Bitcoin miners play a pivotal position within the cryptocurrency ecosystem. They validate transactions, safe the community, and flow into new Bitcoins. Their habits, particularly in holding or promoting mined cash, can present perception into market sentiment and future value actions.

Information from Glassnode has proven that there was a destructive web place change in miner balances in September. This implies miners have been promoting extra Bitcoin than they’ve been mining. This might outcome from many alternative components — miners may be promoting BTC for USD or different fiat currencies to cowl operational prices or take income. Some may also be offloading their BTC in anticipation of a value stoop.

Nonetheless, regardless of the persistent destructive web place change, the whole miner steadiness hasn’t decreased this month. Miner balances have grown from 80,810 BTC on Sep. 1 to 81,760 BTC on Sep. 25. This uptick means that miners are offloading a few of their holdings however aren’t parting methods with their newly minted cash. As an alternative, they’re nonetheless in accumulation mode, albeit at a probably slower price.

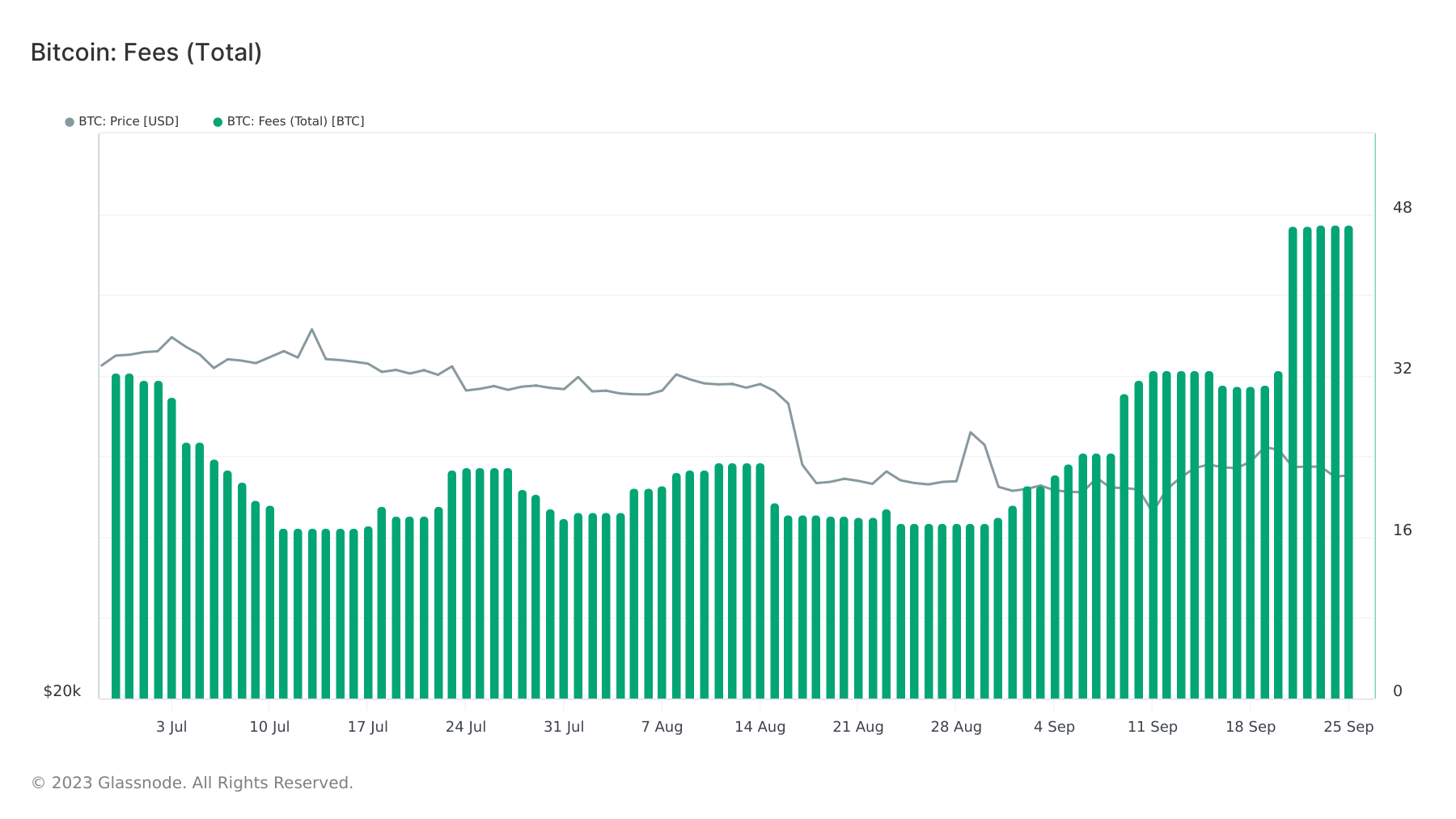

There has additionally been a notable improve in Bitcoin transaction charges this month, which jumped from 19 BTC on Sep. 1 to 46.9 BTC by Sep. 25. This uptrend factors to heightened demand for transactions, probably as a result of a bustling Inscriptions market or an inflow of customers. Nonetheless, the spike in charges may be attributed to community congestion, one thing the Inscriptions market has lengthy been criticized for. A full Bitcoin mempool means many transactions are piling up, ready to be included in a block, main customers to fork out larger charges to expedite their transaction confirmations.

