Revealed: November 24, 2023 at 12:15 pm Up to date: November 24, 2023 at 12:16 pm

In Temporary

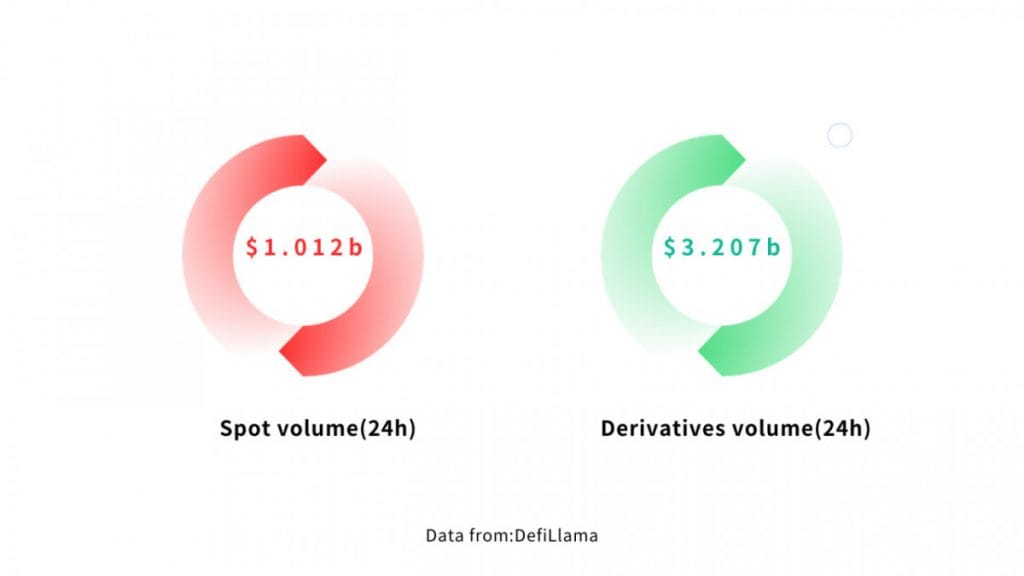

Derivatives buying and selling has turn into an indispensable a part of the crypto panorama. The perpetual contracts market share considerably elevated throughout the derivatives market even on-chain.

Market Overview

Derivatives buying and selling has turn into an indispensable a part of the crypto panorama. The perpetual contracts market share considerably elevated throughout the derivatives market even on-chain.

The event of on-chain derivatives buying and selling protocols has been getting in two essential instructions. One follows the standard Centralized Change (CEX) order ebook mannequin, the place the orders are saved on a centralized server, faces challenges in balancing decentralization with buying and selling expertise. The opposite, represented by the GLP fund pool mannequin, with GMX as a number one instance, operates as a lending mannequin the place liquidity suppliers (LPs) lend funds for consumer positions permitting the customers to make a revenue versus LPs shedding cash. Whereas this mannequin gives an easy buying and selling expertise, it has notable drawbacks. The scale of a dealer’s open place is proscribed by the LPs’ pool of funds, moderately than an actual perpetual contract, the place the open place restrict relies upon solely on the counterparty; subsequently there’s a excessive danger of loss for the LPs when the market is one-sided.

Right here, we introduce a novel derivatives buying and selling protocol that inherits the identical benefits of decentralization, effectivity, and transparency because the spot AMM and is completely suited to the value discovery operate within the perpetual contract product area, which vastly improves the capital utilization.

Equation Introduction

Equation is a decentralized perpetual contract protocol primarily based on Arbitrum, audited by the third-party agency ABDK. Leveraging its progressive Balanced Price Market Maker (BRMM) mannequin, Equation permits merchants to ascertain bigger and unrestricted positions at as much as 200x leverage whereas benefiting from decrease liquidation dangers (MMR = 0.25%). On the identical time, liquidity suppliers also can improve capital effectivity by utilizing leverage on Equation.

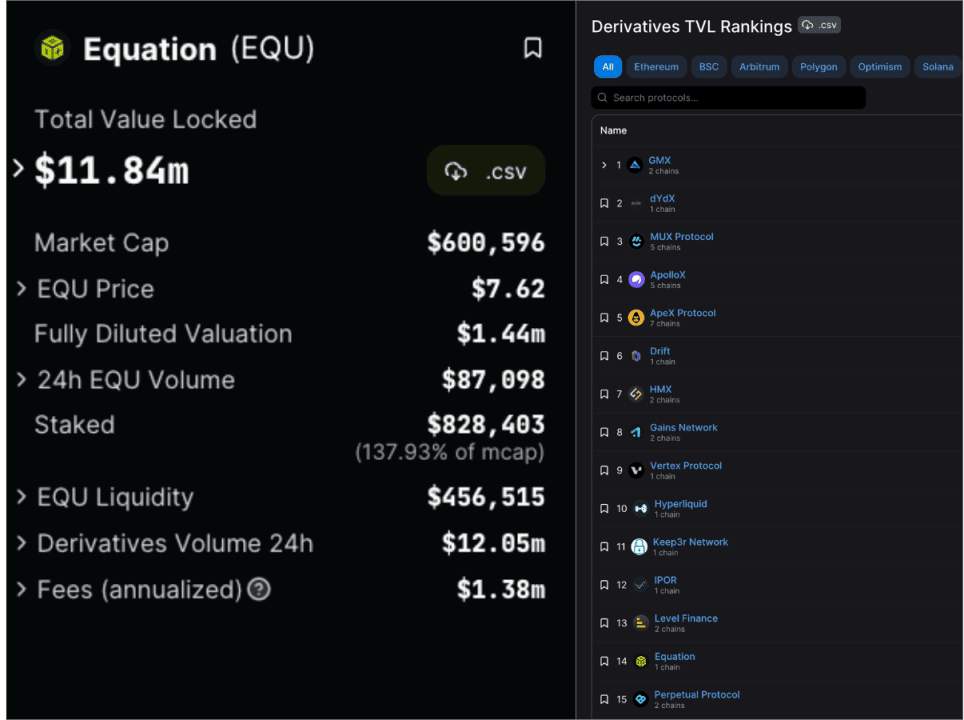

Equation formally launched on the Arbitrum mainnet on October 28, 2023. In keeping with DefiLlama information on the day of writing, Equation ranks thirteenth amongst 162 on-chain derivatives exchanges.

