Metaversal is a Bankless e-newsletter for weekly level-ups on NFTs, digital worlds, and extra!

Pricey Bankless Nation,

The Securities and Trade Fee (SEC) simply undertook an enforcement motion towards the Founder’s Key assortment.

The undertaking, led by Tom Bilyeu and the Influence Principle crew, was marketed boisterously in the way in which many NFT tasks had been, resulting in uncertainty about which dominos will fall subsequent right here within the NFT area.

For at present’s put up, we’ll dissect what Influence Principle did mistaken in accordance with the SEC, the Fee’s troubling give attention to NFT royalties, and why the dissenting opinion of Commissioner Hester Peirce, a.okay.a. “Crypto Mother,” ought to have us all involved.

-WMP

🙏 Sponsor: Uniswap Labs — Higher Costs, Extra Listings: NFTs on Uniswap✨

On August twenty eighth, the SEC printed a press launch asserting that it had charged Tom Bilyeu’s media firm Influence Principle with conducting an unregistered “crypto asset securities” providing by way of its Founder’s Key NFTs.

Keep in mind, within the U.S. a safety is a monetary instrument that may make its proprietor cash by way of dividends, curiosity, or elevated worth over time. When you create and market an asset on this profit-centric manner, the SEC calls for that you just are available in and register.

In line with the SEC, Influence Principle framed and offered these NFTs as funding devices, raised $30M USD accordingly, and repeatedly instructed individuals they’d stroll away with extra ETH than they invested.

Influence Principle agreed to settle with the SEC with out admitting guilt, although they’re now on the hook for $6.1M in fines and should arrange a brand new fund to refund buyers. Additionally they agreed to destroy the Founder’s Key NFTs and take away future royalties from these NFTs.

“We’ll function our go-forward enterprise in step with our good religion greatest understanding of all relevant legal guidelines, guidelines, and laws … and can fiercely discourage individuals from treating our digital property as something apart from what they’re—collectibles with utility,” Bilyeu stated in a response assertion.

🔒 You are a free person and haven’t got entry to Airdrop Hunter

When you wanted a motive to improve to a paid membership, that is it. A single airdrop pays for an annual membership’s price many occasions over!

Within the wake of the information, Drew Hinkes, Companion at Okay&L Gates and an Adjunct Professor at NYU College of Legislation, identified that the SEC is now notably specializing in royalties as a think about figuring out whether or not an NFT is a safety.

“One other traditional SEC enforcement transfer,” Hinkes stated. “Discovering a ‘low hanging fruit’ kind of goal and utilizing a consent to sneak in language that creates new theories of legal responsibility/new glosses on [The Howey Test].”

“Now NFT creator royalties are an element,” he added.

In different phrases? The SEC appears to only be winging it with regard to its focusing on of royalties, and now it seems the Fee is suggesting royalties even contribute to creating an NFT a safety.

I’d love to listen to the argument(s) for why they suppose that’s the case as a result of it is mindless to me, however sadly that’s the place the SEC’s head is at presently.

This unprecedented give attention to royalties could thus have a ripple impact throughout the NFT ecosystem, affecting how creators construction their drops and good contracts going ahead. The eye right here casts extra uncertainty at a time when the NFT royalties panorama is already extra unsure than ever.

SEC Commissioner Hester Peirce, in collaboration with Commissioner Mark Uyeda, supplied a highly effective dissenting opinion towards the charging of Influence Principle.

In her assertion, she notably argued the SEC doesn’t normally take these types of actions towards related non-digital choices.

“We don’t routinely convey enforcement actions towards those who promote watches, work, or collectibles together with obscure guarantees to construct the model and thus enhance the resale worth of these tangible gadgets,” Peirce argued.

In different phrases, this SEC enforcement motion was extraordinarily aggressive and overstepped the Fee’s conventional jurisdiction.

