The Ethereum (ETH) to Bitcoin (BTC) ratio (ETH/BTC) is a pivotal metric, providing insights into the relative energy and market dominance of the 2 largest cryptocurrencies. Representing the worth of 1 Ethereum when it comes to Bitcoin, the ratio serves as a crucial software for traders and analysts to gauge the comparative efficiency and sentiment in the direction of these digital belongings.

Traditionally, the ratio has skilled vital fluctuations. It reached its all-time excessive in June 2017, when Ethereum’s worth considerably overshadowed Bitcoin’s. Conversely, Dec. 2016 noticed the ratio attain its all-time low, reflecting a time when Ethereum’s worth dropped considerably in comparison with Bitcoin.

Nevertheless, the general volatility of this ratio, measured by the usual deviation of its historic closing costs, is comparatively average. That is indicative of the customarily parallel value actions of BTC and ETH, as they usually mirror one another’s market traits.

The synchronized motion of BTC and ETH is a defining issue within the noticed stability of the ETH/BTC ratio. When each cryptocurrencies expertise comparable bullish or bearish traits, their ratio maintains equilibrium, underscoring the interdependence of their market actions. This phenomenon is a testomony to the correlated nature of the crypto market, the place main currencies typically share comparable market sentiments and exterior influences.

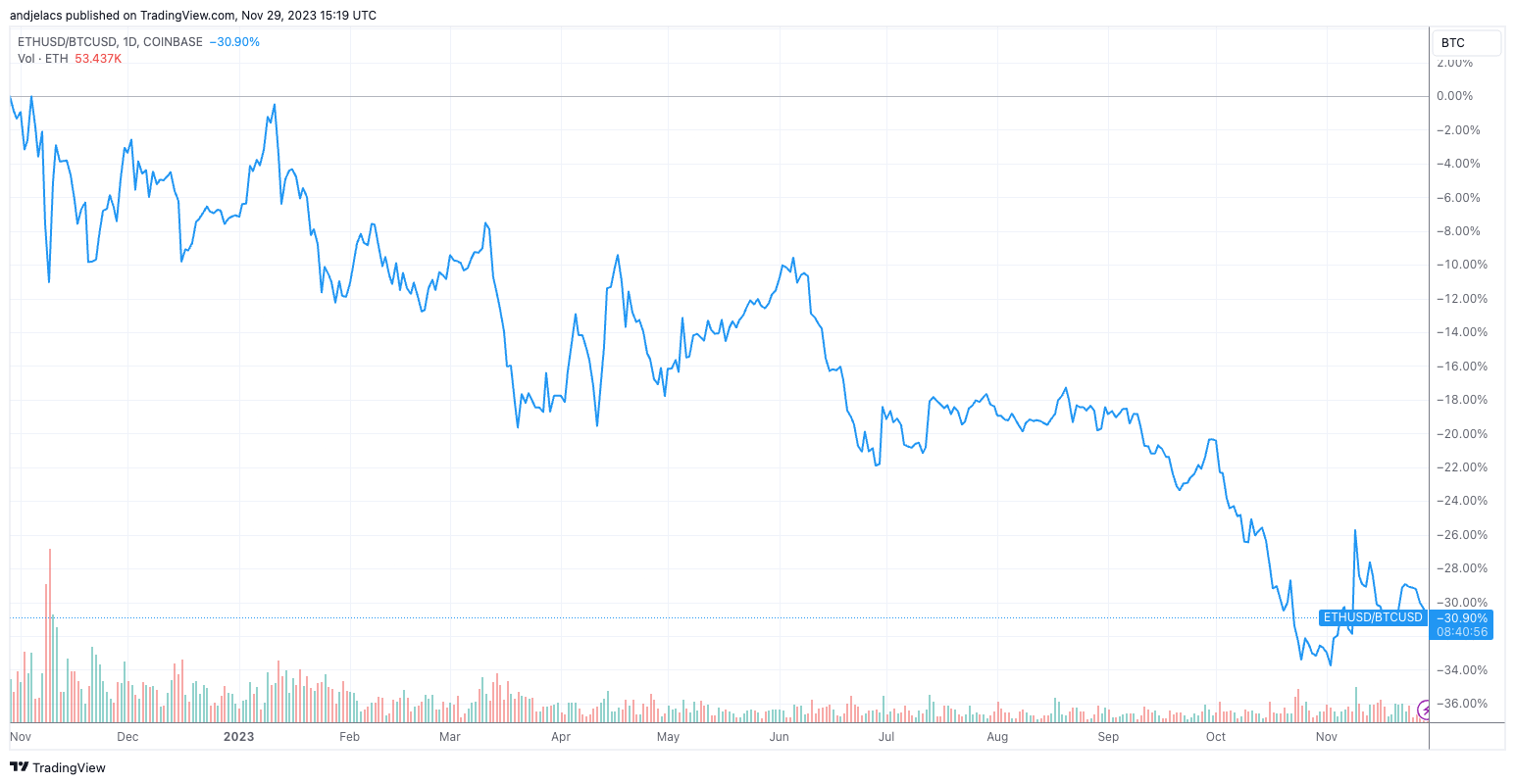

From Jan. 2020 to Oct. 2022, the ETH/BTC ratio noticed an uptrend, attributed primarily to the anticipation surrounding the Merge — Ethereum’s transition to a Proof-of-Stake consensus mechanism. This vital improve in Ethereum’s blockchain was considered as a pivotal step in the direction of enhancing its effectivity and scalability, probably rising its worth relative to Bitcoin.

