Competitors in DeFi is nice. Extra competitors means extra environment friendly markets, innovation and more and more optimized ecosystems for us to current to new customers when the bull market rolls in. So this weblog isn’t about pitting protocols towards one another – no sir. It’s about inspecting distinguishing options of decentralized perps, significantly that of Synthetix and GMX, to showcase distinctive factors of distinction and why they matter. In fact this piece might be biased – I’m a Synthetix Core Contributor in spite of everything. However what it also needs to be is an insightful, fairly balanced evaluation of two protocols main the way in which in a really thrilling house proper now. So let’s get into it!

An summary

Synthetix Perps:

Synthetix Perpetual Futures (Perps) are a novel perpetual future that launched in late 2022, and actually began to make an influence on the house earlier this yr. Reside on Optimism, Every day Buying and selling Quantity for Synthetix Perps is at the moment at greater than $200M with the assistance from frontend integrators Kwenta and Polynomial – who’ve this yr each seen all time highs. Synthetix Perps at this time affords arguably the most effective capital effectivity for on-chain leverage throughout 50+ belongings (foreign exchange, crypto, gold/silver), permitting merchants to make use of as much as 50x leverage on positions, whereas additionally supporting extraordinarily aggressive charges due to off-chain oracle supplier Pyth Community.

So what are the important thing options of Synthetix Perps:

Hybrid oracles that mix a number of sources, and use signed off-chain value updates to enhance efficiency and scale back buying and selling charges to 2/6bps for main pairs.A skew-dependent premium/low cost operate to incentivize rebalancing, and improve composability for belongings with a wider vary of liquidity profiles.A funding price velocity mechanism to create pure value discovery and clean out funding price trajectories. Extra on this later.

Dynamic funding charges and value influence have led to largely impartial markets (no lengthy or brief skew) so Synthetix LPs aren’t depending on dealer efficiency, as a substitute, sitting again and gathering charges.

GMX Perps:

GMX is broadly lauded for its deep liquidity and easy-to-use frontend. A decentralized spot and perps platform – GMX helps low swap charges and 0 value influence trades, permitting customers to leverage as much as 50x on their trades. Spectacular.

GMX is on Arbitrum and Avalanche, with buying and selling supported through a multi-asset liquidity pool that generates rewards from market making, swap charges, leverage buying and selling and asset rebalancing – that are for essentially the most half fed again to Liquidity Suppliers (LPs). Markets embody BTC (and WBTC), ETH, AVAX, LINK and UNI.

The protocol launched its V2 product in August 2023, hoping to beat some drawbacks of the V1 product, significantly round danger administration and charges. Extra on this later.

It’s a clear, user-friendly trade that gives thorough knowledge on buying and selling, charges and liquidity. GMX additionally boasts a non-inflationary tokenomics mannequin, so it doesn’t require inflationary token incentives.

In order that’s the good things, and look – it’s actually great things. However we are able to’t be all reward right here. Let’s speak about just a few of the pitfalls for each the protocols’ Perps choices, after which deep dive into some particular areas that must be fascinating to customers.

Pitfalls

Synthetix:

Some may say UX hasn’t been on the absolute forefront of Synthetix’ technique. The consumer journey, designed like 100 years in the past in crypto-years, is generally managed by integrators and has been utterly acceptable for the degens amongst us. However new customers aren’t so snug with the lengthy hike to Optimism, or the necessity to signal each motion. Truthful. In excellent news, Kain is working to unravel these issues along with his new frontend Inifinex, and shoutout to each Kwenta and Polynomial who’re persevering with to develop their UX within the meantime. What’s extra, there’ll be additional optimisations when Synthetix V3 Perps takes the stage later this yr.Inflation. The neighborhood has performed round with inflationary incentives a lot of occasions over time and whereas these modifications have been profitable in bootstrapping the community, inflation basically tampers with incentives. As talked about earlier, the GMX mannequin doesn’t have this difficulty. Kain put ahead a proposal to fight inflation 3:1 SNX cut up plus buyback as a part of his earlier position on the Synthetix TC. Watch this house.

GMX:

Though GMX charges are good, they’re inferior to Synthetix charges. On the time of writing GMX boasts 10bps on all pairs, whereas as talked about Synthetix affords 2/6bps for its main pairs. It goes with out saying that it’s important to be as aggressive as attainable within the decentralized perps house proper now.Just like how markets constructed on high of Synthetix function, GMX V2 options funding charges as a method to help the discount of enormous imbalances inside swimming pools. When there are too many open lengthy positions, the funding charges will transfer to the brief aspect, and vice-versa. Regardless of the intro of funding charges, borrowing charges will nonetheless exist to make sure that customers keep away from taking pointless positions. Borrowing charges are paid to LPs and assist to stop customers from opening each lengthy and brief positions to take up pool capability with out paying any charges. The priority? This value provides up over time and may liquidate positions, even throughout a flat market.

