The Bitcoin worth rally is shedding energy because the cryptocurrency returns to its assist ranges following weeks of bullish momentum. Within the quick time period, the panorama appears sloped to the draw back, however an analyst offered the primary explanation why the rally has simply begun.

As of this writing, Bitcoin (BTC) trades at $36,550 with a 2% loss within the final 24 hours. Over the earlier week, the cryptocurrency recorded comparable losses following the overall sentiment available in the market. Solely Solana (SOL) preserved its good points throughout the identical interval.

Behind Bitcoin’s Surge: Decoding the 4 Key Elements

In line with a report from Deribit Perception, posted by Markus Thielen, a number of forces are pushing Bitcoin in direction of new yearly highs. These forces stay intact regardless of the latest worth motion.

Among the many causes behind the present BTC worth rally, the analyst included speculations across the U.S. Securities And Change Fee (SEC) Bitcoin Change Traded Fund determination, merchants’ urge for food for leverage, fiat inflows by way of stablecoins, and elevated price technology throughout the Bitcoin community.

SEC’s Choice On The Bitcoin ETFs

A big driver is the anticipation surrounding the SEC’s approval of a spot Bitcoin ETF. Regardless of passing the second deadline in mid-October with none announcement, the market stays watchful, with the third deadline set for mid-January 2024. The uncertainty surrounding this determination has led to fluctuations in implied volatility, influencing Bitcoin’s worth.

Leveraged Positions and Futures Market

The demand for leveraged positions in Bitcoin, primarily by way of perpetual futures markets, signifies a powerful curiosity in buying and selling the BTC/USDT pair. This was evident when the funding premium reached an annualized +28% on November 13.

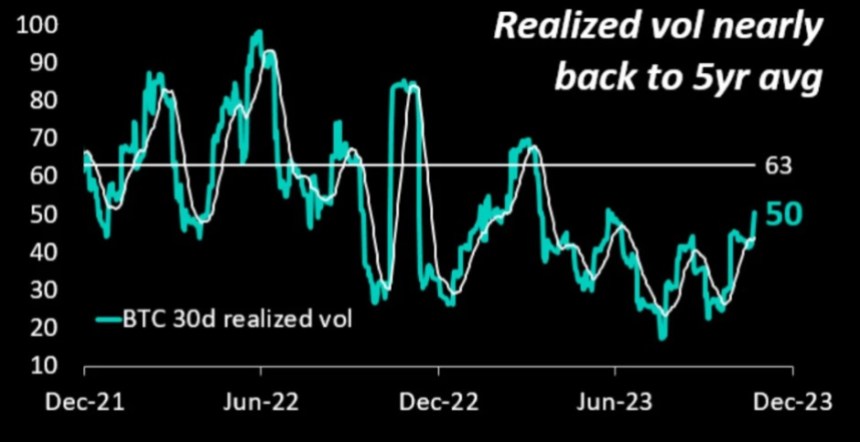

As well as, the BTC choices market noticed an uptick in realized volatility. The rise within the metric alerts threat urge for food for buyers.

The chart under exhibits that the metric approaches its 5-year common. Nevertheless, the analyst believes that volatility ought to decline because the yr ends, suggesting that Bitcoin will observe a sideways trajectory within the quick time period.

Inflow of Fiat By way of Stablecoins

One other essential side is the substantial fiat influx into cryptocurrencies, primarily by way of Tether’s USDT, indicating recent capital getting into the crypto area. With over $3.8 billion transferring into crypto within the final 30 days, this inflow has had a notable impression, particularly on altcoins, reflecting rising investor confidence.

Elevated Bitcoin Community Exercise

The Bitcoin community’s price technology alerts heightened exercise, reaching $54 million. The report claims that this progress in community utilization, partly pushed by the resurgence of Ordinals and assist from main exchanges, underscores the elemental energy of the Bitcoin ecosystem.

Regardless of these optimistic indicators, the absence of an SEC Bitcoin ETF approval and a discount in leveraged lengthy positions may forestall Bitcoin from hovering previous the $40,000 mark. Nevertheless, the continued stable fiat inflows and a strong, fee-generating Bitcoin community present grounds for cautious optimism.

Bitcoin’s journey stays charming because it navigates regulatory choices, market methods, and evolving investor sentiment.

Cowl picture from Unsplash, chart from Tradingview