The Bitcoin worth trajectory has as soon as once more taken a pointy upward flip, marking its ascent previous the $28,000 landmark for the primary time since its notable surge on August 29. This prior leap had been attributed to Grayscale’s conquer the US Securities and Trade Fee (SEC) of their authorized battle concerning the Bitcoin Belief (GBTC) conversion to a spot ETF.

In a placing demonstration of Bitcoin’s notorious volatility, the BTC skilled a worth escalation of over $800 inside a minuscule 5-minute window on Sunday night, rocketing from $27,250 to a peak of $28,053 between 6:15 and 6:20 pm ET.

Why Is Bitcoin Value Up At this time?

One major catalyst behind this dramatic worth motion, as pinpointed by the esteemed crypto analyst Byzantine Common, is the phenomenon often known as a “quick squeeze.” Within the realm of futures buying and selling, a brief squeeze is characterised by a speedy worth enhance, forcing merchants who had wager towards the asset’s worth (quick sellers) to purchase it to forestall additional losses. This reactive shopping for can intensify the asset’s worth bounce.

Throughout yesterday’s surge, a staggering $392 million in Bitcoin quick positions, or about 7.7% of the whole open curiosity available in the market, had been swiftly liquidated. Byzantine Common additional elaborated available on the market’s resilience, observing that the Bitcoin open curiosity bounced again swiftly with an increment of $350 million, humorously suggesting the market’s willingness to embrace such a unstable maneuver once more: “The entire market was really like ‘I’ll fucking do it once more.”

Crypto analyst Fabian D. deepened the evaluation by declaring the intricate interaction between quick sellers being ousted and the potential for additional Bitcoin appreciation. He indicated that the upward trajectory of Bitcoin from this level hinges on two major components: the entry of spot consumers pushed by the worry of lacking out (FOMO) and whether or not quick sellers resolve to re-establish their positions.

Fabian additionally alluded to the absence of institutional shopping for exercise within the week previous this surge however underscored the significance of monitoring premium charges on platforms like Coinbase and CME upon market opening at this time. Including to the complexity of the market panorama, Fabian flagged two impending occasions: the anticipation surrounding the Ethereum Future ETF inflows, and the court docket listening to regarding the Celsius platform, which could probably refocus consideration on its creditor distributions.