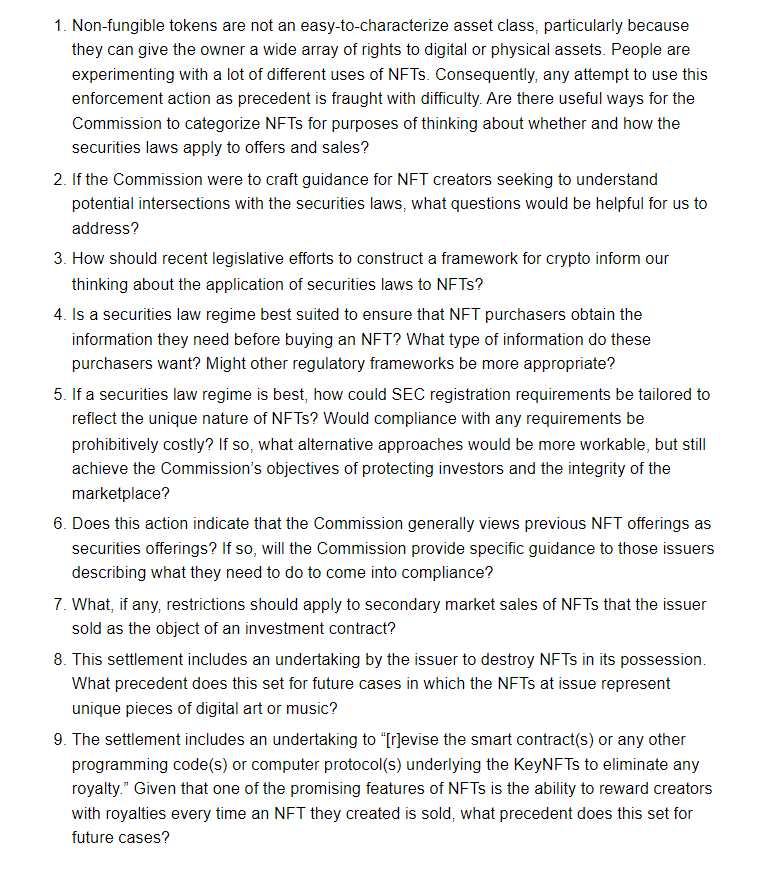

Commissioners Peirce and Uyeda went on to current 9 inquiries to their colleagues on the SEC, noting “The Fee ought to have grappled with these … way back and supplied steering when NFTs first began proliferating.” The questions had been as follows:

The questions introduced right here spotlight the shortage of clear steering from the SEC on how NFTs needs to be handled beneath securities legal guidelines. In fact, it’s exhausting to be compliant when the SEC itself hasn’t been clear!

This absence of readability leaves the NFT neighborhood in a precarious place about learn how to navigate the U.S. regulatory panorama with out inadvertently crossing authorized strains. The dissenting commissioners right here have underscored the pressing want for the SEC to eschew piecemeal enforcement actions in favor of commonsense pointers.

It is price noting that loads of NFT tasks seem to have dedicated the identical wrongdoings as Influence Principle, at the very least for those who’re going by the SEC’s standards.

As such, we may even see extra NFT-centric enforcement actions within the close to future as long as crypto hawk Gary Gensler stays Chairman of the SEC.

Additionally, remember that the SEC nonetheless has its investigation open into Yuga Labs, creators of the Bored Ape Yacht Membership universe. The investigation was first unveiled in October 2022.

I’m not a lawyer, nevertheless it appears apparent to me that almost all of Yuga’s choices aren’t securities, and but some like The Otherside plots could also be. We’ll need to see what the SEC does, and if it’s large, it’ll undoubtedly ship shockwaves throughout the area contemplating Yuga’s stature.

The Influence Principle settlement doesn’t encourage a lot confidence right here, because it suggests the SEC’s present management sees most NFT drops as securities choices! If this tone continues within the U.S., many NFT tasks will merely shift operations abroad identical to many DeFi tasks have began doing. That’d be an enormous mistake, nevertheless it’s clear Gensler doesn’t care at this level.

William M. Peaster is the creator of Metaversal — a Bankless e-newsletter centered on the emergence of NFTs within the cryptoeconomy. He’s additionally a senior author for the principle Bankless e-newsletter.

A Bankless Citizen ⚑ turned $264 into $6,077 final yr. A 22x ROI 🚀 in a bear market!

Commerce NFTs throughout main marketplaces to search out extra listings at higher costs. NFTs on Uniswap are open-source, trustless, and self-custodial. To have fun NFTs on Uniswap, we’re airdropping $5 million to sure historic Genie customers. Begin buying and selling NFTs at present on Uniswap.

👉 Get Began Now!

Not monetary or tax recommendation. This text is strictly academic and isn’t funding recommendation or a solicitation to purchase or promote any property or to make any monetary choices. This text just isn’t tax recommendation. Discuss to your accountant. Do your personal analysis.

Disclosure. From time-to-time I could add hyperlinks on this e-newsletter to merchandise I exploit. I could obtain fee for those who make a purchase order by way of certainly one of these hyperlinks. Moreover, the Bankless writers maintain crypto property. See our funding disclosures right here.