funds in addition to renegotiate the charge construction of each GBTC and ETHE to “aggressive charges.”

The individuals within the Grayscale lawsuit created a web site as a way to collect further shareholders to affix their battle because of the belief paperwork which state that shareholders solely have the precise to deliver a case like this one in opposition to the belief if unaffiliated events collectively holding no less than 10% of excellent shares be part of collectively as co-plaintiffs.

The Grayscale Litigation web site has further particulars for these wishing to enroll to take part within the authorized battle or for these wanting to seek out out extra in regards to the marketing campaign. The preliminary deadline for becoming a member of the litigation is Sept. 1, with the final day by which Alameda is to reply to Grayscale’s movement to dismiss scheduled for Sept. 15.

The above is an summary of the case, however there are a number of associated entities and practically as many energetic lawsuits in opposition to the net of corporations that function and facilitate the belief, in addition to one present case in opposition to the Securities and Alternate Fee (SEC) introduced by Grayscale.

To totally perceive the complexities, it’s useful to step again and study the construction and formation of GBTC in addition to the occasions main as much as the lawsuits.

How Does GBTC Work?

Grayscale runs a number of cryptocurrency trusts with essentially the most well-known examples being GBTC and ETHE. These trusts function equally to one another, with Grayscale because the sponsor that manages the belief, together with administration charges and the way they themselves will be changed with a distinct sponsor. Shares of the respective trusts are issued by a certified participant. On this case, the licensed participant of those trusts was for a few years Genesis, an affiliate of Grayscale. Each corporations are subsidiaries of the identical mother or father firm, Digital Forex Group (DCG).

To ensure that shares to be issued, events needed to deposit bitcoin (or ether) with Genesis, which then positioned the property into the belief and created shares that have been locked up for a interval of six months. After this six month interval, the shares have been thought-about seasoned and have been in a position to be transferred to a different social gathering or bought within the secondary market.

These are at the moment one-directional trusts, that means that the bitcoin (or ether) solely goes into the belief and can’t at the moment be redeemed by surrendering shares. Whereas Grayscale has claimed that they don’t seem to be legally allowed to redeem shares, the authorized criticism says that the agency has contradicted this by admitting that Regulation M beneath federal securities legislation does in actual fact present approval for permitting redemptions as long as there isn’t any ongoing share creation.

Because the market grew, GBTC’s holdings peaked at roughly 650,000 bitcoin, the most important identified single holdings of bitcoin on the earth. The market worth of that bitcoin is value over $17 billion on the time of writing. No matter whether or not the shares are buying and selling at a premium or at a reduction, Grayscale receives 2% of the entire bitcoin holdings on an annual foundation as administration charges. This equates to roughly 13,000 bitcoin, or practically $350 million, in income from charges per yr, making Grayscale extraordinarily profitable. These charges don’t issue within the firm’s different cryptocurrency trusts. At present, there are roughly 624,366 bitcoin remaining within the belief.

