Whereas many crypto customers consider in a cashless and fiatless world, it’s but to come back. Most of us nonetheless need to carry out numerous transactions utilizing good ol’ money, together with BTC and different crypto purchases.

Irrespective of whether or not you want a fiver for a cup of espresso or wish to high up your Bitcoin pockets with out having to undergo a centralized financial institution, crypto ATMs could be of nice assist to anybody seeking to convert their crypto to money and vice versa.

Hello, I’m Zifa, a crypto fanatic and author for over 3 years. Right this moment, I’ll present you how you can use a Bitcoin ATM, step-by-step. Let’s get began!

What Is a Crypto ATM?

A Crypto ATM, brief for cryptocurrency automated teller machine, is a kiosk or terminal that permits customers to purchase and promote cryptocurrency utilizing money or a debit card. Functioning equally to conventional financial institution ATMs, these machines present a handy manner for people to have interaction in cryptocurrency transactions and entry their digital property.

Crypto ATMs function by connecting customers to respected cryptocurrency exchanges, linking their cryptocurrency wallets, and facilitating the switch of funds. Whereas most Crypto ATMs enable customers to buy varied cryptocurrencies like Bitcoin, Ethereum, and Litecoin, it’s necessary to notice that not all ATMs assist the sale of those digital property.

Crypto ATMs have gained recognition and can be found worldwide in quite a few areas, comparable to buying facilities, airports, and comfort shops. Nevertheless, their availability could fluctuate relying on the area or nation as a consequence of regulatory constraints or restricted market demand.

What Is a Bitcoin ATM?

A Bitcoin ATM does precisely what its title suggests — it’s a regular ATM (Automated Teller Machine) that accepts BTC and different crypto cash and tokens as a substitute of fiat currencies and money. Additionally it is generally referred to as a Bitcoin Teller Machine, or BTM. Shopping for Bitcoin this fashion is as simple as depositing money to your financial institution card utilizing conventional ATMs.

Most Bitcoin ATMs enable customers to each purchase and promote Bitcoin, however not all of them: don’t overlook to test whether or not the ATM you’re planning to make use of provides your required performance. You can even use crypto ATMs to ship BTC to a different consumer’s Bitcoin pockets — simply enter their handle within the recipient discipline.

Whereas these ATMs are designed to be safe and maintain your funds protected, there are nonetheless some dangers related to utilizing them to promote and purchase Bitcoin.

Bitcoin transactions are irreversible as a result of nature of blockchain know-how, so that you must be additional cautious when coming into all of your private information, comparable to your Bitcoin pockets handle.There are numerous completely different Bitcoin ATM operators on the market, and a few could be much less… honorable than others. Don’t pay for any additional items or companies supplied by the ATM operator, and check out to take a look at the opinions for that individual ATM if it’s run by an organization you’ve by no means heard of earlier than.Identical to when utilizing fiat ATMs, take note of your environment: whereas there gained’t be a bank card for anybody to seize out of your hand, thieves can nonetheless take your cash, steal your private data, and so forth.

How Do Bitcoin ATMs Work?

Bitcoin ATMs don’t look all that completely different from fiat ones. Nevertheless, they function in a very completely different manner: as a substitute of being related to a financial institution, they convey instantly with the Bitcoin blockchain.

With a purpose to purchase and promote Bitcoin utilizing a crypto ATM, you’ll solely want two issues: a digital pockets and a conventional one. Simply insert some payments into the machine after which scan the QR code in your digital pockets or enter its handle manually — that is all that you must purchase Bitcoin utilizing a Bitcoin ATM.

The cryptocurrency you get from a Bitcoin ATM is distributed from the pockets of its operator firm.

How one can Use a Bitcoin ATM

Though Bitcoin ATMs could seem a bit uncommon at first, they’re simple to make use of.

