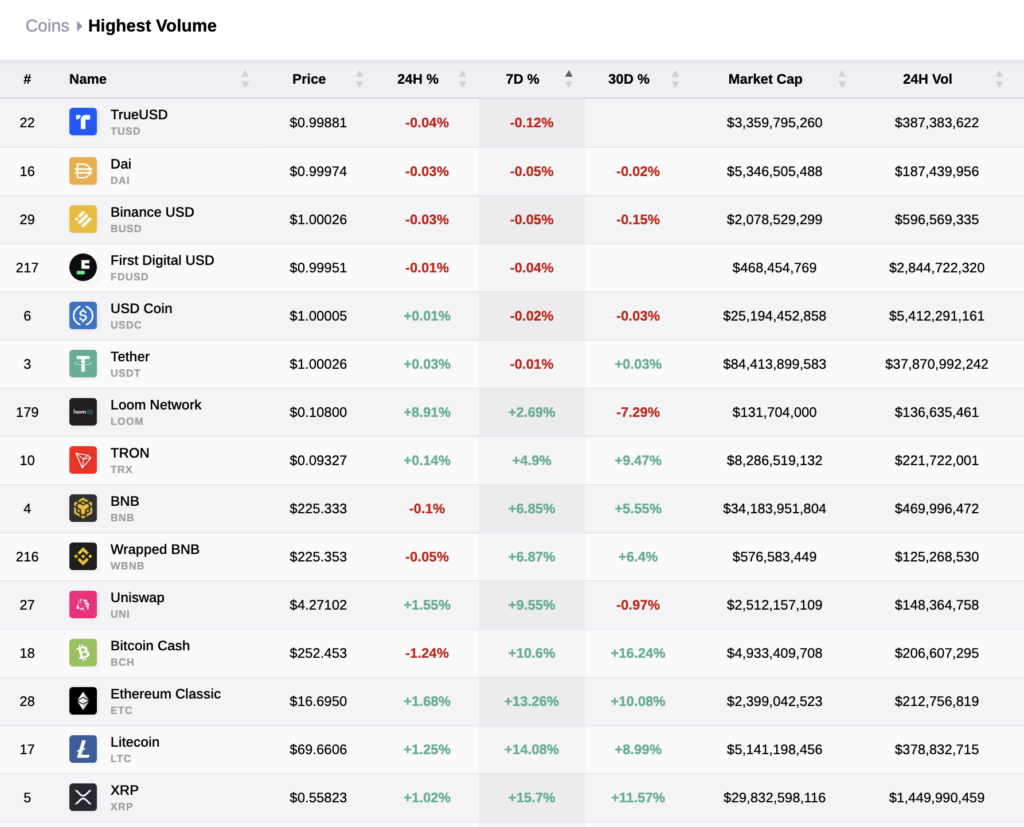

In a bullish indicator for the broader cryptocurrency market, six stablecoins have technically led trade losses over the previous 7 days, with the most important decline at 0.12%, underscoring the general power of the market.

The market stays strong, with stablecoins’ excessive commerce volumes highlighting their elementary function within the crypto ecosystem, holding their peg inside a spread of 0.15%. After the stablecoins, the subsequent asset on the checklist is Loom Community (LOOM), which recorded a 2.69% acquire up to now week.

Solely belongings with buying and selling volumes above $125 million had been included within the desk to investigate the actions of belongings with excessive liquidity. Tether recorded the very best buying and selling quantity of the previous 24 hours at $37,870,992,242, whereas the bottom quantity inside the information set was Wrapped BNB at $125,268,530.

In keeping with CryptoSlate information, TrueUSD (TUSD), Dai (DAI), Binance USD (BUSD), First Digital USD (FDUSD), USD Coin (USDC), and Tether (USDT) secured the highest 6 spots by way of 7-day losses when viewing the very best traded tokens of the previous week. This comes when the market shows a bullish sentiment, marked by a marked uptick in Bitcoin (BTC) and Ethereum (ETH).

Over the previous week, TrueUSD posted a 0.12% decline, whereas Dai skilled a 0.05% dip. Equally, Binance USD, First Digital USD, and USD Coin noticed a 0.05%, 0.04%, and 0.02% lower, respectively. Tether, at the moment main the pack by way of buying and selling quantity, noticed a minute 0.01% decline.

The significance of stablecoins within the digital asset economic system can’t be overstated. Their stability pegged to conventional fiat currencies, makes them the popular selection for merchants in search of to mitigate volatility dangers inherent within the cryptocurrency market. These digital belongings present an environment friendly medium of trade, a strong unit of account, and a sensible retailer of worth, contributing to their excessive buying and selling volumes.

In the meantime, Bitcoin and Ethereum, the second and third main digital belongings by quantity, posted strong good points over the identical interval. Bitcoin rose by 20.07%, at the moment buying and selling at $34,214, whereas Ethereum noticed a rise of 17.67%, with its worth climbing to $1,826.95 as of press time.

Whereas the good points within the main digital belongings counsel a bullish market, the lower in stablecoin values over the previous week signifies a shift in investor sentiment. As stablecoins’ quantity surges, merchants use these digital belongings as a launchpad, on the point of enterprise into extra risky cryptocurrencies amid an optimistic market outlook.

But, these market actions needs to be seen of their broader context. Undoubtedly, the crypto market stays risky and topic to speedy change. Nonetheless, the excessive buying and selling quantity of stablecoins and the current upswing in Bitcoin and Ethereum provide a promising glimpse into the current market dynamics.

As we proceed to watch these tendencies, it’s price noting that such nuances in market conduct spotlight the intricate dynamics of the crypto trade. When stablecoins