The worth of Bitcoin stands agency across the crucial space of $34,000, hinting at additional bullish potential. Nevertheless, market analysts marvel if sufficient clues level to the upside or if BTC will return to $20,000.

As of this writing, BTC trades at $34,150 with sideways motion within the final 24 hours. The cryptocurrency recorded a 15% revenue the earlier week and stays a high coin performer by market cap.

Bitcoin On-Chain Exercise Rises Hinting At A Bull Run?

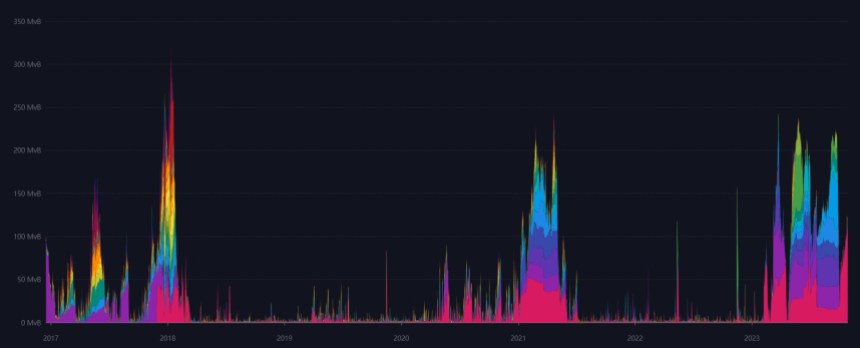

Information from the analytics platform mempool.area exhibits a rise in on-chain exercise on the Bitcoin community. This spike occurred in February 2023, when BTC transactions rose above 50 Mega Digital bytes (MvB).

Based on the analytics platform, the above metric measures the dimensions of transactions and blocks on the BTC community. The bigger the transaction, the more room they required.

As seen within the chart under, every time there’s a rise within the value of BTC, there’s a surge of exercise resulting in the rally. This occurred in 2017, and 2021, and it’s taking place this yr, which suggests the ecosystem is blooming, onboarding extra customers, and getting ready for a extra important rally like within the earlier yr.

Along with the rise in exercise, it’s attainable to see the decline within the metric in the course of the bear market and conclude bull markets report excessive exercise. In distinction, the bear market information a lot much less consumer exercise, and they’re typically cheaper to transact.

Nevertheless, in contrast to 2017 and 2021, this yr, this ecosystem noticed the implementation of non-fungible tokens (NFTs) and new purposes boosting these metrics. Thus, it’s more durable to find out if the present rally can attain comparable ranges than in earlier years because the BTC DeFi ecosystem attracts extra customers seeking to leverage the community for utility quite than long-term investing.

BTC DeFi Makes A Distinction In Key BTC Metric? A Chat With The Workforce Behind “Leather-based”

The surge in BTC on-chain exercise may very well be attributed to the cyclical nature of the crypto market. When the worth of BTC and others rise, or there’s an expectation of additional earnings, extra customers on-board the community.

In consequence, the variety of transactions recorded will increase. Nevertheless, many imagine that with the implementation of NFTs within the BTC ecosystem, transaction exercise can now not be attributed to a brand new bullish cycle.

In that case, rising exercise metrics might grow to be ineffective when measuring the sustainability of a BTC rally. To reply this query, we spoke with Mark Hendrickson, a Basic Supervisor at Belief Machines, an organization engaged on a Bitcoin DeFi pockets. That is what he informed us:

What’s “Leather-based,” and what’s your aim within the Bitcoin ecosystem?

A: Leather-based is a web3 wallets constructed round Bitcoin primarily based applied sciences and purposes. And so you possibly can consider Leather-based, merely put as MetaMask for Bitcoin within the sense that we wish to present a sturdy consumer expertise for connecting to purposes constructed with Bitcoin and Bitcoin layers wherein customers can do loads of the identical form of issues that they’ll concurrently solely do on good contracts enabled L1 chains, however to do them truly on Bitcoin.