Step 1 – Get a Crypto Pockets

Step one to performing any crypto transaction is getting a pockets that helps the coin or token you wish to purchase. It may be a paper pockets, a digital pockets, or a {hardware} one — its sort doesn’t matter so long as it will possibly ship and obtain digital cash and is safe.

Step 2 – Put together Your Bitcoin Pockets

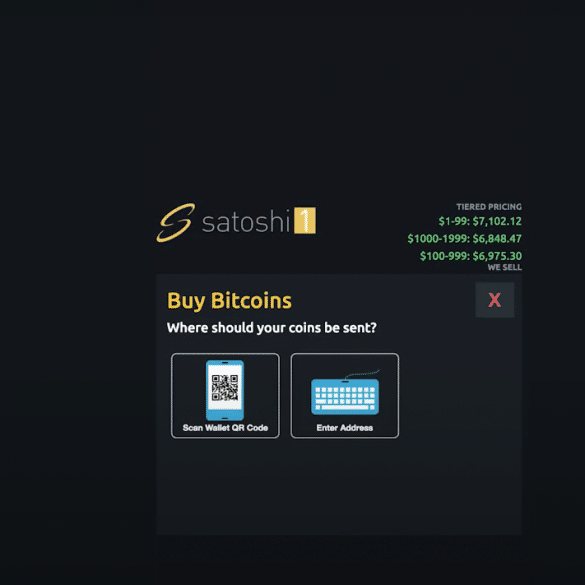

Most Bitcoin ATMs (Bitcoin Teller Machines) mean you can use QR codes to make Bitcoin transactions. Test whether or not your digital pockets provides that characteristic — in any case, it will possibly cut back one’s stress by eliminating the necessity to enter an extended and non-human-readable pockets handle.

Step 3 – Discover a Bitcoin ATM Close to You

Cryptocurrencies are usually not broadly accepted but, so the probabilities of you operating right into a Bitcoin ATM out within the wild are relatively slim, particularly should you don’t dwell in an enormous metropolis like London or NYC. The simplest method to discover Bitcoin ATM areas close to you is to make use of dwell maps like Coin ATM Radar, Bitcoin ATM Map, and others.

Most of those web sites, comparable to Coin ATM Radar, mean you can search for ATMs by proximity, operator, price, and different parameters.

Step 4 – Set Up Your Transaction

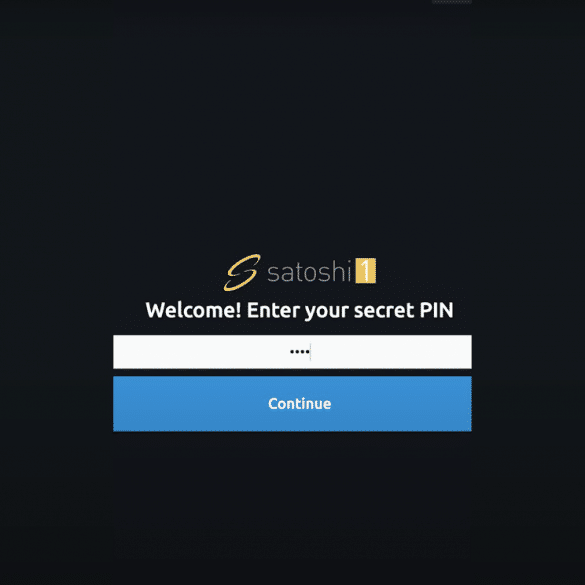

To make use of a Bitcoin ATM, you’ll first must confirm your identification.

As soon as that’s completed, you’ll must enter your PIN.