Mechanism Benefits

The BRMM (Balanced Price Market Maker) idea attracts inspiration from the AMM (Automated Market Maker) mechanism within the spot market, with a key distinction. It calculates the liquidity pool’s steadiness fee primarily based on the non permanent positions held by liquidity suppliers. This fee is then used to calculate the contract value premium relative to the index value. BRMM can then discover value discovery. The BRMM mannequin has a transparent benefit. Equally to perpetual contracts on CEX, who’re relying solely on counterparty measurement, the consumer place sizes usually are not restricted by liquidity. The liquidity offered by LPs solely serves as non permanent counterparty positions, permitting the customers to learn from non permanent place dangers.

The advantages of those mechanisms attracted many customers to Equation, particularly after the Mainnet launch. In keeping with Equation’s official web site, on the 24st day of the Mainnet operation, Equation protocol’s leveraged liquidity amounted to $596,584,794, with a perpetual contract buying and selling quantity of $296 million and an open contract quantity of $76,183,194.

Truthful Launch and Burning Mechanism

EQU is Equation’s native token. EQU has a most provide of 10 million tokens, generated fully by means of place mining, liquidity mining, and referral mining. All of those mechanisms reward the group members of Equation. As of writing, Arbiscan reveals that 224,877 EQU have been mined, and EQU is at the moment solely obtainable for commerce on Uniswap, now at $11.88.

EQU is differentiating itself from rivals when it comes to the token allocation. Equation allocates 50% of tokens by means of Place Mining to merchants. LPs will seize extra buying and selling charges due to our elevated capital effectivity by means of leverage. Equation presents two staking modes for EQU: EQU/ETH LP NFT staking and Solo-asset EQU staking. These two mining modes require totally different lock-up intervals. As we communicate, 159,872 EQU are in staking. Token staking signifies the boldness within the challenge’s improvement, correlating positively with the holder’s time and constructive notion on the challenge.

Equation DAO has adopted a proposal to burn off a proportionate quantity of unused EQUs primarily based on the size of the EQU lock-up interval, a strategic transfer designed to doubtlessly enhance the worth of EQU holders’ holdings and to encourage and reward them for his or her long-term funding within the ecosystem.

Conclusion

Clearly excelling within the decentralized perpetual contract area, Equation outperforms its DEX rivals. Elements similar to buying and selling prices, place limits, liquidity pool depth, and upkeep margin charges straight affect positively the buying and selling expertise for merchants. Equation, by means of measures similar to funding charges, charge reductions, and place mining, gives merchants with a less expensive buying and selling service.

For liquidity suppliers, a DEX’s capital effectivity is essential and Equation presents the chance to LPs to leverage to acquire extra buying and selling charges and token (EQU) shares with much less capital.

With all these constructive impacts, BRMM efficiently addresses the challenges of low capital effectivity and poor buying and selling expertise exhibited by AMM fashions within the software of perpetual contract merchandise. The longer term seems promising for Equation who has the potential to dominate the whole decentralized perpetual contract market.

About Equation

Equation is a decentralized perpetual contract protocol constructed on Arbitrum, audited by third-party auditor ABDK. With its progressive BRMM mannequin, Equation permits merchants to take bigger and limitless positions with as much as 200x leverage at a decrease danger of blowout (MMR = 0.25%). On the identical time liquidity suppliers are in a position to make use of leverage at Equation to enhance capital effectivity. As one of many DeFi protocols advocating for a return to Truthful Begin, Equation is displaying the world in motion how the facility of community-driven innovation can form the way forward for decentralized finance. It prioritizes safety and transparency and goals to offer merchants with a dependable and safe setting for buying and selling perpetual contracts. Please go to the official web site https://equation.org to study extra.

Firm: EquationDAO

Contact: Equation Media Staff

E-mail: [email protected]

Web site: https://www.equation.org/

Twitter: https://twitter.com/EquationDAO

Medium: https://medium.com/@EquationDAO

EQU is tracked on

DefiLIama: https://defillama.com/protocol/equation

CoinMarketCap: https://coinmarketcap.com/currencies/equation/

Coingecko: https://www.coingecko.com/en/cash/equation

Disclaimer

Consistent with the Belief Venture tips, please be aware that the data offered on this web page is just not supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. You will need to solely make investments what you may afford to lose and to hunt unbiased monetary recommendation when you’ve got any doubts. For additional info, we propose referring to the phrases and circumstances in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Writer

Gregory, a digital nomad hailing from Poland, is just not solely a monetary analyst but in addition a invaluable contributor to numerous on-line magazines. With a wealth of expertise within the monetary business, his insights and experience have earned him recognition in quite a few publications. Utilising his spare time successfully, Gregory is at the moment devoted to writing a ebook about cryptocurrency and blockchain.

Extra articles

Gregory, a digital nomad hailing from Poland, is just not solely a monetary analyst but in addition a invaluable contributor to numerous on-line magazines. With a wealth of expertise within the monetary business, his insights and experience have earned him recognition in quite a few publications. Utilising his spare time successfully, Gregory is at the moment devoted to writing a ebook about cryptocurrency and blockchain.