A CryptoQuant analyst believes a major pullback for Bitcoin may very well be inevitable based mostly on the web taker quantity indicator knowledge.

Bitcoin Web Taker Quantity Has Plunged Into Destructive Zone Lately

As CryptoQuant Netherlands neighborhood supervisor Maartunn defined in a submit on X, the BTC web taker quantity has just lately turned purple. The “web taker quantity” refers to a metric that retains observe of the distinction between the taker purchase and taker promote volumes of Bitcoin on the futures market.

When the worth of this metric is optimistic, it implies that the taker purchase quantity exceeds the taker promote quantity proper now. Such a pattern implies a bullish mentality is dominant among the many buyers at present.

Then again, unfavourable values counsel the bulk shares a bearish sentiment, because the promoting strain within the sector seems to be larger in the meanwhile.

Now, here’s a chart that reveals the pattern within the 30-day shifting common (MA) Bitcoin web taker quantity over the previous couple of years:

The 30-day MA worth of the metric appears to have turned purple just lately | Supply: @JA_Maartun on X

As displayed within the above graph, the 30-day MA Bitcoin web taker quantity was extremely optimistic when the newest rally first occurred. This naturally suggests {that a} excessive quantity of shopping for strain was current within the sector.

The chart reveals that such indicator values additionally accompanied many different surges within the cryptocurrency throughout the previous couple of years. Nonetheless, as quickly because the metric dropped, the worth hit an area high.

Lately, the sooner considerably optimistic 30-day MA web taker volumes began disappearing, and now, the indicator has taken on a unfavourable shade. This may very well be dangerous information for Bitcoin, as earlier durations the place taker sellers assumed command led to the asset observing notable bearish momentum.

Some exceptions have been to this, like the online taker quantity briefly turned unfavourable when this rally kicked off. Nonetheless, these cases have had the market leaning in direction of the opposite aspect to a really minimal diploma, which isn’t the case this time.

The indicator has solely simply turned unfavourable, so it definitely doesn’t have the length on its aspect but, however the degree it has plunged to is sort of sizeable. “A big pullback is inevitably on the horizon,” warns Maartunn.

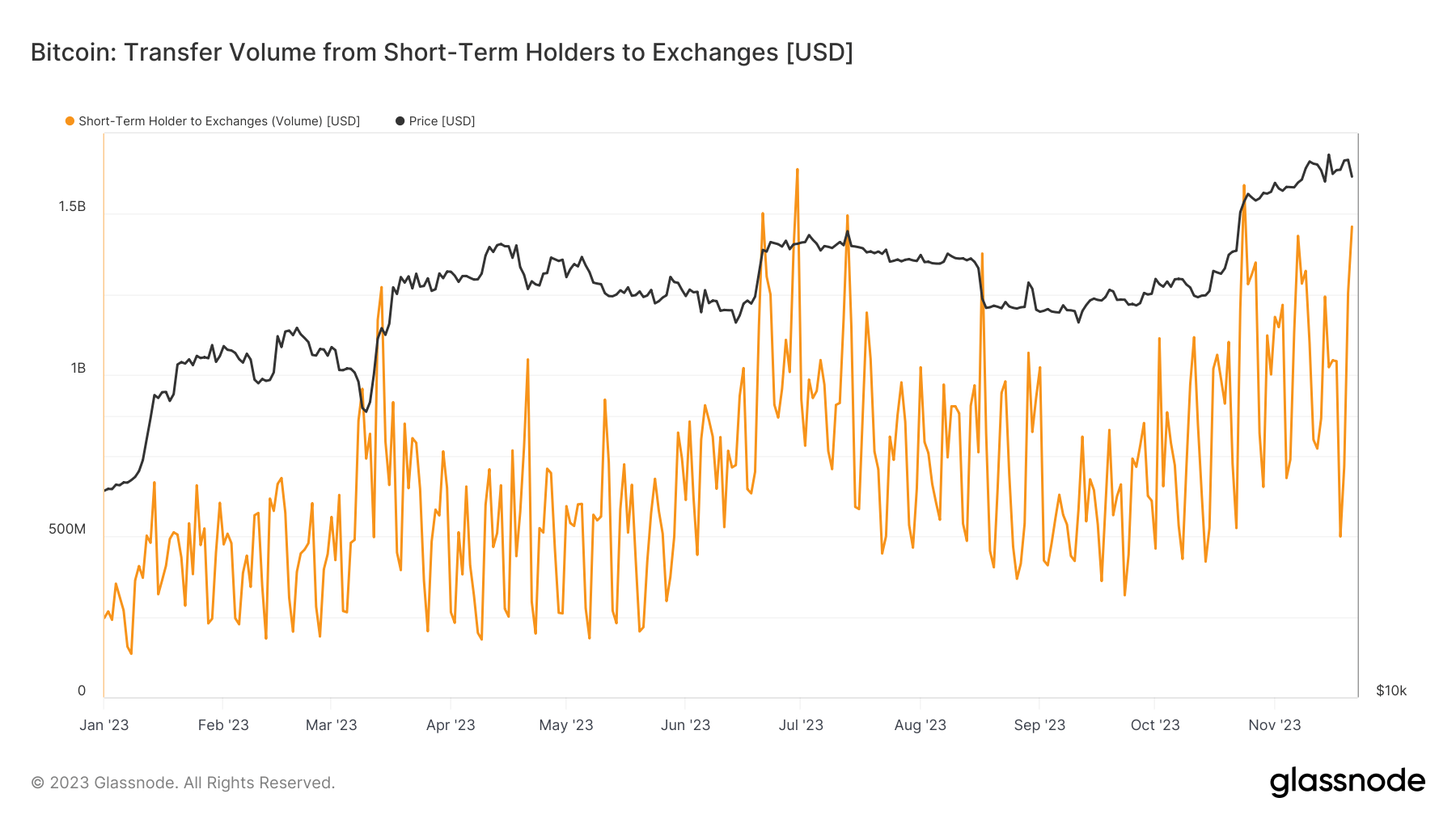

In another information, the Bitcoin short-term holders (buyers holding since lower than 155 days in the past) transferred a big quantity in direction of exchanges yesterday, as analyst James V. Straten has identified.

The information for the switch quantity going from the STH wallets to exchanges | Supply: @jimmyvs24 on X

Traders normally switch to those platforms for promoting functions in order that these deposits might have been an indication of a selloff available in the market. The short-term holders transferred $1.5 billion to exchanges yesterday, making it the fifth largest selloff of the 12 months.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $36,600, up 1% previously week.

Seems like BTC has been largely caught in consolidation just lately | Supply: BTCUSD on TradingView

Featured picture from engin akyurt on Unsplash.com, charts from TradingView.com, Glassnode.com, CryptoQuant.com