Now that icky half is over – let’s see what’s below the hood of every protocol concerning these particular Perps fundamentals – Liquidity, Charges/Value influence, Funding Charge and Oracles.

Liquidity

Liquidity is likely one of the largest challenges for decentralized exchanges. Each Synthetix and GMX satisfaction themselves on deep liquidity – however have very totally different frameworks.

Synthetix:

SNX stakers present the liquidity and are tasked to actively handle their debt on a weekly foundation. On this sense – lots is required of Synthetix LPs. If stakers had been solely backing perps, they’d be delta impartial, however as a result of they’re additionally backing spot/choices/and so forth, they’re answerable for extra energetic administration. As an choice, lazier (or smarter?) LPs can swap their borrowed sUSD into dSNX, which hedges for them, as dSNX replicate the fluctuations of the debt pool.Importantly, 100% of charges go to those SNX stakers to reward their onerous work.

GMX:

A good thing about the GMX mannequin is that GMX stakers don’t have to actively handle their debt as Synthetix Stakers do.GMX V1 makes use of a separate token referred to as GLP that’s utilized for offering liquidity. GLP represents an index of many alternative belongings that may be minted or redeemed primarily based on the proportion of that asset within the pool. This framework means 70% of charges go to GLP stakers and 30% of charges go to GMX stakers.GMX V2 isolates liquidity throughout totally different belongings in an AMM fashion method. This permits for extra belongings to be permissionlessly listed, however liquidity suppliers now have to turn out to be extra subtle to be able to flip a revenue, and eliminates the UX ease of purely holding GLP.

I’ll let the reader come to their very own conclusions on the variations/advantages of those frameworks.

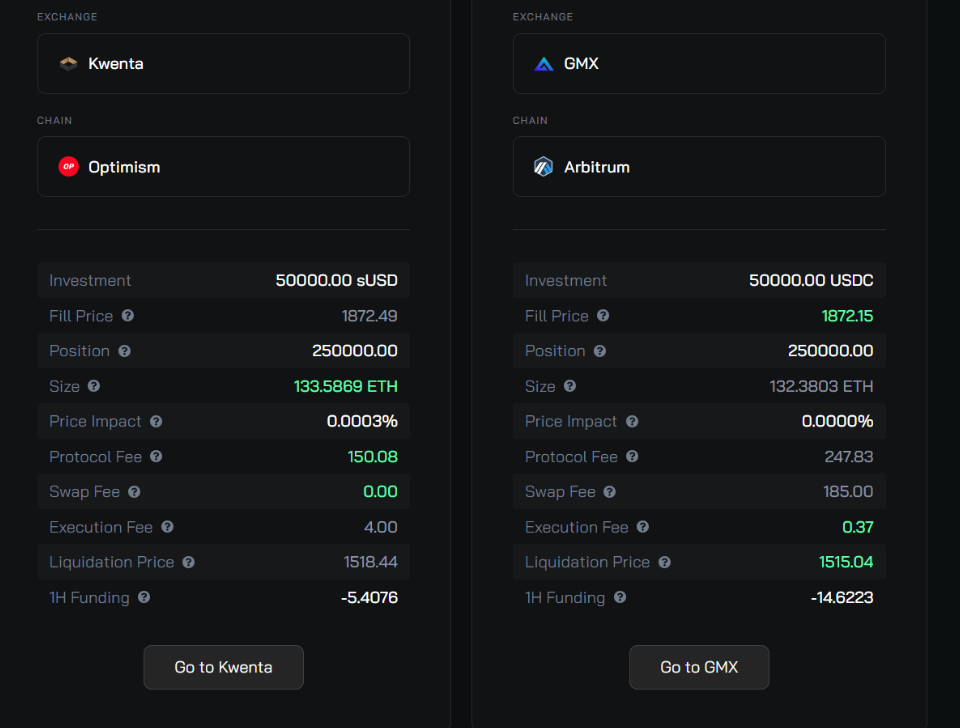

Charges / Value Affect

The problem of excessive gasoline charges is clearly essential to each protocols’ agendas, with L2 scaling options in place for each – Synthetix on Optimism and GMX on Arbitrum. This transfer places each Perps choices in good stead to enchantment to new customers/mass adoption. Just a few different factors of word:

