The distribution of Ethereum’s provide speaks volumes about market sentiment, potential worth actions, and ecosystem well being. Understanding which addresses — be they whales (large holders), sharks (substantial holders), or shrimp (small holders) — personal how a lot ETH can present invaluable insights into market tendencies and potential future actions.

For context, let’s take into account Bitcoin (BTC). Traditionally, the conduct of Bitcoin whales and different massive holders has been seen as a big predictor of market path. In the event that they begin to offload their holdings, it usually alerts a bearish section. Conversely, once they accumulate, the market can anticipate bullish actions.

Ethereum, in contrast, has a extra complicated ecosystem. Whereas Bitcoin is primarily a retailer of worth, Ethereum’s utility as a platform for decentralized purposes means its holders may need completely different motives. Thus, whereas each cryptocurrencies may see comparable tendencies in holdings, the explanations and outcomes can range considerably.

There’s been a big drop in ETH held by whales and different massive holders because the starting of the 12 months.

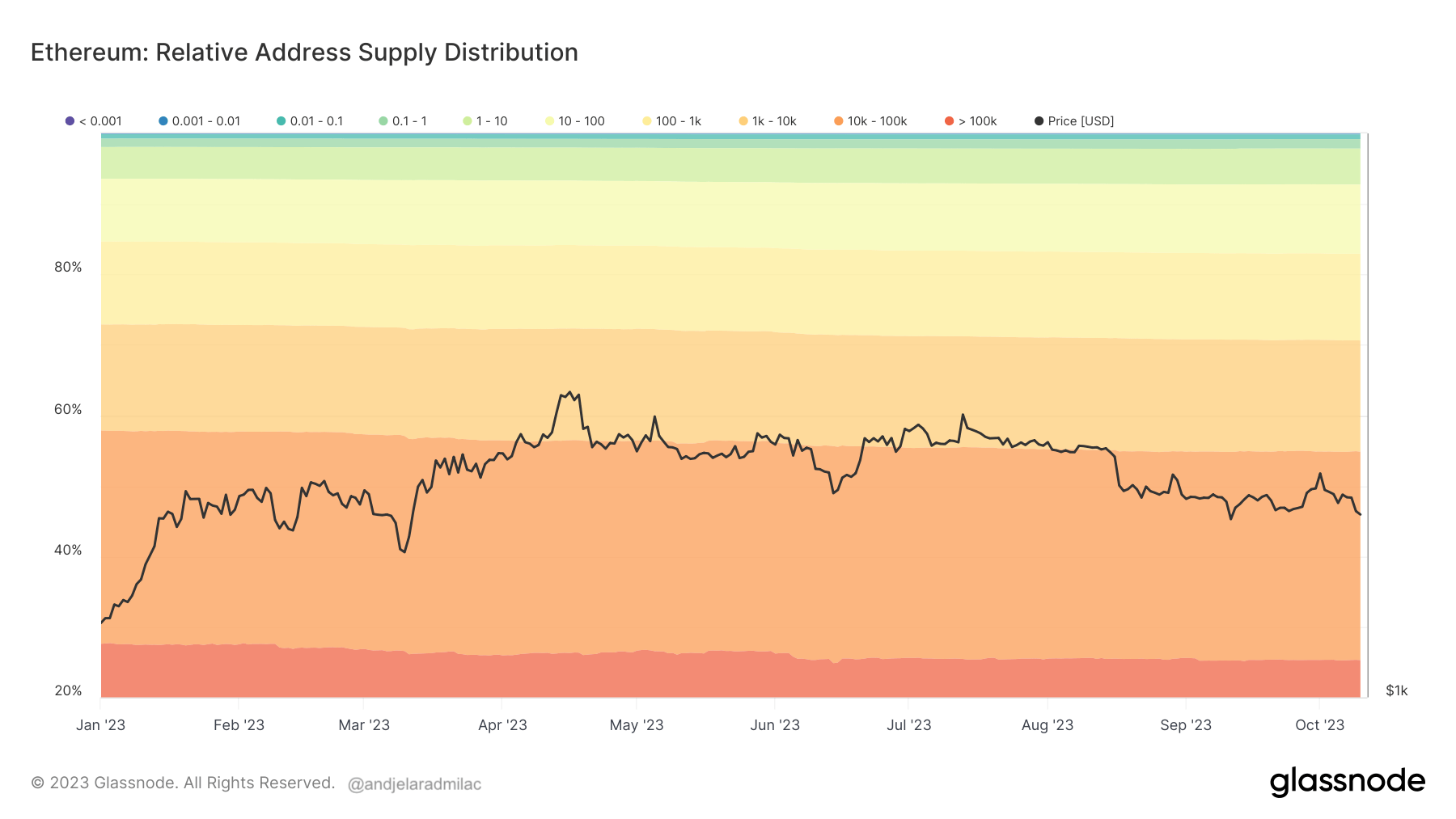

Glassnode information reveals that addresses with a stability of over 100,000 ETH noticed their holdings plummet from 28.9 million ETH in October 2022 to only 20.7 million ETH a 12 months later. This can be a stark lower of 4.7 million ETH in 2023. Equally, addresses holding between 10,000 and 100,000 ETH shed 3.5 million ETH, and people with balances between 1,000 and 10,000 ETH decreased their holdings from 13.8 million ETH to 12.9 million. In the meantime, addresses with 100 to 1,000 ETH and 10 to 100 ETH balances have seen drops of round 800,000 ETH and 200,000 ETH respectively this 12 months.