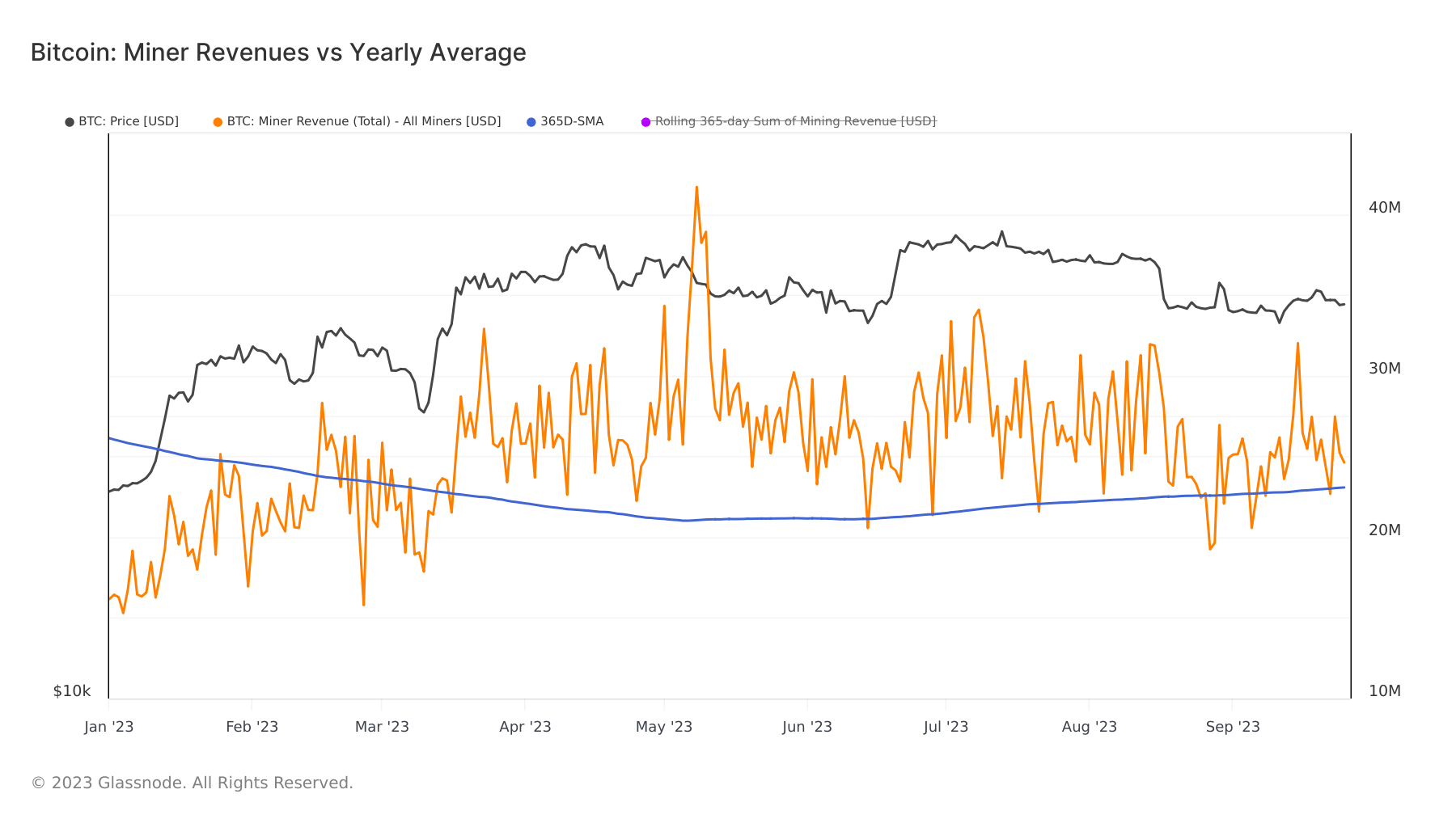

Evaluating the present mining income with the yearly common signifies a positive atmosphere for miners. In accordance with information from Glassnode, miner income has been above the yearly common for many of September. It is a continuation of a pattern that started in March when the yearly common dropped under the present income after a number of months of divergence. This could possibly be as a result of a mixture of rising Bitcoin costs, the above-mentioned elevated transaction charges, or each. This pattern started in March and has since recommended sustained demand and exercise within the Bitcoin community.