Synthetix:

Charges will sometimes all the time be decrease utilizing the Synthetix platform as a result of protocol’s charge system. In contrast to GMX, Synthetix solely requires a perps charge, no swap charge. There could also be a case, nonetheless, if a consumer makes a small commerce, that SNX perps charges may very well be greater resulting from a better execution (keeper) charge. This can be a ramification of Synthetix’s decentralized, off-chain oracles. However for larger-size trades, customers ought to all the time expertise decrease charges utilizing Synthetix Perps.

GMX:

GMX has up to date their Execution Price with V2 to assist steadiness open curiosity and scale back danger to LPs. The Execution Price in V2 has been lowered to 0.05%-0.07% at open and shut. If a commerce contributes to the aspect with extra open curiosity, it pays 0.07%, and the underweighted aspect pays 0.05%. There’s certainly a value influence in GMX V2 too. There may very well be a optimistic or unfavorable value influence for rising / lowering positions and for swaps.

Funding Charge

We touched on the dynamic funding price earlier, however right here is a few extra element to assist readers perceive the danger administration impacts.

Synthetix:

The dynamic funding price, whereas sharing similarities with the normal funding price, has just a few key variations. As an alternative of relying solely on market skew to find out the funding price, the dynamic funding price takes into consideration each velocity and market skew. Which means that when there’s a persistent lengthy skew, funding charges will proceed to extend over time. Conversely, when brief positions dominate, funding charges will lower so long as the brief skew is maintained. By incorporating velocity into the funding price calculation, this mechanism encourages merchants to take positions reverse to the present market skew, selling market stability and steadiness.

GMX:

GMX’ new V2 Funding Price improves on its unique ‘Borrow Price’ in V1, which meant all merchants needed to pay an rate of interest versus only one aspect of the commerce. The V2 Funding Price is paid by the chubby OI aspect of the commerce, to the underweight aspect, and is predicated on the commerce imbalance. For instance, if there may be extra OI lengthy than brief, longs pay shorts. The funding charge paid by the dominant aspect is predicated on the next equation, and accompanies a borrow charge as properly.

Oracles

In the case of oracles, decentralization is paramount and influences a lot of Synthetix’ resolution making. There’ll all the time be trade-offs relating to decentralization, however the consumer advantages of a permissionless, low-fee system aligns finest with the protocol’s overarching ethos.

Synthetix:

New off-chain oracles offered by Pyth Community permit Synthetix Perps charges to be diminished to 5-10bps – on par with centralized perps platforms. These oracles, pioneered by Synthetix, enormously enhance the dealer expertise and decrease the danger of front-running assaults. They work as follows: off-chain oracles save costs off-chain and are offered to merchants by keepers when a commerce is initiated, with an approx 8-sec delay resulting from block occasions. Conversely the on-chain validation course of contains staleness checks, key-threshold affirm and a closing examine towards on-chain oracles.Synthetix will proceed to make use of Chainlink oracles alongside Pyth. In 2022 alone, Chainlink value feeds helped facilitate over $50B+ billion in transaction worth on Synthetix.

GMX:

GMX Perps boasts a customized oracle resolution with an combination of costs from main quantity exchanges, so there may be not a variety of certainty across the actual origin of all of its knowledge feeds. Having an oracle supplier that’s as decentralized as attainable is essential and helps fight any transparency challenges. GMX would be the first perps trade to make use of Chainlink’s low-latency oracles. This partnership will assist GMX scale back buying and selling charges, help decentralization and enhance the consumer expertise due to faster execution – making it harder for potential front-running. Good.

To wrap this up – I revert again to the intro stance: Competitors is nice, because it drives industries ahead and contributes to the general well being and growth of the ecosystem. In addition to pushing one another to diversify and innovate, competing protocols encourage change inside. GMX’ easy, clear interface has impressed modifications to the Synthetix UX technique and that of our integrators, whereas Synthetix’ dedication to decentralization has maybe influenced a few of GMX’ resolution making round oracles and fundamentals. Competitors performs a brilliant essential position in shaping crypto because it drives innovation, high quality, effectivity and variety, and encourages a dynamic ecosystem that advantages customers, buyers, and the broader adoption of crypto and blockchain expertise.

Thanks for studying and a giant thanks to CC Matt and Ambassador Westie for his or her ideas and contributions.