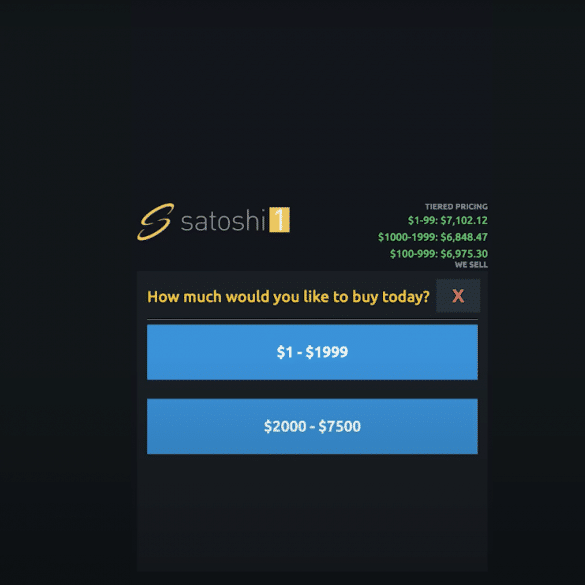

Subsequent, select the cryptocurrency you want to get (if the ATM provides multiple) and enter the quantity you’d prefer to buy.

Step 5 – Enter Your Pockets Info

When you’ve arrange your transaction, you will have to enter your Bitcoin pockets handle. Most ATMs mean you can use QR codes to reduce the danger of sending your new crypto to the mistaken pockets handle. For those who select to not go along with the QR code possibility, please bear in mind to double-check the handle you entered.

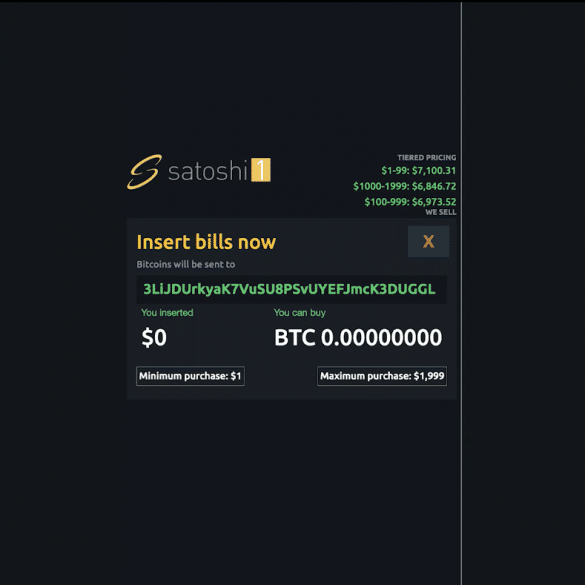

Step 6 – Insert Money

Double-check all transaction information and insert the required amount of money into the ATM.

Step 7 – Affirm the Buy

That’s it! Affirm the acquisition and wait in your new cryptocurrency to reach in your pockets. Supply instances rely on the cryptocurrency you’re buying however normally vary from 10 to fifteen minutes.

Bitcoin ATM Charges

All Bitcoin ATM operators have completely different insurance policies on the subject of transaction charges. A few of them could be fairly excessive, so generally it may be price it to journey a bit additional to benefit from the bottom charges within the space.

As cryptocurrencies change into extra broadly accepted, the variety of energetic Bitcoin ATMs is prone to improve, and the charges will most likely go down. Till then, we advocate utilizing ATM finders that allow you to kind ATMs by charges.

