In a current pattern evident on crypto charts, Bitcoin dominance is as soon as once more on the rise, prompting some merchants and buyers to rethink their methods regarding altcoins. An in-depth evaluation of the information, coupled with insights from distinguished crypto analysts, unveils a number of compelling causes to train warning when contemplating an altcoin buy at this second.

Historic Priority

Bitcoin’s market dominance – its market cap relative to the complete cryptocurrency market – has traditionally been a number one indicator of market sentiment. If Bitcoin dominance is growing, it signifies that sentiment towards altcoins is waning.

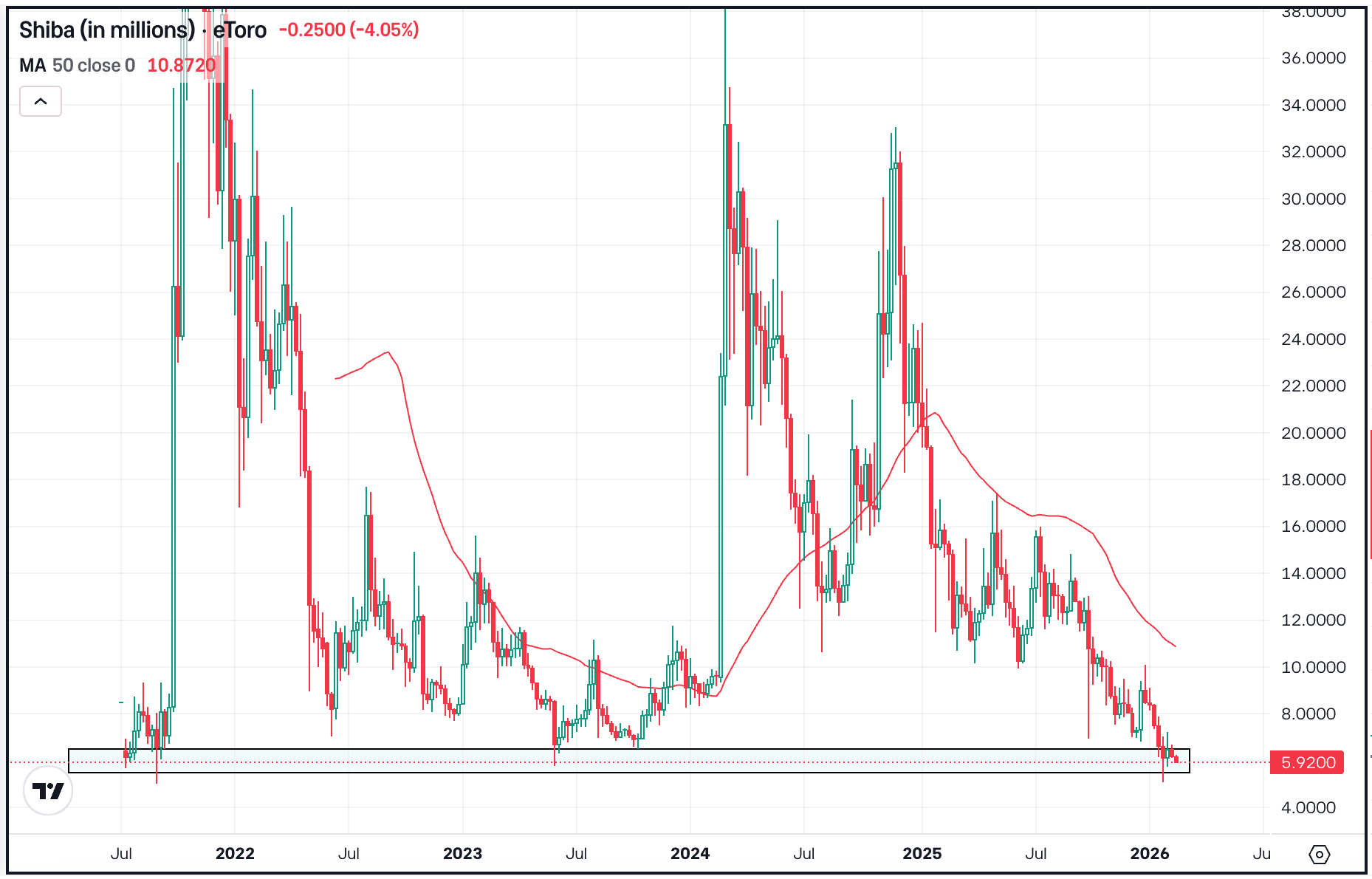

In an evaluation right now, famend analyst Rekt Capital has warned of this flashing sign, he shared the next chart and tweeted:

BTC Dominance has left the “retest zone”. Now within the technique of getting into an uptrend continuation which may see BTC Dominance revisit the 58% mark for the primary time in years.

Over the previous 5 months, the Bitcoin dominance noticed a consolidation inside the ‘retest zone’ after it noticed a ten%+ rise for the reason that starting of the 12 months. BTC dominance pulled again as a part of its retest which enabled altcoins to achieve some momentum for a brief time period. However, like in mid-2018, BTC is now breaking above the resistance zone, suggesting that 58% might be the following goal. Notably, BTC dominance peaked above 71% over the last run in 2021.

Altcoin Liquidity Issues

When Bitcoin’s dominance rises, it usually corresponds to diminished liquidity within the altcoin market. Lowered liquidity can result in heightened volatility, with worth swings doubtlessly wiping out important parts of invested capital. For buyers with a risk-averse profile, such circumstances won’t be supreme.

