The under is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

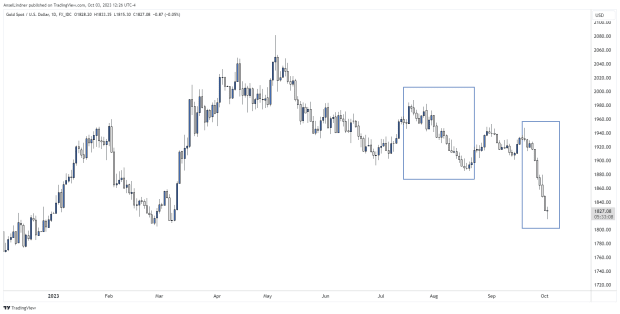

Bitcoin Decouples with Gold

Bitcoin and gold have comparable inflation-hedge narratives. Presently, gold has a decrease inflation charge (1.7%) than Bitcoin (1.8%), however it will likely be a monumental flip on the halving. A simplistic inflation story would require gold and bitcoin to rise collectively. Nonetheless, gold is getting hammered in the previous couple of days whereas bitcoin is bouncing.

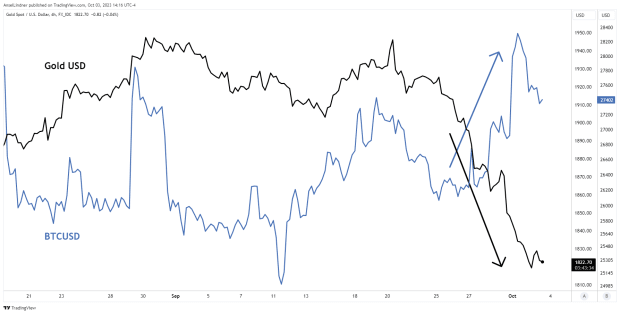

Very just lately, Bitcoin has been trending larger as gold crashes. They’re decoupling over the past week in a really apparent method. We’d count on gold to lag bitcoin throughout strikes, however that is precisely the other way. Gold is crashing whereas bitcoin has been bouncing.

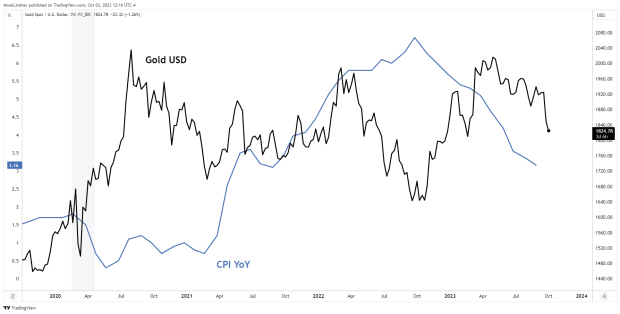

We really see a slight inverse relationship with CPI for gold and bitcoin. Final 12 months, as CPI was spiking, gold and bitcoin offered off. Some have arbitrarily argued about timing, saying bitcoin pumped earlier than CPI shot up. Or, possibly, inflation shouldn’t be the first drive on this market.

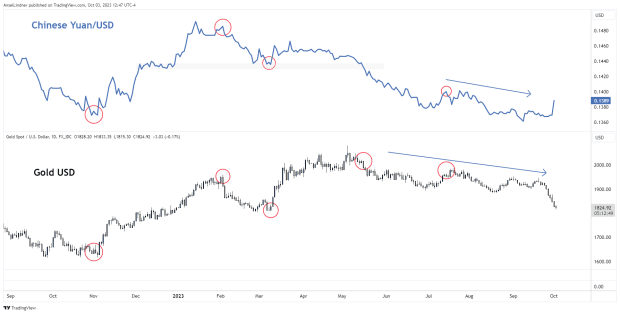

Chinese language Promoting Gold

We do have one thing to clarify this contradiction of crashing gold and bouncing bitcoin. It’s doubtless the Chinese language are promoting gold, as an alternative of their {dollars}, as a solution to defend their forex and protect their treasured greenback FX reserves. I ran throughout this text from Mining.com, China gold costs plunge essentially the most since 2020, curbing document premium, which claimed a Chinese language Communist Celebration quota on gold was simply lifted on imports to “cut back the necessity for native banks to purchase {dollars}.”

That could be a staggering improvement and explains what we’re seeing within the gold chart above. The Chinese language are in a devastating greenback scarcity/credit score crunch. I repeat, a greenback scarcity, not a flood of liquidity and cash printing. It’s time to bury the inflation narrative.

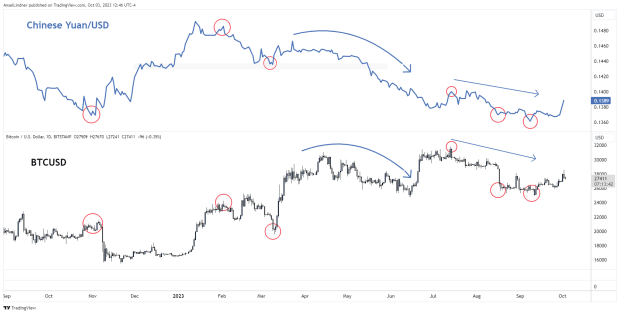

The correlation of each gold and bitcoin to CNY is placing.