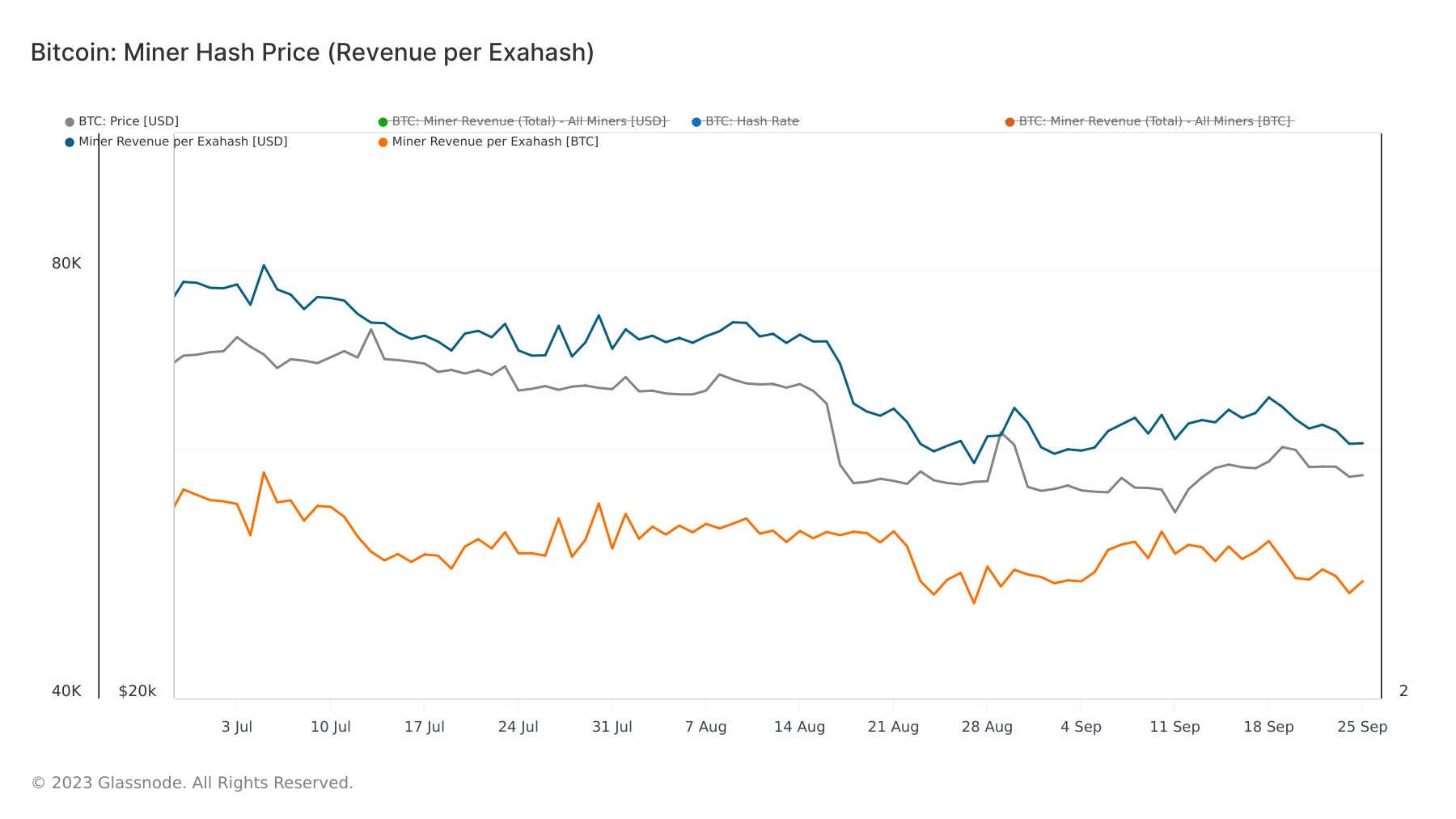

A better examination of miner income per exahash reveals a slight dip in Bitcoin-denominated income, shifting from 2.32 BTC to 2.30 BTC for the reason that month’s inception. This means that miners are pocketing a tad much less Bitcoin for each unit of computational effort. Potential culprits could possibly be escalating competitors amongst miners or minor community inefficiencies. Nonetheless, when considered via the lens of USD, the income per exahash has climbed from $60,120 on Sep. 1 to $60,505 on Sep. 25, signaling an appreciation in Bitcoin’s greenback worth.

The sentiment within the Bitcoin market seems to be a mix of optimism and warning. Miners, whereas promoting, proceed to build up. The uptick in charges underscores a bustling community, and the sustained above-average miner income since March hints at a conducive atmosphere for mining, probably luring extra miners to the fray. The dip in Bitcoin-denominated income per exahash raises eyebrows, however the uptick in its USD counterpart exhibits a optimistic improve in Bitcoin’s valuation.

The put up Cautious optimism in Bitcoin miner exercise as accumulation tentatively continues appeared first on CryptoSlate.