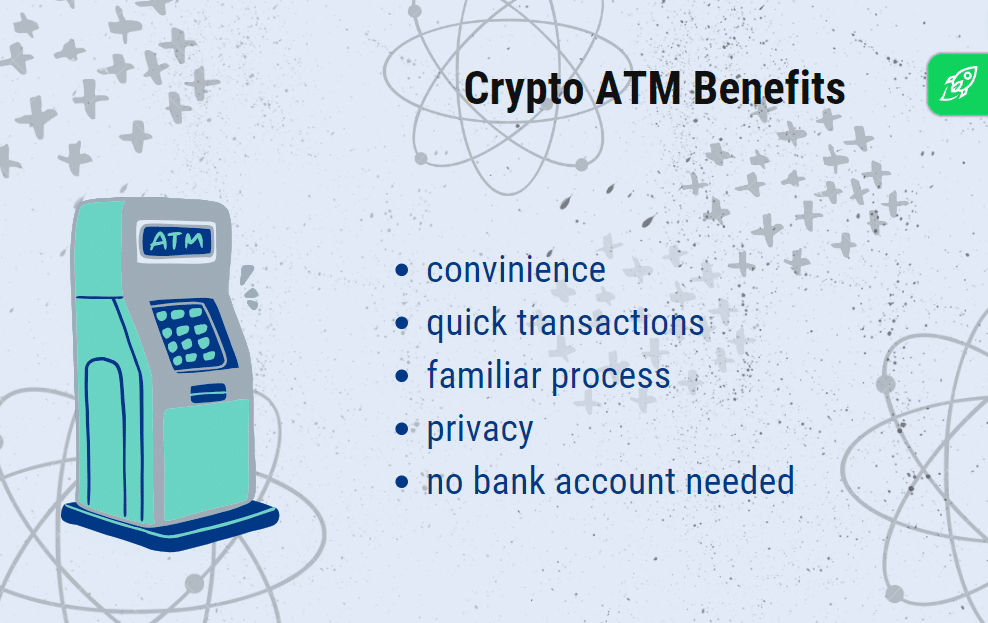

Advantages of Utilizing a Bitcoin ATM

Why do individuals go for crypto ATMs? Listed here are the advantages BTC ATMs supply over conventional cryptocurrency exchanges.

Comfort

Bitcoin ATMs supply quick entry to money, making them extremely handy for customers. They permit immediate conversion of digital currencies to money, not like conventional exchanges that may require linking financial institution accounts and ready for fund transfers.

Moreover, their rising ubiquity means you could find these ATMs in varied handy areas like buying facilities, gasoline stations, and airports. Working 24/7, they cater to customers at any time, mirroring the always-available nature of auto-teller machines.

Fast Transactions

One of many standout options of Bitcoin ATMs is the flexibility to order money upfront for withdrawals, guaranteeing fast entry when customers arrive. Transactions are virtually instantaneous, considerably decreasing wait instances in comparison with conventional banking strategies. With their rising quantity worldwide, Bitcoin ATMs have gotten extra accessible, providing a swift means for money transactions and withdrawals.

No Financial institution Account or Identification Required

For smaller transactions, many Bitcoin ATMs don’t require identification, making them accessible even and not using a checking account. This characteristic is especially helpful for low-risk transactions. Nevertheless, for bigger transactions, identification could also be required to adjust to AML and KYC rules. Customers usually confirm their identification by means of a cellphone quantity, which is confirmed through SMS.

Acquainted Course of

The acquainted format of conventional ATMs is leveraged in Bitcoin ATMs, making them extra approachable for customers. Positioned in strategic, high-traffic areas, they provide a easy and simple manner for individuals to purchase Bitcoin. This acquainted setup might help appeal to new crypto buyers, providing a handy entry level into the crypto market with out the complexities of conventional exchanges.

Privateness

Privateness is a key side of Bitcoin ATMs, interesting to those that worth monetary discretion. Customers can improve privateness by selecting ATMs that don’t require identification verification and utilizing Bitcoin wallets with privateness options. Whereas they provide extra anonymity than on-line exchanges, full privateness isn’t at all times assured as a consequence of potential safety measures like cameras or cell phone quantity verification.

Dangers of Crypto ATMs

Whereas crypto ATMs present comfort and accessibility, they aren’t with out dangers.

Excessive Charges

Bitcoin ATMs usually have greater charges in comparison with different monetary companies. These charges cowl the prices of working bodily machines, together with {hardware} upkeep, renting house, and offering buyer assist. Conventional banks, benefiting from extra established infrastructures and a broader vary of companies, can maintain their charges comparatively decrease. Equally, on-line crypto exchanges usually have decrease charges than Bitcoin ATMs, as they keep away from the overheads related to bodily machines and profit from bigger scale operations. Additionally they are inclined to have decrease blockchain transaction (or gasoline) charges.