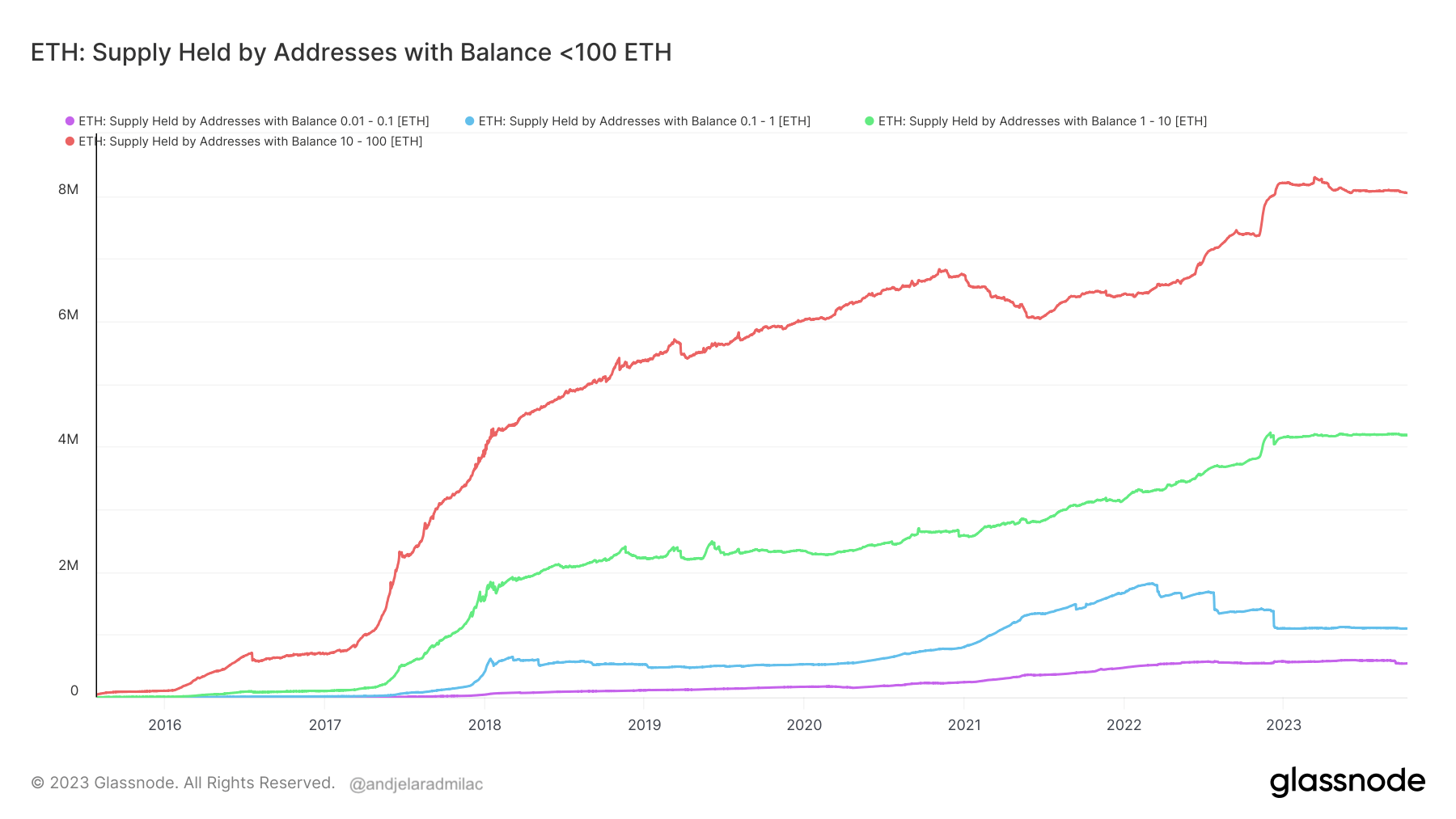

Trying on the smaller fish within the Ethereum sea exhibits a unique market dynamic. Holders with balances between 1 and 100 ETH have remained comparatively steady all year long, with solely marginal will increase. Nonetheless, the tiniest holders, these with lower than 0.01 ETH, noticed a notable uptick, accumulating an extra 21,860 ETH since January.