So, Leather-based has the power to attach the purposes, determine your self to these purposes primarily based in your Bitcoin addresses and your related property with these purposes prompts for signed transactions which might be basically actions for these purposes and to take action throughout layers. (…) We additionally wish to facilitate the motion of liquidity between L1 and L2 (networks) and accomplish that in a really seamless method.

Lots of people, for a lot of causes, are unfamiliar with the Bitcoin DeFi ecosystem. Are you able to inform us extra about it, and what’s Leather-based’s function in it? Additionally, what do you say to customers who need Bitcoin to stay unchanged, the best way it has been since its inception in 2009?

A: Bitcoin primarily based DeFi, I’d say is mostly happening nowadays or form of rising in two locations. You’ve primitives for Bitcoin primarily based divide on Bitcoin itself. That’s an L1 (Layer one), largely pushed by Ordinals and inside Ordinals fungible token requirements like BRC 20. After which you will have additionally Bitcoin associated happening on Layer2 like Stacks which have good contract performance. (…) most of that’s happening through Ordinals on the layers. It’s happening largely via the native good contracting capabilities of these layers.

To the query of people that need Bitcoin to stay unchanged, I believe that the oldsters who’re engaged on Bitcoin-related performance, I’d say Bitcoin web3 typically, which incorporates DeFi. We’re attempting truly to do extra with Bitcoin with out having to alter Bitcoin actually in any respect. So truly our normal method is to attempt to lengthen what you are able to do with Bitcoin with out having to alter it essentially as a result of we do, after all, wish to respect all of the work that’s gone into Bitcoin so far and we’d love the safety profile of Bitcoin. And that has to do with taking a comparatively conservative method. And so should you have a look at Ordinals, for instance, which is actually an innovation primarily based on taproot launched pretty lately, there’s loads of innovation occurring on account of taproot ordinals with out having actually modified anything about Bitcoin. It’s a design area that’s truly fairly respectful of Bitcoin as blockchain.

There’s a principle that each bull run is preceded by a rise in on-chain exercise, with charges following costs on their approach to new highs. What do you consider community exercise proper now? Do you suppose a lot of it could actually now be attributed to Ordinals and different purposes?

A: Going again to the beginning of the yr, Ordinals has been an enormous exception to the final rule of the crypto bear market as a result of we’ve skilled basically two bull runs within Ordinals itself, which I believe have boosted Bitcoin’s place and positively has boosted community exercise on Bitcoin and charge charges have gone up on account of it. And actually proven that this concept of storing knowledge on chain on Bitcoin past simply easy transactions and making use of these primitives to numerous web3 purposes, whether or not it’s artwork or whether or not it’s new token requirements, that may have an enormous impact on simply how Bitcoin is used and likewise valued. (…) it’s arduous for me to essentially pinpoint any given motive why any given month the Bitcoin could have gone up in value due to different components, however it, it’s fairly clear that it has an total impact (on community exercise). Ordinals has been a optimistic affect on the curiosity in Bitcoin.

ETFs, retailer of worth, Gold 2.0, Halving, and now Bitcoin DeFi, what’s the present narrative dominating the BTC market? And which narrative will acquire extra prominence in the long term?

A: I believe the dominant narrative round Bitcoin might be that within the wake of the final crash, actually it’s a spillover from final yr. I believe there are loads of weaker applied sciences, weaker platforms and property that have been shaken out and other people ran away from and so they’ve taken extra protected harbor and Bitcoin come again to Bitcoin as actually the one which’s stood the take a look at of time. In order that mixed with the truth that individuals, for the reason that begin of the yr with Ordinals particularly have opened as much as that there are extra frontiers to what you are able to do with Bitcoin. I believe that mixture has actually pushed form of a renewed enthusiasm round Bitcoin. It’s a mixture of, it’s been across the longest, it’s probably the most safe, plus it’s not a dinosaur that may’t evolve nonetheless. It truly has loads of potential. It truly has each of these qualities which might be very engaging, safe and conservative in a technique, however it’s additionally extra revolutionary and there’s extra potential than individuals had realized earlier than then again.

Cowl picture from Unsplash, chart from Tradingview