Funds Not Insured

One other vital threat with cryptocurrency ATMs is the dearth of insurance coverage for funds. In contrast to conventional banks the place deposits are insured, cryptocurrencies in ATMs don’t take pleasure in this safety. This leaves customers uncovered to losses from safety breaches or technical failures. Moreover, many cryptocurrency ATMs lack anti-theft measures present in conventional ATMs, comparable to surveillance cameras, which will increase the danger of theft. The absence of devoted buyer assist can be difficult, leaving customers to take care of points like transaction errors on their very own.

Transaction Limits

Transaction limits at Bitcoin ATMs fluctuate. Operators could set predefined limits or modify them based mostly on buyer wants. Bigger transactions normally require Know Your Buyer (KYC) verification to adjust to anti-money laundering rules. Some ATMs supply tiered verification ranges, permitting customers to extend their transaction limits by offering extra data, like linking a checking account.

Availability

Bitcoin ATMs, although rising in quantity, are much less widespread than on-line exchanges. As of November 2023, there are round 39,000 Bitcoin ATMs globally, a small determine contemplating the worldwide inhabitants. In distinction, on-line exchanges are accessible to anybody with an web connection, providing a extra intensive vary of choices and sooner setup for buying and selling Bitcoin.

How are Crypto ATMs Regulated?

The regulation of cryptocurrency ATMs is a fancy and evolving side of the monetary panorama, influenced by a mixture of worldwide, federal, and state legal guidelines. In america, the operation of those ATMs falls beneath the jurisdiction of the Monetary Crimes Enforcement Community (FinCEN). Operators are required to register as cash companies companies in compliance with the Financial institution Secrecy Act (BSA), which calls for a sturdy Anti-Cash Laundering (AML) program, together with submitting Suspicious Exercise Stories (SARs) and Forex Transaction Stories (CTRs) for sure transactions. The Patriot Act additional dietary supplements this framework with stringent Know Your Buyer (KYC) procedures, notably for transactions above specified thresholds.

On the state degree, Crypto ATM operators usually want a cash transmitter license, adhering to particular state rules and client safety legal guidelines. These can embrace the clear disclosure of charges and trade charges and the safety of client information. Native ordinances can also affect Crypto ATM operations, together with zoning legal guidelines and particular operational necessities.

Internationally, regulatory approaches can fluctuate. A notable instance is the U.Okay., the place the Monetary Conduct Authority (FCA) has not too long ago intensified efforts to manage cryptocurrency ATMs. In a major transfer, the FCA has been cracking down on unregistered crypto ATMs, citing issues over cash laundering. This aligns with the broader regulatory coverage within the U.Okay., the place all cryptocurrency-related corporations are required to register with the FCA, guaranteeing compliance with AML requirements and different regulatory measures.

This intricate regulatory tapestry, comprising each nationwide and worldwide guidelines, highlights the continuing efforts to steadiness innovation within the cryptocurrency sector with the necessity for monetary safety and client safety.

A fast look again at Bitcoin ATMs

Let’s take a second to replicate on the attention-grabbing historical past of Bitcoin ATMs, a major improvement within the cryptocurrency world. It began in 2013 in North America – in Vancouver, Canada, the place the primary operational Bitcoin ATM appeared. This progressive machine simplified the method of exchanging money for Bitcoin, making cryptocurrencies extra approachable and user-friendly.

Shortly after its debut in Vancouver, Bratislava, Slovakia, embraced the pattern by putting in its first Bitcoin ATM in 2014. This enlargement showcased the widespread curiosity in such digital options, highlighting the convenience of shopping for and promoting Bitcoin with conventional foreign money.

In 2014, america joined in. The primary Bitcoin ATM within the U.S. was arrange in Albuquerque, New Mexico. This was an thrilling step ahead for American cryptocurrency fans, signaling a brand new degree of accessibility.