Regardless of the declines among the many bigger holders, the availability distribution nonetheless exhibits Ethereum’s majority provide resting within the arms of considerable addresses. As of October 10, 29.5% of Ethereum’s provide is held by addresses with 10,000 to 100,000 ETH balances. Compared, 1 / 4 (25.2%) of its provide is within the wallets of the whales, these with over 100,000 ETH.

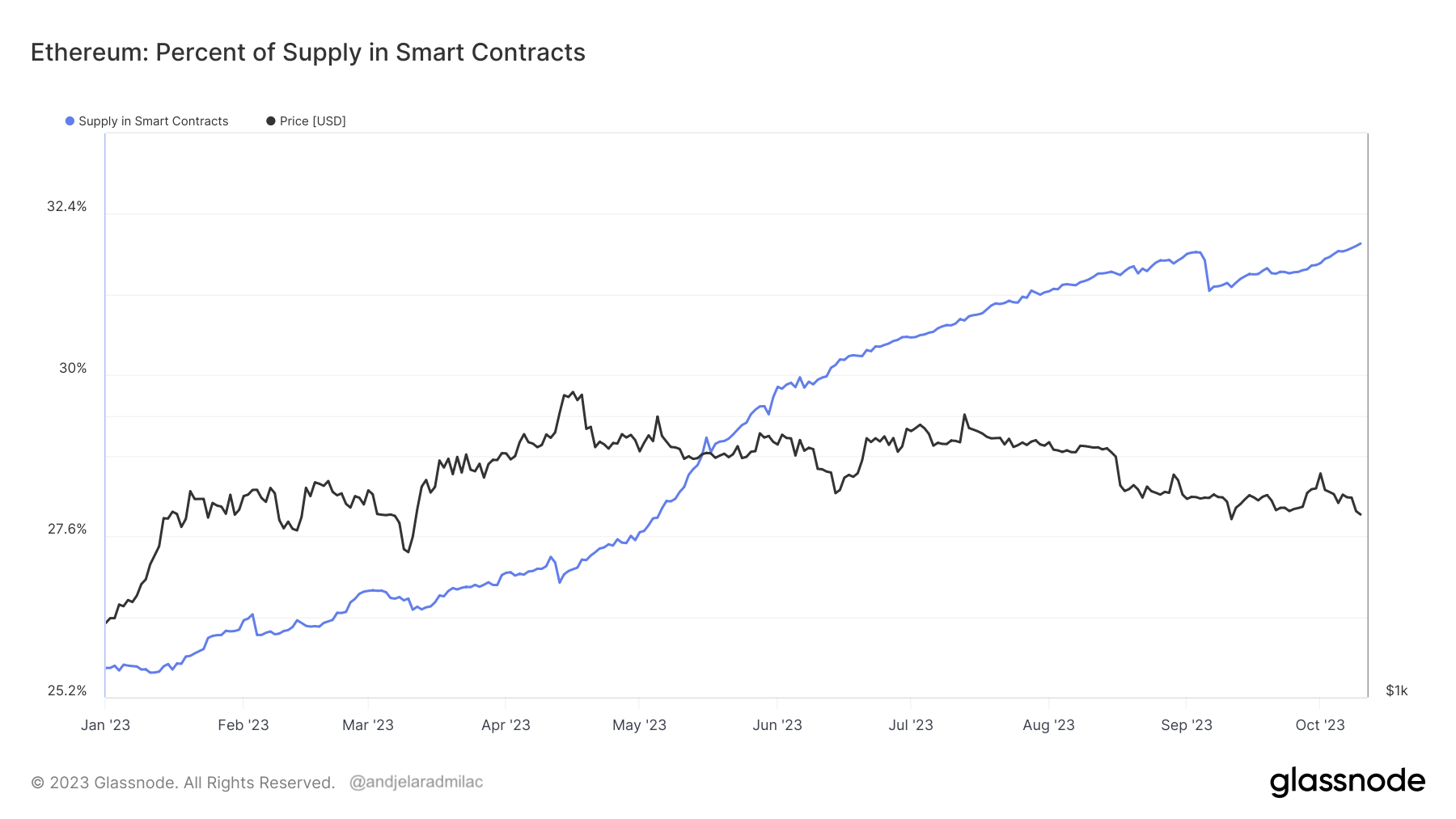

However what does this shift point out? A easy assumption may be that whales are promoting off. Nonetheless, diving deeper into on-chain metrics provides one other perspective. The proportion of Ethereum’s provide locked in good contracts has surged this 12 months, from 25.6% to 31.9%.

This improve means that whereas massive holders may be reducing their liquid ETH holdings, they aren’t essentially leaving the Ethereum ecosystem. As a substitute, they may be locking their belongings into DeFi initiatives, staking, or different good contract-driven initiatives.

The publish Diving into Ethereum’s altering provide panorama appeared first on CryptoSlate.