Ethereum ETFs have change into the rave in current occasions with a superb variety of funding companies throwing their hats within the ring. Because the bear market lingers, crypto traders proceed to look to occasions that might set off one other worth rally. The approval of an Ethereum ETF would little question be one among such occasions, which is why these October dates are necessary to remember.

First Ethereum ETF Approval Choice Coming Up

After companies have been in a position to finalize their filings for Ethereum ETFs with america Securities and Trade Fee (SEC), the ball is now within the court docket of the regulator. Relying on the dates on which the ETF filings have been made, their resolution dates are both nearer or farther away, however the first one is lower than two weeks away.

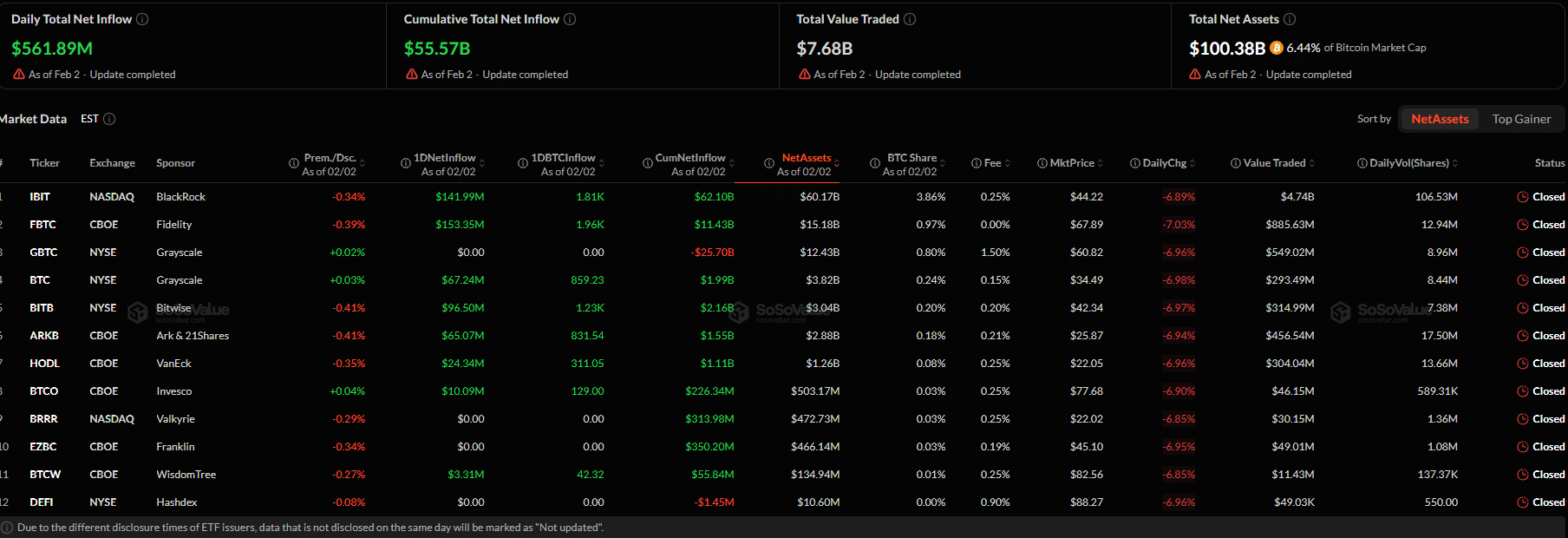

Based on the SEC’s schedule of deadlines for all the Ethereum ETFs utilized for therefore far, the Valkyrie Bitcoin & Ether Technique ETF (BTF) submitted by Valkyrie Investments in August is the primary to be selected. Valkyrie’s ETF resolution is anticipated to be made on October 3, 2023.

Whereas the regulator can both settle for or deny the Ethereum ETF software on this date, it may well additionally select to postpone its resolution. Nonetheless, some imagine that there’s an approval coming in October. A Bloomberg report citing sources accustomed to the matter acknowledged that they don’t imagine that the SEC would block out the Ethereum ETFs.

The October 3 date is, nonetheless, not the one necessary one as all the filings have their deadline dates scattered by means of the month. The subsequent in line is the Bitwise Bitcoin & Ether Equal Wght ETF (BITC) with a deadline of October 9, 2023. Following shortly after that is the Ether Technique ETF (ETHU) filed by Volatility Shares with a deadline of October 11, 2023.

In whole, there are 16 ETF filings on the checklist. Eight of those have their deadlines set for October 16, 2023, three have a deadline of October 17, 2023, one on October 18, 2023, and the final on October 30, 2023.

Deadlines for 16 ETF filings | Supply: Bloomberg

What Occurs If An ETF Will get Accredited?

Expectations for when an Ethereum ETF will get authorized have been nearly unanimously bullish throughout the house. Such an approval would give institutional traders an avenue to spend money on the second-largest cryptocurrency by market cap, resulting in billions of {dollars} being pumped into the digital asset.

Among the filings have additionally revealed that they plan to buy Ether to satisfy their obligations. In the event that they achieve this, the massive portions that these funds can be shopping for would see a superb chunk of provide being purchased up.

On this case, approval might simply see the worth of ETH rise one other 50% from its present place to place it above $2,000. Taking the primary Bitcoin ETF approval as a case examine, it may very well be the catalyst wanted for ETH to succeed in a brand new all-time excessive.

ETH bears threaten worth crash | Supply: ETHUSD on Tradingview.com

Featured picture from AMBCrypto, chart from Tradingview.com