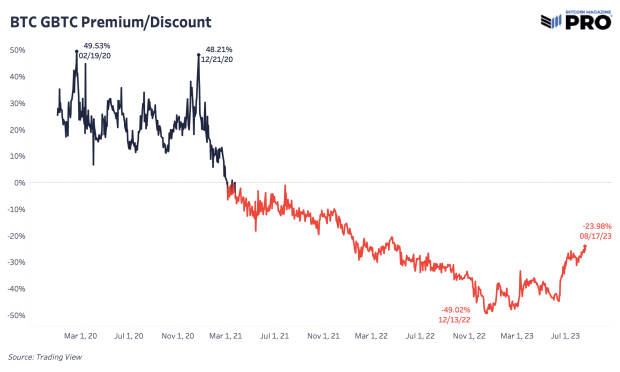

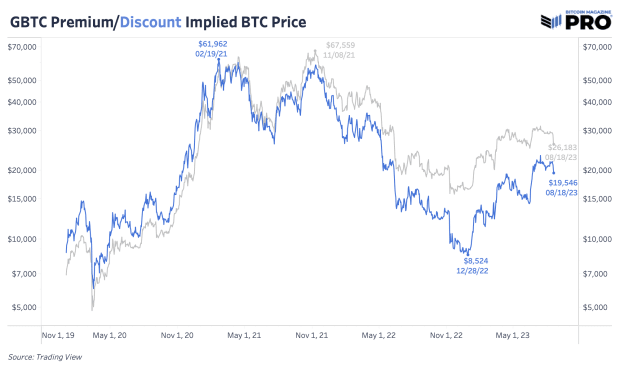

Previously, the value of GBTC loosely adopted the bitcoin worth, however because of the six month lockup interval, the share worth grew to become uncorrelated to the underlying bitcoin sitting throughout the belief. There have been instances when the belief traded at a premium of practically 50%, that means that the worth of a share was being valued a lot increased than the equal bitcoin held in belief. This was optimistic for shareholders who may promote their shares at a worth increased than the worth of the underlying asset. Nevertheless, in February 2021, shares not traded at a premium and as an alternative traded at a reduction under the online asset worth (NAV). At their lowest level, shares have been buying and selling at practically a 50% low cost and proceed to commerce at a reduction to today, costing shareholders billions of {dollars} in misplaced share worth worth.

Why Would Somebody Make investments In GBTC?

Bitcoin shouldn’t be typically traded in conventional brokerage accounts, so buyers who primarily commerce by institutional exchanges, comparable to Charles Schwab or TD Ameritrade, wouldn’t be capable to use their funding portfolio to buy bitcoin. This consists of these with 401(okay) or particular person retirement accounts.

Since there’s not at the moment a spot bitcoin ETF for buyers to get publicity to bitcoin, and particularly throughout the instances when GBTC was buying and selling at a premium, shopping for shares in Grayscale’s belief was touted as a clever funding. In the event that they wished to speculate instantly in bitcoin, the one different possibility for buyers with retirement accounts can be to liquidate their accounts and pay an early withdrawal penalty earlier than with the ability to purchase bitcoin on an alternate with the not tax-advantaged funds.

From its inception, Grayscale has all the time said its intention to transform the belief into an ETF and is in energetic litigation in opposition to the SEC about this matter. An ETF product within the U.S. has to get approval from the SEC, whereas the corporate’s present belief construction doesn’t require the identical degree of regulatory approval. Grayscale created this belief to permit folks to purchase bitcoin who in any other case wouldn’t be capable to and it was thought-about a really revolutionary mannequin on the time of its formation in 2013.

Grayscale was in a position to cost a comparatively excessive annual charge of two% for GBTC as a result of this belief was a singular funding automobile. Buyers who have been unable to realize bitcoin publicity in different methods have been keen to pay this charge, particularly if their shares may very well be traded at a premium to NAV. Lately, these charges have turn out to be increased than aggressive charges, because the lawsuit particulars.

Cryptocurrency Contagion

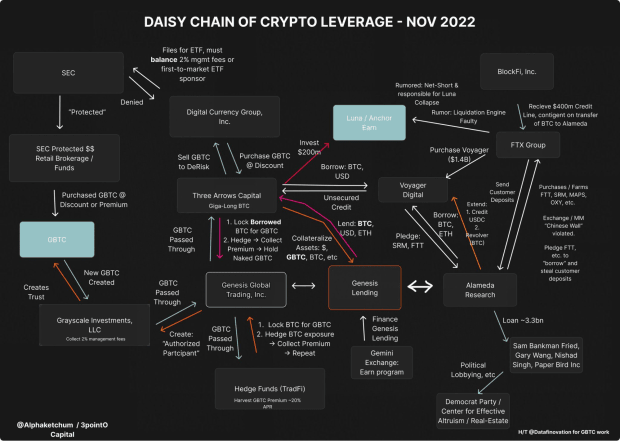

A related a part of the story is that Grayscale’s unique licensed participant, Genesis, was lending thousands and thousands of {dollars} to hedge funds, like Three Arrows Capital, allegedly on the situation that they parked the cash within the Grayscale Trusts. In June 2023, after GBTC began buying and selling at a reduction, Three Arrows Capital blew up, sparking a wave of contagion occasions that bankrupted a number of cryptocurrency corporations, comparable to Babel Finance, Voyager, BlockFi and FTX.

