The under is a bit from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Binance, one of many world’s largest cryptocurrency exchanges, has seen a number of tough months of varied authorized challenges, and just lately bought all property of their Russian department to an organization solely based days earlier.

The difficulty started for this main trade in June, when the Securities and Alternate Fee (SEC) sued Binance for alleged violation of securities regulation. Citing the “unregistered gives and gross sales of securities” and mendacity to potential buyers “relating to surveillance and controls over manipulative buying and selling,” the SEC put this firm within the crosshairs of a serious investigation. The Fee later chastised Binance in September about their lack of cooperation with federal regulators, and additional motion to unseal Binance’s file was carried out quickly after.

Though Binance and its defenders have continued to claim that this lawsuit is an unfair assault in a part of a federal “crypto crackdown,” new difficulties have been showing in its battle because the authorized battle escalated. A shockwave went via the Bitcoin group as Brian Shroder, CEO of Binance’s US department, resigned on September 12 alongside a sequence of layoffs that eradicated roughly one third of the department’s employees. American clients already are required to undergo the Binance.us website to adjust to regulators, and US {dollars} are now not accepted by the platform. With these present difficulties, the added bother of layoffs and new administration have put the way forward for Binance’s entry to the complete American market in danger.

Nevertheless, though the American operation of Binance has seen difficulties, it’s nonetheless not less than considerably purposeful and nominally open for crypto transactions. These setbacks, in different phrases, really pale compared to the announcement on September 27 that Binance was promoting off all trade companies and enterprise operations within the Russian Federation, denying any plans to have ongoing income sharing or inventory buybacks. And the kicker? CommEX, the customer of all these property, is an organization that first got here into existence at some point earlier than the sale.

A transfer this dramatic definitely got here with a big deal of hypothesis from the worldwide Bitcoin group, with analyst Adam Cochrane figuring out not just some telltale Binance fingerprints on CommEX’s on-line presence and a attainable utilization of the platform by Russian mercenaries in Nigeria and Ukraine. Though Binance’s press launch claims that this transfer is prompted partially by a Division of Justice investigation into sanctions violations, CEO Changpeng “CZ” Zhao has denied that he’s the proprietor of CommEX. Many former Binance workers will proceed their features at CommEX, nonetheless, and he assured that “all property of present Russian customers are secure and securely protected.”

For a serious worldwide firm already concerned in a months-long authorized battle with the federal authorities, these developments are exceptionally shady. Russia has lengthy been one of many worldwide crypto scene’s main nations, with excessive ranges of curiosity in buying Bitcoin and energetic improvement in crypto and blockchain expertise. So, for Binance to abruptly and utterly withdraw from this main market implies a severe disruption with their regular actions and a determined state of operations. And what if the Justice Division continues this probe, suspecting that CommEX merely is a shell firm created to keep away from costs? Might a lawsuit for violating sanctions be part of the accusations of monetary impropriety?

Binance has seen some excellent news within the days following this announcement, but in addition additional setbacks. On September 30, two influential gamers within the cryptocurrency business, stablecoin issuer Circle Web Monetary Ltd. and crypto funding fund Paradigm Operations filed amicus briefs in help of Binance’s try and dismiss the lawsuit in opposition to them. Though it’s absolutely heartening to see help from corporations with no monetary stake in Binance — Circle is even partially owned by Binance’s competitor Coinbase — it’s unclear whether or not the actions of those different companies will deter the SEC’s offensive.

Worse, it’s now not solely the federal authorities focusing on Binance via the SEC and Division of Justice. On October 3, Nir Lahav filed a class-action civil swimsuit in opposition to Binance and a number of other subsidiaries, particularly mentioning CEO Changpeng Zhao by identify. Though this swimsuit alleges that Binance has certainly violated SEC laws, the aim of this lawsuit is for personal entities to win compensation for harm to their companies. In essence, Lahav and the plaintiffs have accused Binance of triggering the collapse of FTX, permitting Binance to safe extra of the market.

These costs appear considerably flimsy, particularly contemplating that they allege foul play in opposition to a agency whose CEO is at the moment on trial for fraud and cash laundering costs. Nonetheless, even when this lawsuit is dismissed briefly order, it nonetheless is a really telling snapshot of the final angle in direction of Binance: there may be blood within the water. Maybe these plaintiffs are primarily aiming to pressure Binance to settle with them, or maybe they plan to pursue this battle so long as attainable. Regardless, actions like this are hardly ever taken in opposition to multibillion greenback companies with a secure footing.

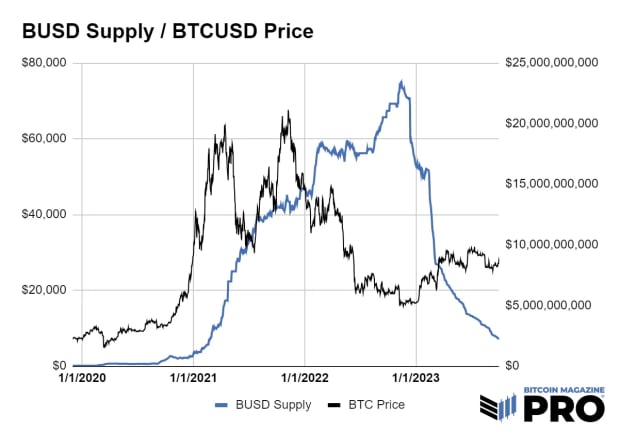

Even when this lawsuit flops with out a lot influence to Binance’s underlying enterprise, there are different warning indicators that appear much more dire. There was a dramatic fall from grace for Binance’s stablecoin, BUSD, because the agency introduced on October third that they might stop all borrowing and lending in BUSD earlier than the tip of the month. In August, Binance introduced a gradual closure of the BUSD asset, albeit with a imprecise timeline of a while in 2024. To have such a serious facet of the token shuttered in such quick order is typical of a lot smaller stablecoin operations. BUSD, nonetheless, had a peak market capitalization of $23 billion in November 2022, and has cratered dramatically in lower than a yr to barely over $2 billion. Evidently, one thing has gone deeply unsuitable with this previously-successful product, now that it’s being deserted completely.

It’s anybody’s guess as to what occurs to Binance from right here, whether or not it finally ends up utterly ceasing to exist a yr from now or flourishing past its former prominence. In any occasion, the worth of Bitcoin itself appears untangled from these proceedings. Though the complete crypto business took an enormous and sustained hit when FTX collapsed abruptly, the compounding difficulties for one more large crypto trade have coincided with a stable efficiency by the largest cryptocurrency. Maybe Bitcoin has discovered some classes from earlier setbacks, and will probably be extra resilient to future setbacks. In spite of everything, if there’s one factor that these developments can exhibit, it’s that the world of Bitcoin is a world enterprise with multifarious connections. It’s far greater than even the biggest crypto trade.