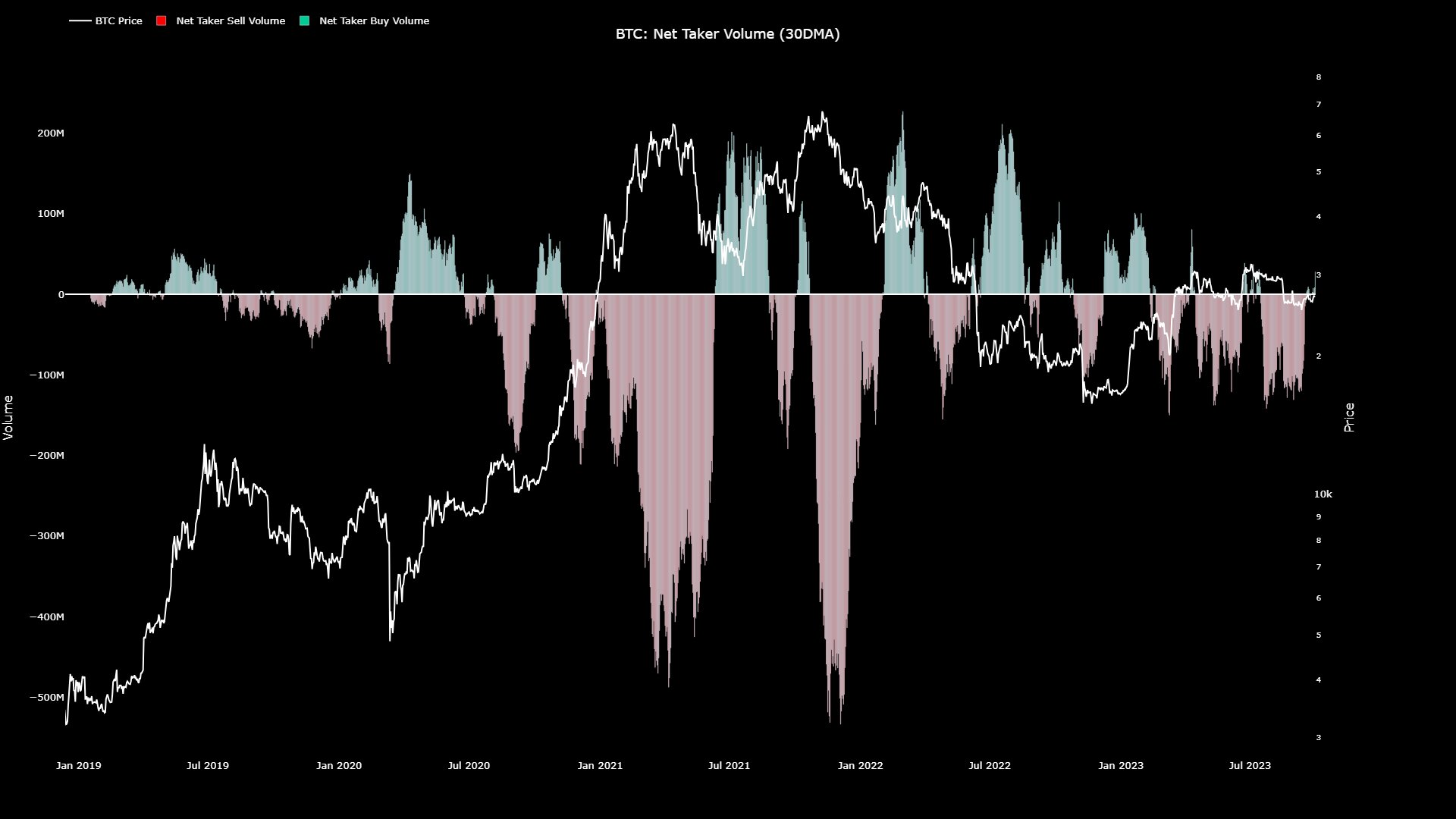

Drawing insights from on-chain information, analyst Maartunn launched one other layer of optimism, noting that “Internet Taker Quantity has crossed into the inexperienced zone, indicating that consumers are in management. The final time was 4 months in the past.”

