The emergence of decentralized finance (DeFi) exchanges lately has revolutionized the monetary panorama. Whereas conventional monetary establishments grapple with a sequence of challenges, startups are more and more turning to DeFi exchanges as a wellspring of innovation and alternative.

With improved accessibility, decreased intermediaries, unparalleled liquidity, and programmable monetary devices, the event of DeFi exchanges holds the potential to inaugurate a contemporary period of economic empowerment and inclusivity.

This text comprehensively explores some great benefits of DeFi alternate growth to startups.

What are DeFi Exchanges?

DeFi exchanges enable customers to commerce cryptocurrencies straight between themselves with out the involvement of intermediaries like banks or brokers.

Not like centralized exchanges that function as custodians of customers’ funds, DeFi exchanges enable customers to personal their personal keys. This improves safety and offers better management over their belongings.

The first distinction between DeFi and centralized exchanges lies of their operation and structure. Centralized exchanges maintain customers’ funds in custody, elevating issues about safety breaches and potential single factors of failure.

DeFi exchanges, then again, run on blockchain networks, utilizing sensible contracts to automate buying and selling and settlement processes, thus eradicating the necessity for a government.

Key Options and Functionalities of DeFi Exchanges

Automated Market Making (AMM)

Many DeFi exchanges use the AMM methodology, which is dependent upon algorithms to set token pricing and facilitate buying and selling. Customers can provide liquidity to buying and selling pairs by investing tokens in liquidity swimming pools and incomes returns in transaction charges.

Non-Custodial Buying and selling

DeFi exchanges enable customers to commerce straight from their wallets slightly than transferring funds to an exchange-controlled account. This non-custodial nature ensures that customers retain management over their personal keys and belongings always.

Decentralized Order Books

Some DeFi exchanges use decentralized order e book methods, which allow customers to position restrict and market orders straight on the blockchain with out counting on a central group to match orders.

Token Swapping

DeFi exchanges typically present token-swapping providers, permitting clients to right away and straight switch one cryptocurrency for one more from their wallets.

Flash Loans

Flash loans enable customers to borrow belongings with out requiring collateral, so long as the borrowed quantity is repaid in the identical transaction. These loans have prompted new developments in DeFi protocols and buying and selling strategies.

The Position of Good Contracts in DeFi Exchanges

Good contracts, that are self-executing code that runs on blockchain networks, are the muse of DeFi exchanges. These contracts automate and implement completely different features, similar to commerce execution, transaction settlement, and price distribution to liquidity suppliers.

DeFi exchanges use sensible contracts to allow trustless and clear operations as a result of the code is open and verifiable by anybody on the blockchain.

Why Ought to Startups Develop Their DeFi Exchanges?

Startups that choose to develop their very own DeFi alternate have a singular potential to excel within the fast-evolving cryptocurrency area and DeFi.

DeFi exchanges, using sensible contracts and blockchain know-how as their basis, supply quite a few distinctive options that may profit enterprise house owners. Listed below are the important thing benefits that startups can get pleasure from by embracing DeFi alternate growth:

Accessibility and Inclusivity

Conventional monetary methods sometimes exclude substantial segments of the worldwide inhabitants, particularly those that shouldn’t have entry to common banking providers.

DeFi exchanges, then again, run on blockchain networks and can be found to anybody with an web connection. This inclusivity permits entrepreneurs to achieve a bigger consumer base, increasing monetary providers to areas the place conventional methods have restrictions.

Startups can interact with a various and unexplored market by enabling cross-border transactions and investments.

Decentralization and Safety

Safety breaches and single factors of failure are dangers related to centralized exchanges. DeFi exchanges, then again, are decentralized, with no central authority or mediator.

Transactions are validated through consensus mechanisms, which makes them proof against hacking and reduces the opportunity of system-wide failures. This elevated safety is essential for startups in constructing belief and attracting clients who’re cautious of safety breaches which have stricken the centralized alternate trade.

Decreased Intermediaries and Prices

Conventional monetary transactions contain a number of intermediaries, every of which provides to the complexity and value of the method. Most of those intermediaries are eradicated in DeFi transactions, streamlining the method and decreasing prices.

Customers profit from decreased transaction charges, and startups profit from operational financial savings. Startups can go on these value financial savings to their clients, rising the attractiveness and competitiveness of their alternate available in the market.

