In a brand new analysis report, Constancy examines the burning query: how does the utility of the Ethereum community translate into worth for its native cryptocurrency, ETH?

Whereas customers have loved the technological advantages of Ethereum’s in depth ecosystem, the funding group has sought to know the explanations behind buying and holding ETH past its utility as a transactional token.

Constancy’s Ethereum Funding Thesis delves into the worth proposition of ETH from an funding thesis perspective, whereas additionally dissecting the technical facets associated to numerous funding theses.

Key observations from the report embody:

Worth Linked to Community Utilization: The perceived worth of Ethereum is tied to community utilization and the dynamics of provide and demand, which have developed considerably because the implementation of The Merge.Platform Utilization and Worth Accrual: Elevated utilization of the Ethereum community and platform might contribute to the buildup of worth for Ether token holders.Ether as an Rising Type of Cash: One funding thesis posits Ether as an rising type of digital cash, akin to Bitcoin.Challenges in Competing with Bitcoin: The report acknowledges that whereas different digital property, together with Ether, might try and function types of cash, competing with Bitcoin’s traits and community results might be a formidable problem.Ether’s Capabilities as Cash: The report explores Ether’s means to satisfy two major capabilities of cash: a retailer of worth and a method of cost.

Ether’s Aspiration as Cash

A prevailing narrative within the cryptocurrency area typically positions Bitcoin as a nascent type of digital cash. This begs the query: Can ETH assume an identical function? In essence, can or not it’s thought of “cash”?

The reply, as per Constancy’s evaluation, is affirmative however comes with caveats. ETH does certainly share a number of traits with conventional types of cash, together with Bitcoin, akin to its function as a medium of trade. Nevertheless, there are notable variations to think about.

Challenges in Changing into Broadly Accepted

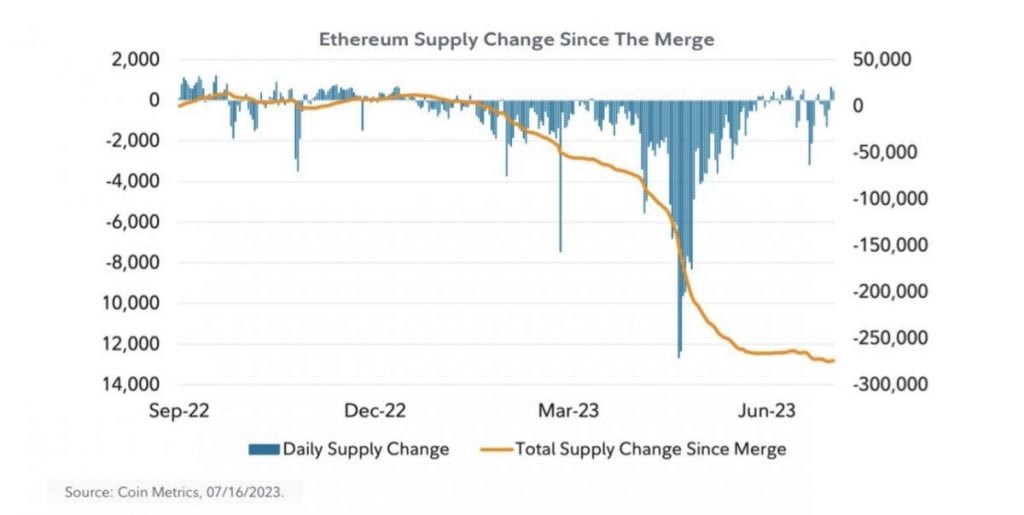

One of many key challenges ETH faces in turning into a extensively accepted type of cash is its provide dynamics. Not like Bitcoin, which adheres to a hard and fast provide schedule and is seen as a safe and sound digital forex by many, ETH provide parameters are technically limitless. These parameters can fluctuate based mostly on components just like the variety of validators and burning mechanisms.

Moreover, ETH’s observe document as a financial asset differs from Bitcoin’s. Ethereum undergoes community upgrades roughly annually, requiring time and developer consideration to determine a steady efficiency historical past. That is necessary for garnering belief amongst stakeholders.

Competing Types of Cash

Whereas Bitcoin holds a powerful place as a financial asset, Constancy means that this doesn’t preclude the existence of different types of digital cash, together with ETH.

Ethereum’s distinctive attributes, akin to its means to facilitate complicated transactions and execute good contract logic, set it other than its digital forex counterparts. These capabilities present it with a singular utility past being a easy medium of trade.

Actual-World Ethereum Integrations

Whereas widespread on a regular basis transactions on Ethereum are but to materialize, Constancy supplies examples of already noteworthy integrations between the Ethereum ecosystem and the bodily world in addition to the standard finance sector:

MakerDAO’s Multimillion-Greenback Buy: MakerDAO, a mission working on the Ethereum blockchain, not too long ago accomplished a considerable buy of $500 million, highlighting Ethereum’s rising affect.Ethereum’s Position in Actual Property: Ethereum marked a historic milestone because the platform for the sale of the primary U.S. home utilizing a non-fungible token (NFT), showcasing its potential to disrupt the true property market.Blockchain Bonds by European Funding Financial institution: The European Funding Financial institution ventured into the blockchain realm by issuing bonds straight on the blockchain, an indication of conventional finance’s rising embrace of Ethereum’s expertise.Franklin Templeton’s Ethereum-Powered Cash Market Fund: Franklin Templeton launched a cash market fund using Ethereum and Polygon to streamline transaction processing and document share possession.

Challenges on the Path to Mass Adoption

Whereas the convergence of the Ethereum ecosystem with real-world property is undeniably underway, the report means that there are robust challenges to beat.

These embody the necessity for steady community enchancment, regulatory readability, training, and the passage of time to instil confidence in Ethereum and comparable platforms.

It might take years earlier than Ethereum sees widespread adoption for on a regular basis transactions, making ETH a distinct segment type of cash in the intervening time.

Constancy’s Concluding Thought

In keeping with Constancy, the important thing query on the minds of buyers is whether or not Ethereum’s sturdy developer exercise and the proliferation of functions translate into tangible worth for ETH.

“We’ve got proven that, in each idea and information up to now, elevated exercise on Ethereum’s community drives demand for block area, which, in flip, generates money circulation that may accrue to token holders,” Constancy concludes.

“What can be evident, although, is that these numerous drivers are complicated, nuanced, and have modified over time with numerous protocol upgrades and the emergence of scaling developments, like layer 2, and will change once more sooner or later.”