The worth of Bitcoin was rejected because it approached crucial resistance north of $27,000, and promoting stress continues over at the moment’s buying and selling session. If consumers can’t defend present ranges, BTC’s worth will doubtless re-test crucial assist, however this motion might set off a bounce for the cryptocurrency, in line with recent information.

As of this writing, Bitcoin trades at $26,650, with a 2% loss within the final 24 hours. Over the earlier seven days, the cryptocurrency has recorded sideways worth motion and underperformed XRP and Toncoin’s TON, which recorded a 5% and 25% revenue, respectively, throughout an identical interval.

The Bitcoin Stage To Watch If Bears Take Over

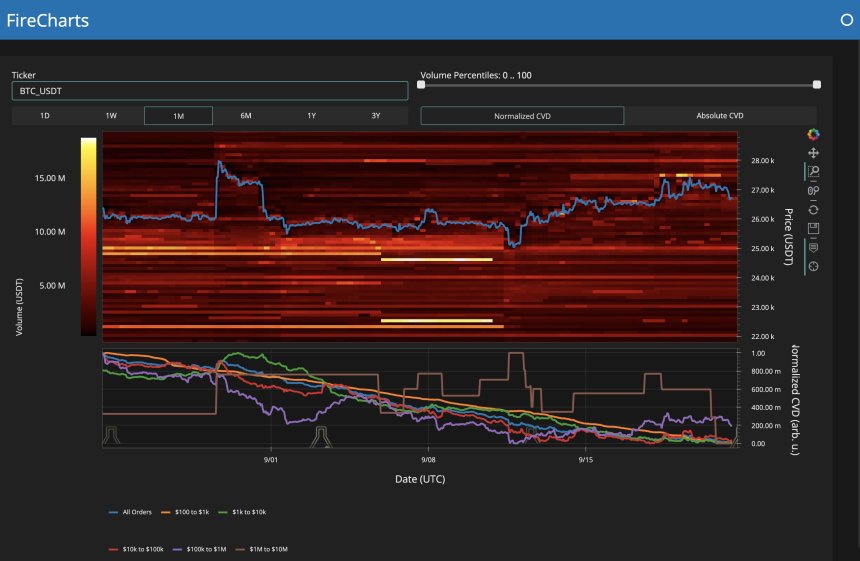

An analyst crypto analysis agency Materials Indicators shared a hearth chart displaying essentially the most vital liquidity ranges for the BTCUSDT buying and selling pair on Binance. On a month-to-month foundation, merchants on this venue have been promoting the cryptocurrency and transferring liquidity under present ranges.

The chart under reveals that the Binance orderbook for this buying and selling pair seems “skinny.” The analyst claims a “small purchase wall” at round $24,700, which stands as a “line within the sand” that must be defended to stop additional draw back worth motion.

Liquidity round this crucial stage is low, however bulls can inject capital to defend the extent in case of additional draw back. If bulls succeed, Bitcoin will doubtless rally and reclaim beforehand misplaced territory.

In any other case, bears may have the chance to press additional on the worth, returning it to crucial assist round $23,000 and $22,000. These ranges show even much less liquidity than $25,000, which might trace at a deeper correction of “Bearadise,” because the analyst referred to as it.

Further information offered by buying and selling desk QCP Capital signifies that macroeconomic forces have performed a crucial position in influencing the worth of Bitcoin. Yesterday, the US Federal Reserve (Fed) despatched a “hawkish” shock throughout monetary markets, limiting any BTC upside momentum.

This occasion had a bearish influence on legacy markets, with the Nasdaq 100 and charges markets breaking “some very key ranges,” QCP Capital said. The buying and selling desk added:

(…) reflexivity can take over with the bearish thesis from right here. If we’re proper, then this macro transfer might seep into crypto markets and take BTC decrease with it (Chart 3), albeit with a decrease beta as in comparison with different very stretched macro markets just like the NASDAQ.

Cowl picture from Unsplash, chart from Tradingview