Innovation and Flexibility

Startups can experiment and innovate with new monetary services because of DeFi exchanges. Since blockchain and sensible contracts are programmable, entrepreneurs can develop advanced buying and selling strategies, yield farming mechanisms, and revolutionary funding alternatives.

This adaptability permits startups to differentiate themselves by offering distinctive options and providers that align with particular consumer calls for, thereby rising consumer engagement and loyalty.

Liquidity Alternatives

Liquidity swimming pools are widespread options of DeFi exchanges. They permit customers to lend, borrow, and earn curiosity on their holdings. Startups may revenue from this function by facilitating liquidity availability whereas incomes from transaction charges.

Moreover, startups can create their very own tokens to encourage customers to take part within the community via prizes and governance rights. These liquidity alternatives may also help the alternate and the ecosystem as a complete develop.

How Can Startups Develop Their Personal DeFi Alternate Platform?

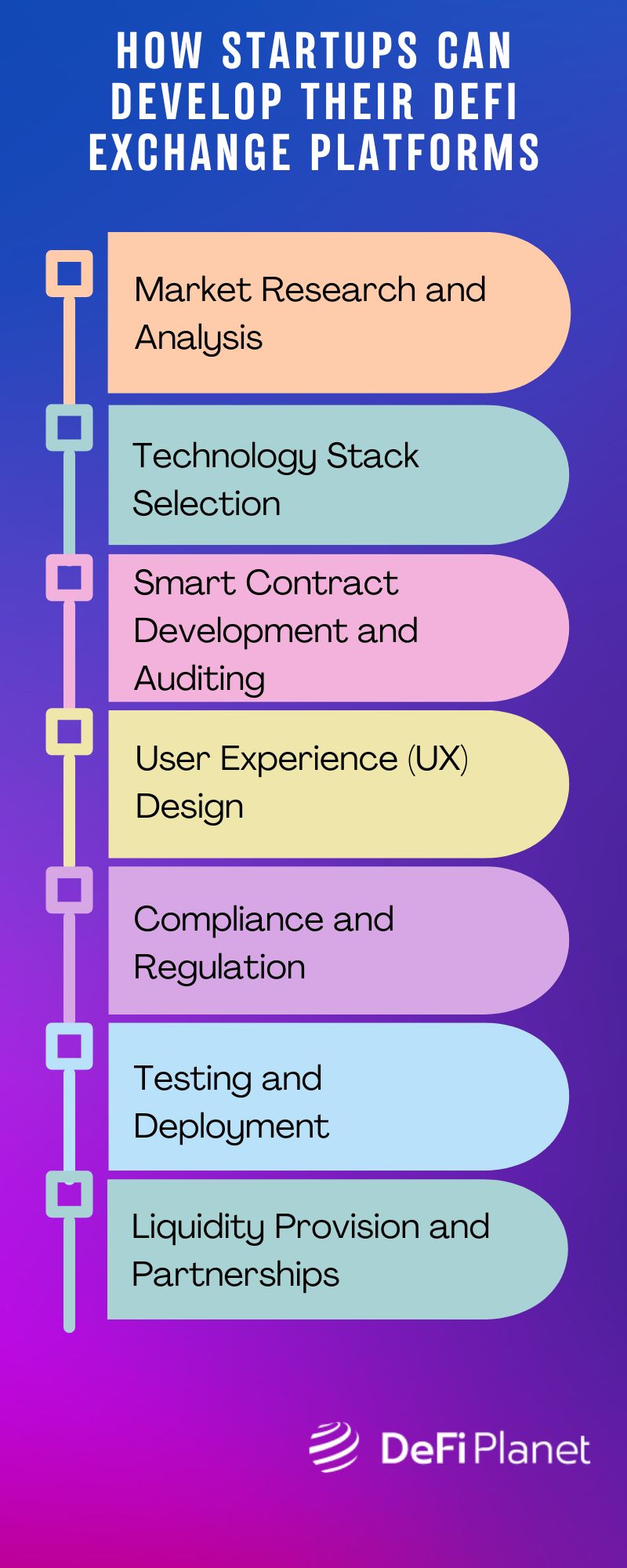

Creating a DeFi alternate requires a well-structured method that features market analysis, technological stack choice, sensible contract growth, consumer expertise design, compliance measures, amongst many different elements.

