Bitcoin (BTC) miner Canaan‘s second-quarter monetary report confirmed that the agency operated at a loss throughout the reporting interval regardless of its rising mining income and computing energy.

Per the unaudited monetary report, the miner generated a complete income of $73.9 million, whereas its “price of revenues” had been $143.9 million, leading to a gross lack of $70.1 million. The agency had recorded a gross lack of $47.5 million throughout the first quarter.

James Jin Cheng, the chief monetary officer of Canaan, added that the agency recorded a web lack of $110.7 million, together with stock write-down, provision for dedication reserve, and impairment of property and gear, totaling $54.7 million.

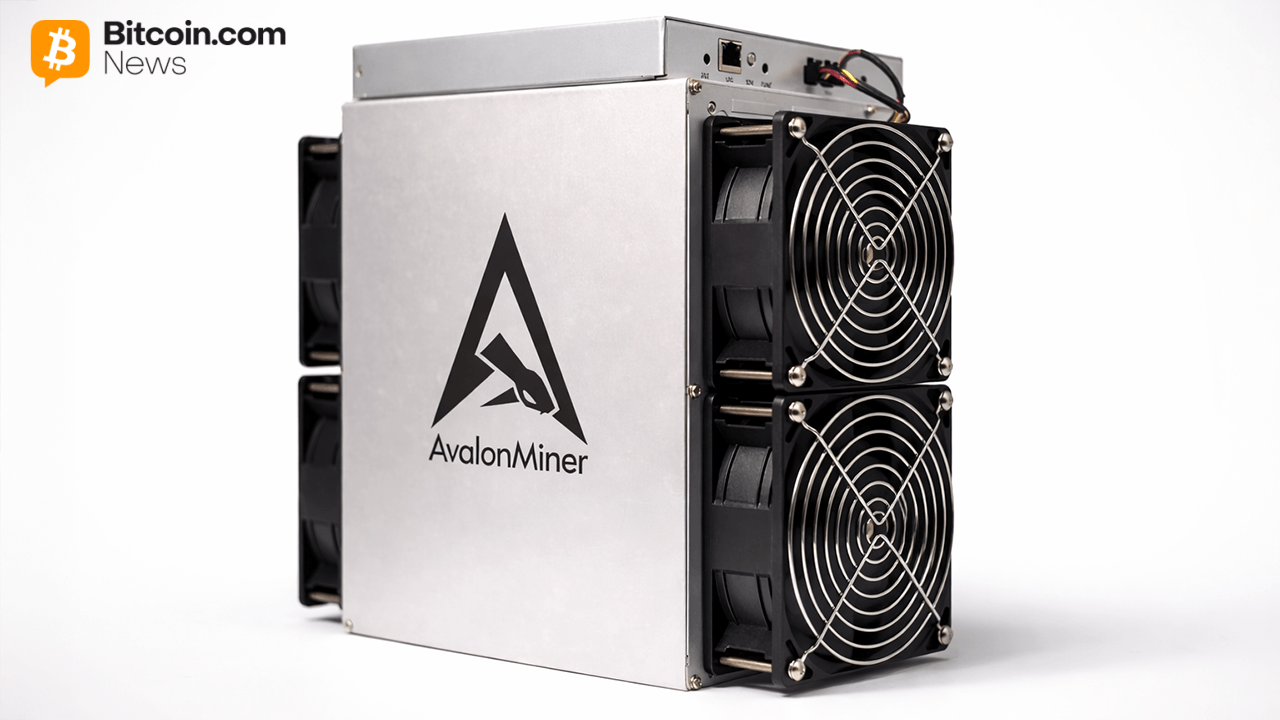

BTC mining income and computing energy climbs

Canaan revealed that its mining income for the second quarter grew to a historic excessive of $15.9 million, representing a 43.3% enhance from what it generated throughout the first quarter of the yr.

Per the assertion, the mining income achievement is noteworthy, contemplating the persistent rise in mining problem and hash charges and the regulatory challenges a few of its mining amenities encountered.

CEO Nangeng Zhang acknowledged that the agency surpassed its topline steering regardless of the comparatively stagnant worth of the flagship digital asset.

Apart from that, the miner revealed that the entire computing energy it offered throughout the quarter jumped by greater than 44% to six.1 million Thash/s.

Zhang stated the agency’s endeavor to drive gross sales throughout varied fronts, together with main shoppers, channels, and retail, yielded encouraging outcomes. He additional highlighted how the corporate’s partnerships with channel shoppers proved fruitful whereas its on-line retail retailer continued to seize new clientele from various geographical areas.

In the meantime, CFO Cheng attributed the “better-than-expected” income performances to enhancements in its gross sales and mining actions.

Regulatory challenges

The miner, nonetheless, conceded that the regulatory setting and the unpredictability of the crypto market may pose challenges for its continued success.

Cheng stated:

“The extreme rising challenges which will impede our enterprise operations. These challenges embody regulatory shifts throughout international locations, counterparty dangers inside this evolving market, and the broader financial panorama’s unpredictability in addition to unexpected occasions which will strain the bitcoin worth.”

The CEO additionally shared related sentiments, notably noting that the agency encountered adversarial impacts from regional regulatory modifications and the way an unnamed companion breached an settlement regarding its mining operations.

Canaan suspended round 2.0 Exahash/s of its mining computing capability after encountering regulatory points in Kazakhstan. The agency can also be concerned in a authorized tussle in america over a breached “Joint Mining Settlement.”