Furthermore, current curiosity seems to be concentrated totally on Bitcoin. In instances of capitulation and tedium, buyers usually search the safety and liquidity offered by Bitcoin over altcoins. A driving issue for that is that potential catalysts for the crypto market are Bitcoin-specific, just like the halving and the potential approval of a spot ETF. As these occasions play out, Bitcoin will most likely proceed to outshine altcoins.

Extra Insights From High Crypto Analysts

Joshua Lim, the previous head of derivatives at Genesis Buying and selling and former head of buying and selling technique at Galaxy Digital, lately weighed in on the continuing tussle between Bitcoin and Ethereum. “ETH/BTC spot ratio is a serious battleground proper now,” Lim famous, including that the rally in BTC/USD was successfully suppressing Ethereum. He highlighted a major skew in choices quantity favoring Bitcoin over Ethereum, emphasizing Ethereum’s diminishing allocator curiosity (choices quantity skewed 5:1 in the direction of BTC).

In the meantime, Miles Deutscher, a well-regarded crypto analyst, provided a condensed perspective on the prevailing market sentiment. “We’re in probably the most tough market section… the place time capitulation actually begins to set in,” Deutscher remarked. He additional cautioned retail contributors who’ve been distancing themselves from the market, suggesting that this is perhaps an inopportune second to take action.

Deutscher added, “Settle for that BTC is prone to lead within the early phases of the bull run… it’s not smart to fade BTC throughout this era.” He really useful a “top-down method to the market,” emphasizing a method that begins with the foundational property, Bitcoin and Ethereum, earlier than exploring different altcoins.

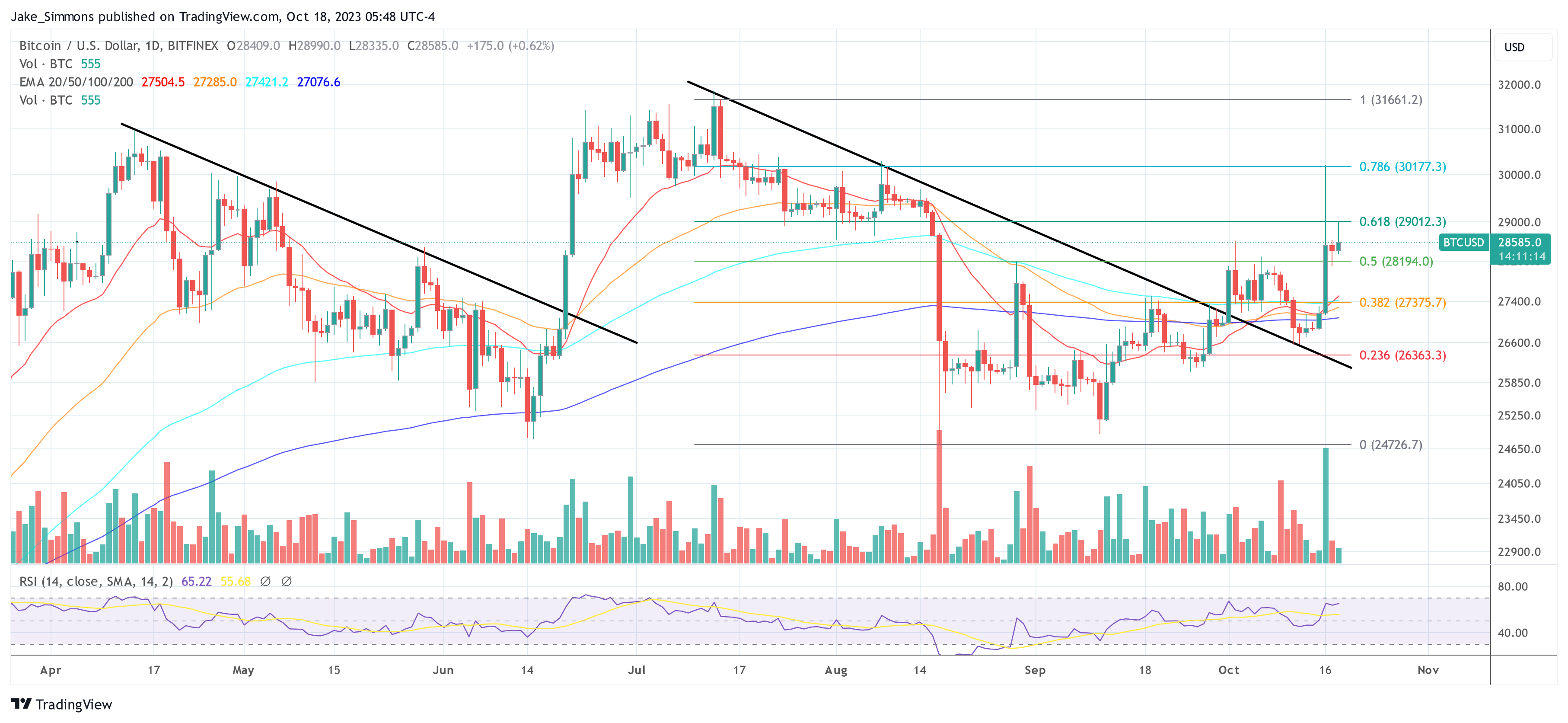

At press time, BTC traded at $28,585.

Featured picture from iStock, chart from TradingView.com