Listed below are the important thing steps entrepreneurs ought to take to develop a profitable DeFi alternate:

Market Analysis and Evaluation

Earlier than you begin creating a DeFi alternate, you should first correctly analysis the market panorama and select your audience. Conduct in depth analysis to:

Decide the classes of customers you need to serve: merchants, buyers, liquidity suppliers, and so forth. Acknowledge their wants, preferences, and ache factors.

Analysis present DeFi exchanges to find out their strengths, shortcomings, and distinctive options. Sustain-to-date on the latest DeFi tendencies and breakthroughs.

Expertise Stack Choice

The collection of the suitable technological stack is crucial for a profitable DeFi alternate. Contemplate the next ideas:

Decide which blockchain platform is greatest suited to your alternate’s necessities: Ethereum, Binance Good Chain, Polygon, and so forth.

Select a protocol for token requirements (for instance, ERC-20 or BEP-20) and features.

Choose programming languages (e.g., Solidity for Ethereum) and growth instruments that correspond to your technical experience.

Good Contract Improvement and Auditing

Good contracts function the muse of a DeFi alternate, permitting for safe and automatic transactions:

Develop sensible contracts for commerce, liquidity provision, and different functions utilizing greatest practices to scale back vulnerabilities and improve effectivity.

Collaborate with respected safety evaluation providers to find and rectify potential safety flaws in your sensible contracts.

Good contract auditing is important to stop hacks or exploits.

Consumer Expertise (UX) Design

Make sure you create an intuitive and seamless consumer expertise for consumer adoption and retention.

Create consumer interfaces which might be easy to make use of, responsive, and visually interesting.

Make the consumer expertise a precedence in each the desktop and cellular editions.

Make the buying and selling course of extra environment friendly, from account opening and deposit to order placement and withdrawal.

Present real-time value information and order e book particulars.

Compliance and Regulation

It’s advisable to exhaustively discover the regulatory landscapes of your operational jurisdictions to make sure that your DeFi alternate complies with all authorized necessities.

Combine anti-money laundering (AML) and know-your-customer (KYC) procedures to stop unlawful actions and guarantee full compliance with laws.

If obligatory, take into account collaborating with compliance service suppliers.

Seek the advice of authorized specialists who’re well-versed in blockchain and cryptocurrency rules to make sure that your alternate adheres to the related legal guidelines in operational areas.

Testing and Deployment

Thorough testing and a flawless deployment course of are required earlier than going stay together with your DeFi alternate.

Check all functionalities completely, together with buying and selling, deposits, withdrawals, and safety measures. Check for each performance and safety.

Deploy your DeFi alternate on the blockchain platform of your selection.

Guarantee scalability and redundancy to satisfy consumer demand.

Liquidity Provision and Partnerships

A profitable alternate requires liquidity. Contemplate the next ideas for attracting liquidity suppliers:

Set up incentivized liquidity swimming pools the place customers can contribute funds and earn rewards.

Create measures to stability the swimming pools and forestall non permanent losses.

Work with different DeFi initiatives, liquidity suppliers, and market makers to extend liquidity and enhance the general buying and selling expertise.

Challenges of DeFi Exchanges

Whereas the emergence of DeFi exchanges provides vital potential for companies, it isn’t with out its challenges. As companies embark on constructing their very own decentralized buying and selling platforms, it’s essential to concentrate on potential hurdles and devise methods to beat them.

Regulatory Panorama

Numerous nations have adopted differing stances on cryptocurrencies, blockchain know-how, and decentralized cash.

Navigating the intricate regulatory framework is among the most formidable challenges for startups within the DeFi alternate trade. Whereas the decentralized construction of those platforms offers freedom and accessibility, it may doubtlessly conflict with established monetary rules.

Answer: Startups should be well-versed in native legal guidelines and rules to make sure compliance with AML and KYC protocols. Collaborate with authorized specialists and keep up-to-date on new rules to keep away from authorized entanglements and reputational hazards.

Good Contract Vulnerabilities

Good contracts guarantee automated and trustless transactions. Nonetheless, they don’t seem to be resistant to vulnerabilities and coding errors. Even seemingly minor coding errors may result in devastating losses.

The high-profile sensible contract assaults within the DeFi ecosystem function a stark reminder of the need for strong safety measures.

Answer: Good contracts that govern buying and selling, liquidity provision, and yield farming should be completely examined and verified. Startups should additionally allocate assets for complete code critiques and exterior audits to establish and mitigate dangers earlier than launching their DeFi exchanges.