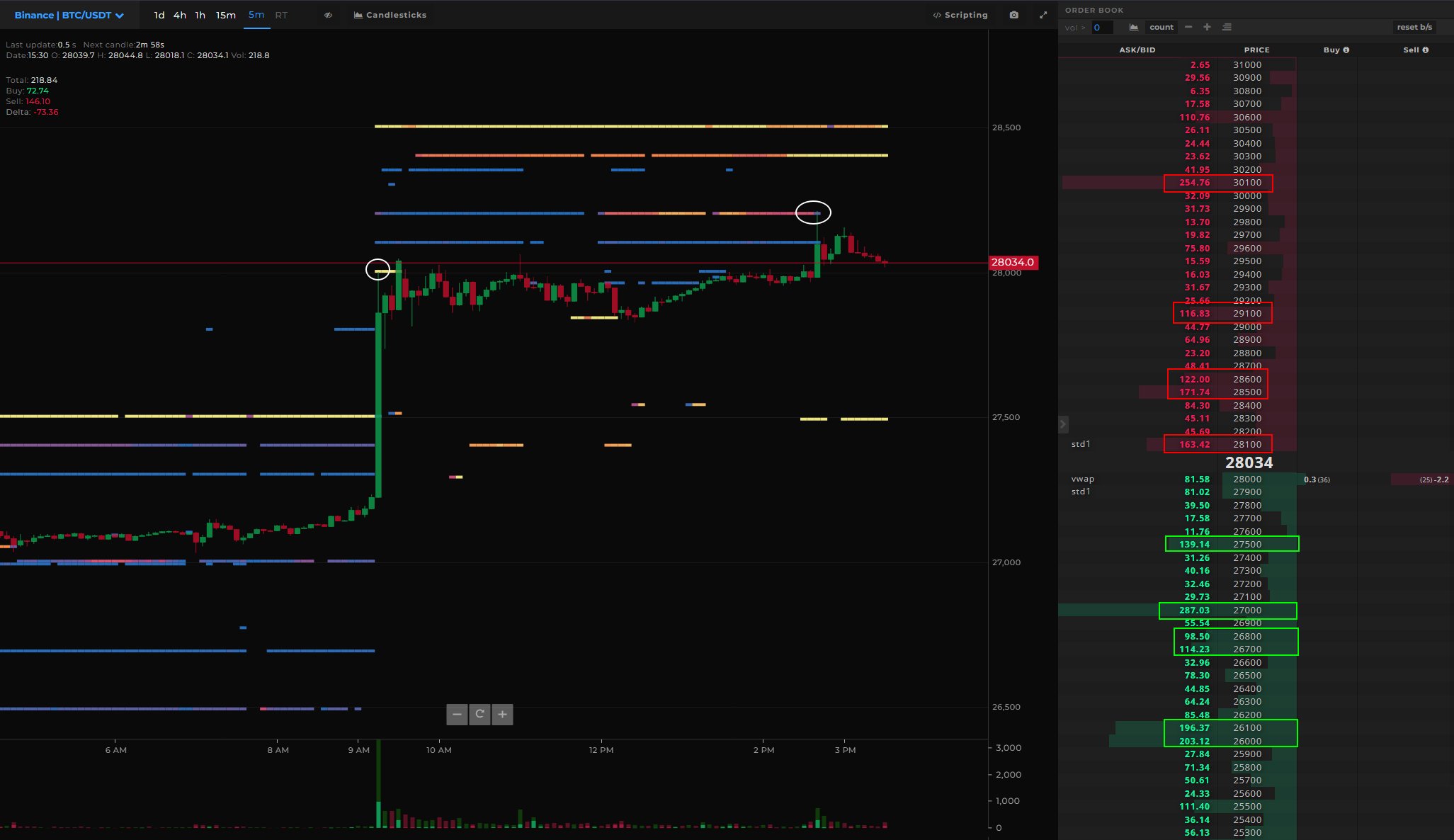

Diving into granular analytics, quant dealer Skew make clear the dynamics at play on platforms like Binance and Bybit. He emphasised that the latest worth upswing wasn’t totally unexpected, significantly given the noticeable shift away from quick positions and the sturdy perpetual bid main as much as the spike.

Trying on the Bitcoin combination CVDs & delta, he additional famous: “Principally seeing promote stress simply in perps for now. Value decline with Perp CVD decline & Perp promote delta choosing up. Subsequent transfer that decides the destiny of this whole transfer is spot.”

Highlighting the evolving market dynamics, Skew identified that the BTC Binance Spot exhibited a notably broad order ebook with a major quantity of accessible and resting liquidity. He inferred that such a setup may result in extra pronounced worth reactions.

Highlighting the evolving market dynamics, Skew remarked that the BTC Binance spot market displays a notably broad order ebook with a major quantity of accessible and resting liquidity. He inferred that such a setup may result in one other pronounced worth response. “Rising ask liquidity on spot order books; implies larger quantity wanted by spot takers to clear $28K – $29K (Market construction shift),” he warned.