Please be aware, Chinese language markets are closed this week for Mid-Autumn Pageant and China’s Nationwide Day (29 Sept – 8 Oct). The CNY knowledge above is from the Intercontinental Change (ICE) however different sources aren’t displaying the current spike. There was the next low on the CNY previous to market closing for the vacation, and I’ve been anticipating an imminent broad market pivot/consolidation. This might match each payments.

One other piece of proof that helps this bounce in CNY is seen in bitcoin. It too has been extremely correlated to CNY, and this week’s bounce in all probability corresponds to a CNY bounce in shadow markets.

Utilizing gold as an alternative of Treasuries and FX reserves to assist the crashing Yuan is a brilliant transfer and would take away promote stress from US Treasuries. This might flip the tide on the runaway US 10Y yield, which hit 4.82% on Tuesday. The identical factor occurred final September into October, with the 10Y spiking from roughly 100 foundation factors (bps), from 3% to 4%.

The overriding stress on this market is a greenback scarcity, not inflation. A greenback scarcity, larger charges, and better oil costs we’ve mentioned beforehand, will squeeze the market into recession. Even a quick leisure of stress on the yuan by promoting gold may create a disproportionate transfer in bitcoin. Bitcoin rallied 40% in January and March, and 26% in June on comparable or weaker yuan strikes. Bitcoin solely has to rally 17% at the moment to interrupt the long run resistance at $31,000.

Market-based Inflation Expectations

Shifting gears again to the US markets, relating to inflation vs recession odds. Final week, I wrote extensively on this relationship. If a recession is across the nook, which markets are pricing into Fed Funds futures and lots of consultants agree, that situation precludes even delicate inflation. It’s both/or. Both inflation, or recession.

Utilizing that heuristic, we are able to study inflation expectations and apply them to recession odds.

Essentially the most revered market-based indicators for basic inflation expectations are the 5y-5y Ahead Contract (anticipated inflation for the 5 12 months interval beginning in 5 years) and the 5 and 10-year Breakevens (the distinction between inflation protected securities (TIPS) and unprotected securities at these maturities).

All three measures are displaying the market anticipating inflation of lower than 2.5%. Crimson arrows denote instances of inversion, that’s instances when the 5-year breakeven was above the 10-year breakeven. That is one other inversion just like the yield curve, that indicators recession.

There may be additionally a sample to the compression in spreads. Previous to the Nice Monetary Disaster and previous to COVID, as recession grew to become extra doubtless, spreads compressed. As we speak, we once more see compression with solely 24 bps separating all three.

Inflation expectations of two.5% are neither excessive nor low, so it’s laborious to attract a direct conclusion from the extent itself. Nonetheless, the tightness signifies the market is changing into more and more fearful, like in 2007 and 2019. The subsequent factor we should always count on is inflation expectations to begin shifting down as we method recession.

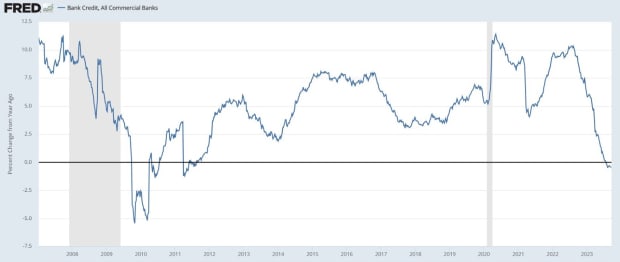

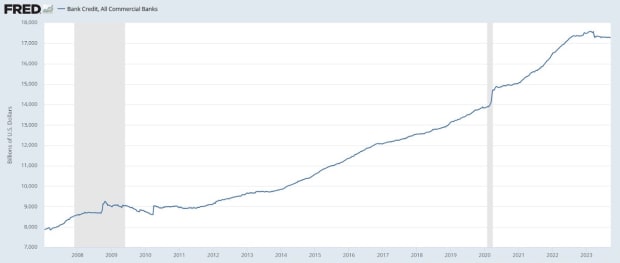

We are able to cross verify a forecast for falling inflation expectations with the extent of financial institution credit score. That’s base cash in spite of everything in a credit-based system. If inflation was a menace, financial institution credit score must be rising, making recession unimaginable. Nonetheless, we see simply the other. YOY change in financial institution credit score has hit zero.

Financial institution credit score is stagnant, that means a deflationary consequence could be very doubtless. That’s nice for bitcoin, as a result of additionally it is a hedge towards systemic credit score threat. There isn’t any counterparty threat to your bitcoin, not like all method of credit-based monetary belongings.

We’ve, subsequently, added two extra metrics to our ‘recession-not inflation’ thesis we’ve been constructing. Stagnant financial institution credit score will pull down inflation expectations and the ensuing gradual decline in breakevens define a basic timeline. As soon as inflation expectations start to fall, which financial institution credit score says it’ll, traditionally a recession follows in roughly 15 months.

Shares and threat belongings, together with bitcoin, are inclined to rise and yields fall within the 12 months main as much as recession (as outlined final week). So, we’ve got one more affirmation that bitcoin ought to have loads of runway by way of the halving and into subsequent 12 months.