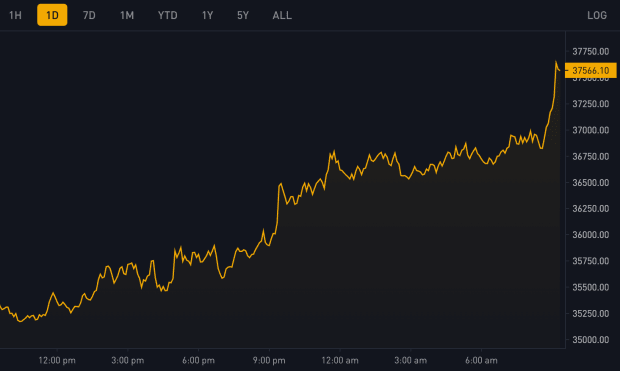

Bitcoin costs neared $37,000 in Asian buying and selling hours, making a “quick squeeze” that drove costs larger. Slightly below $50 million of bitcoin shorts (bets in opposition to the worth rising) had been liquidated in a four-hour interval, extending the BTC rally. Quick squeezes happen when the worth of an asset jumps larger than anticipated and quick sellers are compelled to cowl their positions, driving the worth larger nonetheless. Exchanges with a big Asian presence akin to BitMEX, OKX and Binance accounted for big chunks of the exited positions. Bitcoin’s bullish momentum adopted stories late Wednesday that the U.S. SEC is starting talks with fund supervisor Grayscale, with whom it has been engaged in a authorized battle over the conversion of the Grayscale Bitcoin Belief right into a spot ETF.