The Bitcoin worth returned to its sideways worth motion following a strong surge into new yearly highs. The cryptocurrency appears poised for additional positive aspects if bulls can maintain a crucial degree.

As of this writing, BTC trades at $36,370, with a 2% loss within the final 24 hours. Over the earlier week, the primary crypto by market capitalization recorded a 5% achieve, whereas the sentiment within the sector seems to be combined, with BTC recording losses as Ethereum and Solana stayed sturdy in the identical interval.

Bitcoin Seemingly To Bounce If This Situation Performs Out

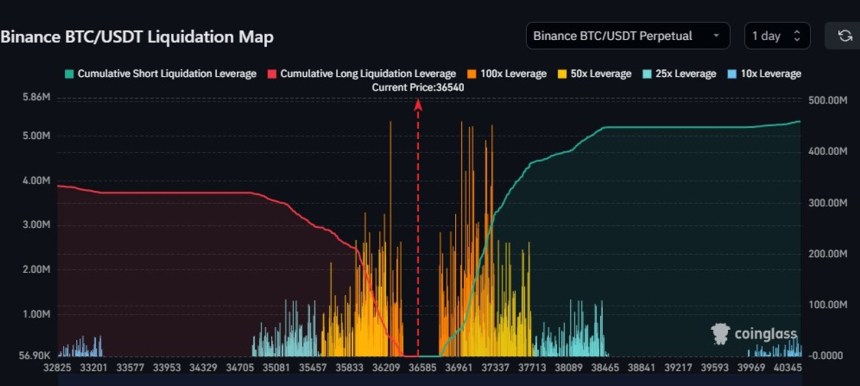

Based on a pseudonym analyst, the liquidity within the Bitcoin spot market, measured by a “Liquidity Map,” has been allotted to the draw back. This metric gauges the quantity of leverage within the BTC/USDT buying and selling pair.

The chart under reveals that BTC is buying and selling near an enormous liquidation cluster. Overleverage positions create these ranges and are sometimes tapped by large gamers to take advantage of the liquidity.

BTC whales chase liquidity, transferring costs in direction of the largest swimming pools of overleveraged positions. If the $36,300 will get tapped, the subsequent degree of curiosity is positioned to the upside between $36,961 and $37,700. The analyst acknowledged:

Huge clusters at $36K and ~$37K. Would anticipate there to be fairly some positions construct up round that 37K area primarily as we chopped round all of it day yesterday. Bears are again in management on the LTF (Low Timeframe) under $36.3K I’d say.

BTC Hits Native High?

However, the Bitcoin worth might pattern sideways between $36,300 and the excessive of its present vary. Extra knowledge from crypto analytics agency Bitfinex Alpha signifies that historic knowledge hints at unhealthy information for optimistic merchants.

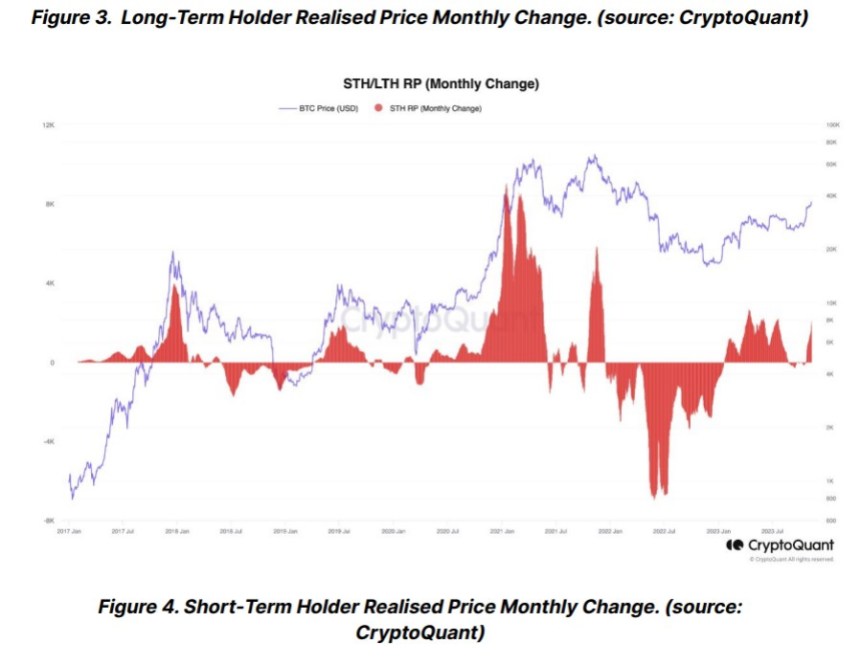

The agency advises warning for merchants because the liquidity hole within the Bitcoin spot market will increase. Per current knowledge, BTC Brief-Time period Holders Realized Value (STH RP) purchased the cryptocurrency at a mean worth of $30,380, which might incentivize these buyers to take revenue at present ranges.

That is the primary time STH has had a chance to make a giant revenue on their BTC holdings since April 2022 and December 2022. Traditionally, a month-to-month change in STH RP exceeding $2,000 typically indicators native peaks, significantly post-recovery in bear markets, as seen within the chart under.

Concurrently, a unfavorable month-to-month shift in LTH RP often implies long-term holders are offloading their Bitcoin. The convergence of a $2,000 enhance in month-to-month STH RP and a decline in LTH RP suggests a excessive chance of an area peak in Bitcoin’s worth.

Cowl picture from Unsplash, chart from Tradingview