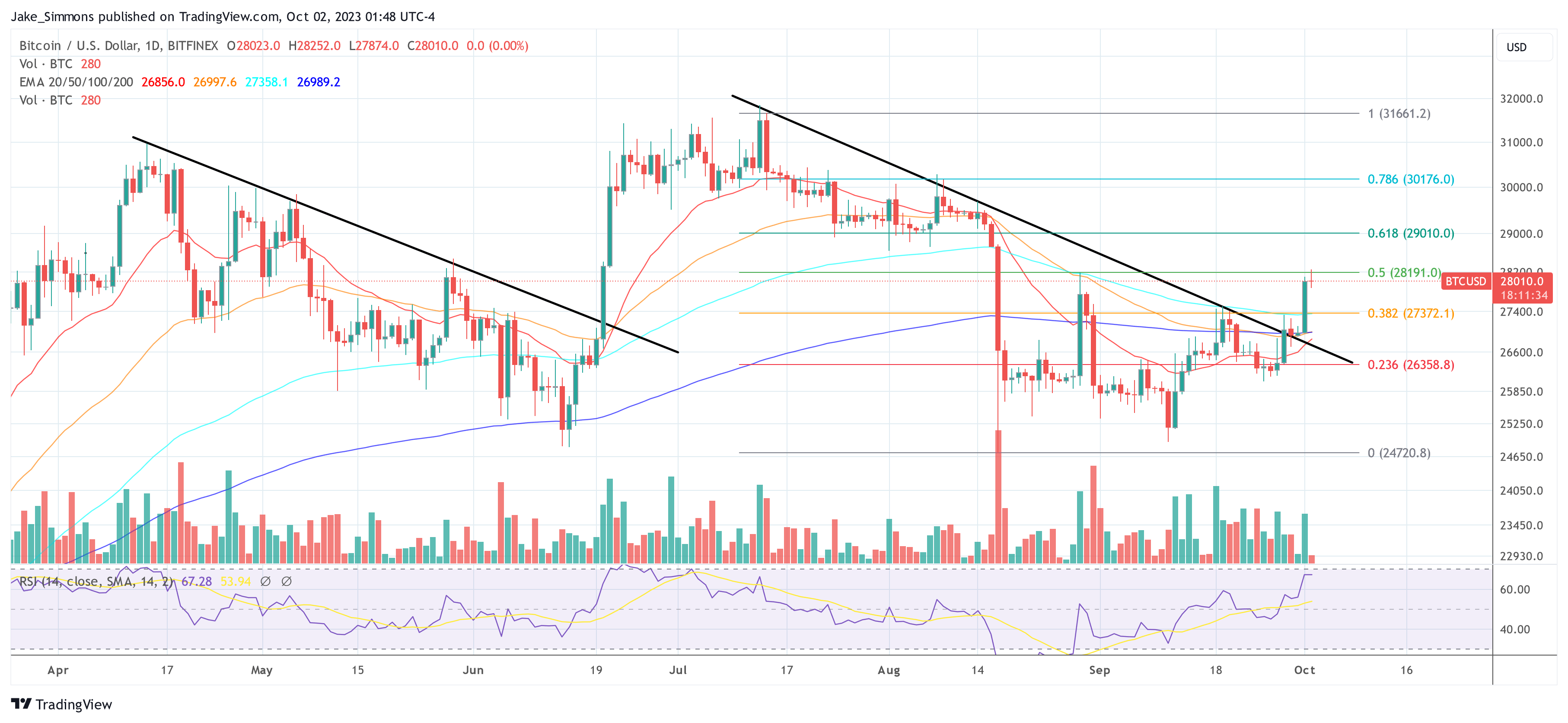

It is usually fascinating to notice that the worth motion was already evident within the 1-day chart. As defined within the final Bitcoin worth analyses, the worth broke via the (black) downtrend line established in mid-July final Thursday. Whereas the profitable re-test of the trendline befell on Friday and Saturday, confirming the bullish momentum, the anticipated bounce occurred yesterday.

Featured picture from Shutterstock, chart from TradingView.com