Market Competitors

The panorama is changing into more and more aggressive as DeFi (decentralized finance) turns into extra widespread. New firms are coming into the market with contemporary ideas, hoping to face out and achieve market share.

Standing out from the group requires not solely a singular worth proposition but in addition a agency grasp of consumer preferences and tendencies.

Answer: Startups ought to deal with offering distinctive merchandise, user-centric experiences, and environment friendly advertising strategies. They’ll additionally obtain a aggressive benefit by constructing strong alliances and communities.

Interoperability and Scalability

Interoperability between completely different blockchain networks and platforms is essential for DeFi buying and selling. The flexibility to interface seamlessly with various belongings and protocols improves the consumer expertise and expands the scope for creativity.

Moreover, as DeFi attracts public consideration, scalability turns into a major problem. Many blockchain networks face scalability challenges because of excessive transaction charges and community congestion throughout peak hours.

Answer: To make sure environment friendly and cost-effective operations, startups should select blockchain platforms that prioritize scalability and in addition discover Layer 2 options.

Safety and Custodianship

The decentralized nature of DeFi exchanges emphasizes consumer custody of funds. Whereas this provides customers authority over their belongings, it additionally locations the duty for safety squarely on their shoulders.

Answer: Startups ought to educate customers about really useful practices for safeguarding their personal keys and deploying {hardware} wallets. DeFi exchanges also can supply elevated security measures similar to multi-factor authentication and withdrawal whitelists to assist customers defend their accounts from intrusions.

Case Research: Profitable DeFi Alternate Startups

Listed below are examples of profitable DeFi alternate startups which have constructed a reputation for themselves within the trade:

Uniswap

Uniswap is well known for popularizing the idea of AMMs (Automated Market Makers), which allow the decentralized and algorithmic pricing of buying and selling pairs.

Launched in 2018, Uniswap operates on the Ethereum blockchain and permits customers to commerce numerous tokens with out counting on intermediaries. Its easy interface and seamless token alternate expertise have considerably contributed to its widespread adoption.

The success of Uniswap might be attributed to its revolutionary AMM idea, which allows customers to supply liquidity to a number of buying and selling pairs in alternate for charges. Uniswap has constructed a self-sustaining atmosphere that facilitates environment friendly and decentralized buying and selling by incentivizing liquidity suppliers.

SushiSwap

SushiSwap emerged in 2020 as a significant fork of Uniswap, aspiring to develop on the present DeFi alternate options. The platform started as a clone however rapidly added new options and governance strategies to distinguish itself.

One among its distinctive improvements is the “yield farming” function, which compensates customers for offering liquidity with its native SUSHI cash.

SushiSwap’s capacity to iterate on present concepts and supply new providers has confirmed widespread with customers, ensuing within the protocol’s fast growth. The mission’s community-driven decision-making and growth strategies have additionally contributed to its long-term success.

PancakeSwap

PancakeSwap stands out as a superb instance of a DeFi alternate using another blockchain to realize enhanced scalability. The protocol debuted on the Binance Good Chain (BSC), providing decreased transaction prices and quicker affirmation instances in comparison with the Ethereum community.

The deliberate determination to construct on BSC attracted customers on the lookout for a more practical buying and selling expertise.

The success of PancakeSwap on BSC demonstrates the necessity to handle blockchain scalability and cost-effectiveness when creating DeFi exchanges. PancakeSwap gained a big consumer base by eliminating the challenges related to community congestion and exorbitant costs.

To Sum Up

The event of DeFi exchanges can democratize finance by permitting startups to reshape a extra inclusive and open monetary atmosphere. Startups should method this market with a mix of technological prowess, audacious innovation, and respect for regulatory norms.

By doing so, startups can benefit from the quite a few alternatives that DeFi provides, thus propelling each their companies and the trade to unprecedented heights.

Additional analysis can discover the regulatory concerns for startups, the comparative evaluation of various DeFi alternate fashions, the potential environmental impacts of decentralized monetary fashions on startups, and the safety measures to mitigate dangers.

Understanding these areas will assist startups navigate the ever-evolving DeFi panorama and leverage it for long-term success.

DISCLAIMER: This piece is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. At all times conduct due diligence.

If you need to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

The put up 5 Excellent Advantages of DeFi Alternate Improvement for Startups appeared first on DeFi Planet.