Nevertheless, after Oct. 2022, the ratio exhibited a downward pattern. This decline could possibly be a market correction following the excessive expectations the Merge set or a mirrored image of broader market traits affecting each cryptocurrencies. It additionally exhibits that, throughout this era, Ethereum’s progress or decline in worth was not as pronounced as Bitcoin’s, resulting in a lower in its relative worth.

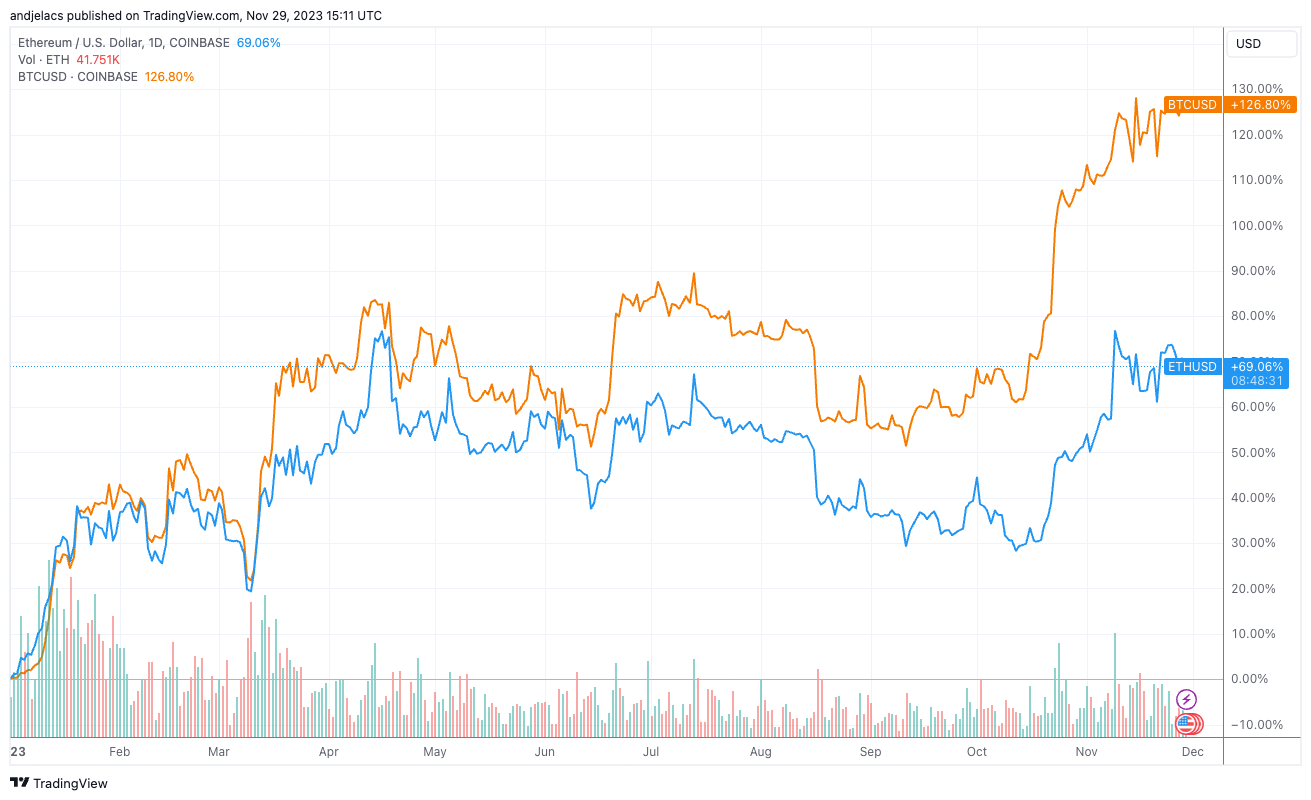

The ETH/BTC ratio gives vital insights into the market’s present dynamics. The comparatively low ratio will be primarily attributed to Bitcoin’s extra substantial value improve than Ethereum. YTD, Bitcoin has seen a 126% improve, whereas Ethereum’s progress, though notable, was comparatively decrease at 69%. This disparity of their progress charges has been a crucial consider preserving the ETH/BTC ratio subdued.

The differing trajectories of their costs present Bitcoin’s rising dominance out there. Whereas Ethereum continues to play a big position within the crypto ecosystem, particularly as the house of DeFi, Bitcoin’s extra vital value improve underscores its rising prominence and presumably better investor confidence. This pattern is mirrored within the ETH/BTC ratio, serving as a barometer for Bitcoin’s strengthening place relative to Ethereum.

The ratio’s motion clearly signifies the shifting steadiness of energy throughout the crypto market, with Bitcoin at present taking a extra dominant position.

The publish Decline in ETH/BTC ratio exhibits Bitcoin’s rising market dominance appeared first on CryptoSlate.