In finance, ‘sensible cash’ usually refers to institutional or skilled traders presumed to own larger market data and assets. Nevertheless, an intriguing sample emerges when inspecting the highest holders throughout main DeFi platforms.

CryptoSlate analyzed the highest 5 wallets (excluding funds and exchanges) and the highest 5 fund wallets from main DeFi platforms listed on the on-chain information website Cherry Choose. Platforms included Uniswap, Aave, Curve, Balancer, and 1inch.

Threat Tolerance and Diversification.

The information exhibits that single wallets linked to establishments usually have decrease balances than particular person wallets. This might point out a number of issues.

Firstly, institutional traders could also be diversifying their portfolios to mitigate threat. Conventional monetary knowledge advocates diversification as a hedge towards volatility, and it appears this precept could also be carrying over into the creating world of DeFi. That is supported by funds having a number of wallets tagged. Secondly, the decrease balances might counsel that establishments are nonetheless cautiously exploring DeFi, probably skeptical of its long-term prospects or operational dangers.

Right here, ‘sensible cash’ seems to be exercising warning by not placing all their eggs in a single basket or limiting their publicity to the DeFi house altogether.

For instance, the typical steadiness in Aave for wallets is roughly $11.46 million, whereas funds maintain a mean of simply $528,635. This stark distinction might indicate that institutional traders are diversifying their dangers or are maybe nonetheless testing the waters within the DeFi enviornment.

Elevated losses from funds.

Regardless of these decrease balances, funds exhibit increased realized and unrealized losses. Uniswap’s common realized loss for funds is round $470,000, in comparison with the colossal common lack of $68.6 million for particular person wallets.

Staggeringly, the highest UNI pockets has over $500 million in unrealized losses, with all however one of many prime 5 seeing nine-figure unrealized losses. Analyzing the highest pockets, it seems to be a pockets linked to the protocol itself, because it obtained 39.7 million UNI in March 2021, valued at round $1.1 billion.

At Uniswap’s peak simply two months later, it was value round $1.68 billion.

At the moment, the pockets is valued at $101 million after sending round 16 million UNI out of the pockets over the previous 36 months, promoting solely as soon as for a revenue.

The divergence might counsel that whereas institutional traders are extra cautious with their capital, they’re extra accepting of short-term losses, probably as a part of a long-term funding technique.

A altering of the guard.

Each particular person wallets and institutional funds present a powerful inclination towards Uniswap. With a mean steadiness of $66.9 million for wallets and $104,821 for funds, it’s evident that Uniswap stays a cornerstone in retail and institutional DeFi portfolios.

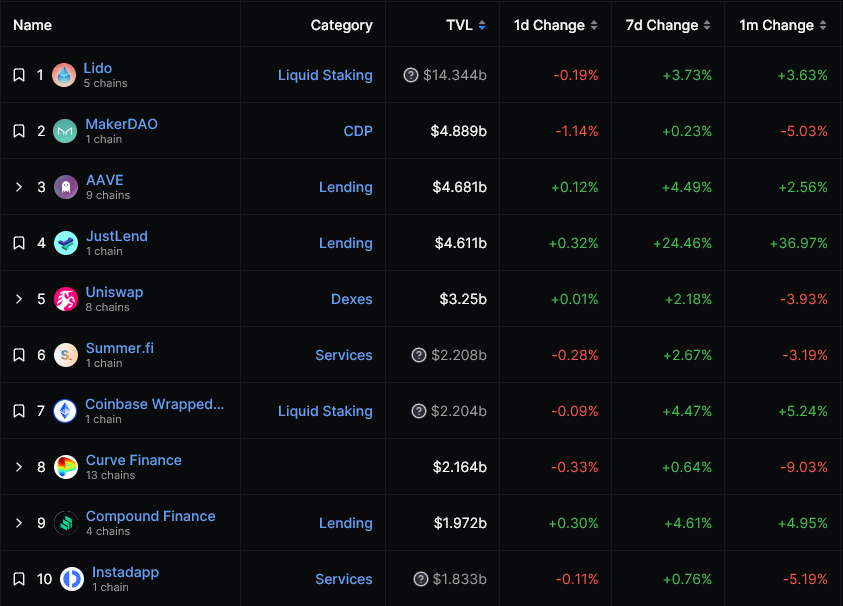

Whereas platforms like JustLend are making strides with a TVL of $4.611 billion, information exhibits that ‘sensible cash’ continues to be primarily invested in legacy platforms, with Lido, Maker, Aave, and Uniswap all remaining within the prime 5 DeFi platforms by TVL.

But, the highest 10, as tracked by DefiLlama, is now lacking a number of legacy DeFi gamers, equivalent to Balancer, PancakeSwap, SushiSwap, and Yearn Finance. As an alternative, newer protocols equivalent to JustLend, Summer time.fi, and Instadapp have taken their spots.

Profitability and Effectivity

One would possibly count on ‘sensible cash’ to flock towards platforms with increased revenues and charges. Nevertheless, this isn’t essentially the case. For instance, whereas Uniswap has cumulative charges of $3.254 billion, it has not prevented ‘sensible cash’ from incurring common realized losses of over $470,000.

Trying forward, information from DeFiLlama reveals thrilling traits in TVL adjustments over time. Platforms like JustLend have seen a 24.46% improve in TVL in simply 7 days.

Whereas our dataset doesn’t present a direct correlation, it begs the query: Is ‘sensible cash’ agile sufficient to capitalize on these fast shifts?