When Genesis filed for Chapter 11 chapter in January 2023, it owed collectors over $3.5 billion. The graphic under demonstrates the convoluted chain of leverage amongst varied cryptocurrency hedge funds, which allowed them to capitalize on the GBTC premium commerce, thus creating an outsized Genesis lending ebook and in the end resulting in the crypto contagion in 2022.

The Grayscale Lawsuit

Along with Alameda, there’s a group of GBTC shareholders organizing as a way to take motion in opposition to Grayscale with the hopes of clawing again lots of of thousands and thousands in charges, renegotiating the charge construction shifting ahead and being granted the flexibility to redeem the shopper bitcoin held within the belief. This lawsuit is a by-product motion, that means that it impacts all shareholders and never simply the shareholder submitting the lawsuit.

To even be capable to file a by-product motion in opposition to the belief, a number of unaffiliated shareholders who collectively personal no less than 10% of shares excellent want to affix collectively as co-plaintiffs to deliver the lawsuit, in line with belief paperwork and Grayscale’s associated arguments.

The shareholders accuse Grayscale of mismanagement and conflicts of curiosity. The conflicts of curiosity relate to all essential events related to the belief being subsidiaries of DCG: Grayscale because the sponsor, Genesis because the licensed participant and CoinDesk because the index supplier for the bitcoin worth. Different companies have provided to take over operation of the belief at a decrease administration charge that’s extra according to trade requirements, together with Valkyrie Investments who revealed a letter providing to handle the belief with an annual charge of 0.75%.

In his end-of-year letter to buyers, Grayscale Investments CEO Michael Sonnenshein said, “We stay steadfast in our perception that the conversion of GBTC to an ETF is in the very best curiosity of buyers, and we stay 100% dedicated to that endeavor.” Whereas he shared plans for a possible 20% tender supply, ought to that not be attainable, the corporate “would as an alternative proceed to function GBTC with out an ongoing redemption program till we’re profitable in changing it to a spot bitcoin ETF.” That is according to the corporate’s claims that they’re unable to permit redemptions with out categorical permission by the SEC and are solely targeted on their lawsuit in opposition to the SEC to permit the conversion of the belief into an ETF.

With shares buying and selling at such a big low cost and redemptions not allowed, shareholders are trapped except they promote their shares at a substantial loss. Notable Bitcoin critic, Congressional Consultant Brad Sherman, wrote a letter to SEC Chair Gary Gensler in search of clarification from the company as as to if Grayscale is definitely prevented from permitting redemptions. He additionally questions the corporate’s lack of an impartial director on its board and its comparatively excessive charges, amongst different regulatory considerations.

The Alameda chapter property is main a by-product motion in opposition to Grayscale, claiming the sponsor has collected $1.3 billion in administration charges in violation of its belief settlement. In a movement filed within the Delaware Chancery Court docket, Alameda mentioned that it had assembled over 45 events, together with dozens of people, quite a few funds and household workplaces, who indicated they have been keen to take part as further plaintiffs.

The movement particulars how the plaintiffs believed they reached the ten% threshold of shares, that’s till a big shareholder who was anticipated to be a plaintiff dropped out with out rationalization, leaving Alameda under the required share rely. The court docket granted the plaintiffs till Sept. 15 to collect the remaining help from shareholders.

The plaintiffs are placing out a name to any and all GBTC shareholders who’re eager about becoming a member of the Grayscale lawsuit. Their web site has extra info and an consumption course of the place shareholders can enroll earlier than Sept. 1 to take part within the authorized case in opposition to Grayscale.

Disclosure: David Bailey is the CEO of BTC Inc., the mother or father firm of Bitcoin Journal and UTXO Administration. UTXO Administration is a plaintiff within the Grayscale Litigation.