The Way forward for Bitcoin ATMs

The way forward for Bitcoin ATMs largely depends upon the additional improvement of the crypto trade. As Bitcoin and different cryptocurrencies change into extra in style and, much more importantly, extra broadly accepted as a cost technique by varied companies and companies, the variety of cryptocurrency ATMs you see on the streets may even improve.

There’s at all times a risk that ATMs, normally, could change into out of date sooner or later, however we don’t assume that’s a possible situation — at the least, not for the subsequent 5 or 10 years.

Having studied the cryptocurrency ATM market, varied researchers got here to the conclusion that it’s going to see vital development within the subsequent few years. Specialists from Allied Market Analysis, for instance, predict that this trade is prone to develop at a CAGR (compound annual development charge) of 58.5% every year from 2021 to 2030.

And should you can’t bear to attend till Bitcoin ATMs change into commonplace and get all of the perks that include widespread recognition, you’ll be able to at all times purchase, trade, and promote Bitcoin and different cryptocurrencies on our immediate trade as a substitute.

FAQ

What’s the greatest Bitcoin ATM to make use of?

Selecting the very best Bitcoin ATM largely depends upon your location and particular wants. To discover a Bitcoin ATM close to you, the best technique is to make use of dwell mapping companies like Coin ATM Radar or Bitcoin ATM Map. These platforms are extremely user-friendly and mean you can seek for ATMs based mostly on varied standards comparable to proximity, operator, charges, and extra.

Among the many high crypto ATM operators, you may come throughout names like Coinstar Bitcoin Machines, identified for his or her widespread presence. Coin Cloud Bitcoin ATM and RockitCoin are additionally in style for his or her user-friendly interfaces. For these searching for handy choices, Simply Money ATM and LibertyX ATM stand out. Moreover, Pelicoin ATM is one other notable supplier, providing dependable companies in lots of areas.

Keep in mind, when selecting an ATM, think about not simply the placement but additionally components like transaction charges, limits, and consumer opinions to make sure you get the absolute best expertise.

How do I ship cash to a Bitcoin ATM?

In case you are shopping for BTC, then you need to use money. For those who’re promoting Bitcoin, you need to use your Bitcoin pockets by both manually coming into its handle or scanning a QR code.

Do I want an account to make use of a Bitcoin ATM?

Whereas some Bitcoin ATMs could ask you to create an account, not all of them accomplish that. Most ATMs mean you can begin shopping for Bitcoin after merely coming into a textual content verification code.

Can you set money in a Bitcoin ATM?

Sure, you need to use money to buy Bitcoins in your nearest Bitcoin ATM.

Are Bitcoin ATMs protected?

Sure, they’re as protected as conventional ATMs and any trade. This is among the most incessantly requested Bitcoin ATM questions since each crypto and conventional banking ATMs can generally be seen as much less dependable. Nevertheless, so long as you look out for issues like terminals on high of present ones or cameras, it ought to typically be nice. Bitcoin ATMs are designed to be safe and defend your funds, however please at all times bear in mind to be cautious when utilizing them.

How do I take advantage of a Bitcoin ATM with a debit card?

Generally, nearly all of Bitcoin ATM machines settle for money solely. For those who can’t discover one that permits you to buy Bitcoin along with your card, you need to use a fiat foreign money ATM to withdraw money out of your checking account first and use it to purchase Bitcoins in a BTC ATM.

How a lot Bitcoin are you able to ship in a single transaction through a crypto ATM?

Every Bitcoin ATM operator (Bitcoin Depot, Coin Cloud, and so on.) has their very own limits you can search for on their web sites.

Additionally they normally publish directions on how you can ship cash by means of their specific Bitcoin ATM machine.

Disclaimer: Please observe that the contents of this text are usually not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native rules earlier than committing to an funding.