In a testomony to its unwavering confidence in Bitcoin (BTC), MicroStrategy, one of many largest Bitcoin holding firms, has as soon as once more expanded its cryptocurrency portfolio.

The corporate’s former CEO, Michael Saylor, introduced the acquisition of an extra 16,130 BTC, valued at roughly $593 million. This strategic transfer comes as Bitcoin enters a section of accumulation above the $37,000 mark.

MicroStrategy Provides To Bitcoin Stash

As introduced, MicroStrategy’s newest buy was made at a median worth of $36,700 per Bitcoin. With this acquisition, the corporate’s whole Bitcoin holdings now stand at a formidable 174,530 BTC.

All through 2023 and former years, MicroStrategy has constantly demonstrated its dedication to BTC, accumulating a considerable quantity of the cryptocurrency.

The overall value of MicroStrategy’s Bitcoin investments exceeds $5.20 billion, with an common buy worth of $30,252 per Bitcoin. This important funding displays the corporate’s long-term bullish outlook on Bitcoin’s potential as a retailer of worth and hedge in opposition to inflation.

As reported by NewsBTC, the corporate has reaped substantial beneficial properties from the current uptrend within the general cryptocurrency market and Bitcoin’s spectacular worth surge. With BTC experiencing a 36% enhance since October, Microstrategy has now amassed over $1 billion in unrealized earnings.

Notably, Bitcoin’s constructive efficiency has instantly impacted Microstrategy’s inventory, traded beneath the ticker title MSTR. The inventory has witnessed a big surge in worth, carefully tied to the continuing bullish momentum of BTC.

On November 9, as Bitcoin reached its earlier yearly excessive of $38,000, the value of MSTR inventory additionally soared to an all-time excessive (ATH) of $533 per share. This milestone additional proves Microstrategy’s profitable funding technique over the previous three years.

Michael Saylor, a outstanding advocate for Bitcoin, has been a vocal proponent of the cryptocurrency, emphasizing its superior qualities in comparison with conventional fiat currencies.

MicroStrategy’s continued accumulation of Bitcoin reinforces Saylor’s conviction in its long-term prospects and serves as a testomony to the corporate’s perception within the digital asset’s store-of-value properties.

Potential For Brief-Time period Pullback Looms

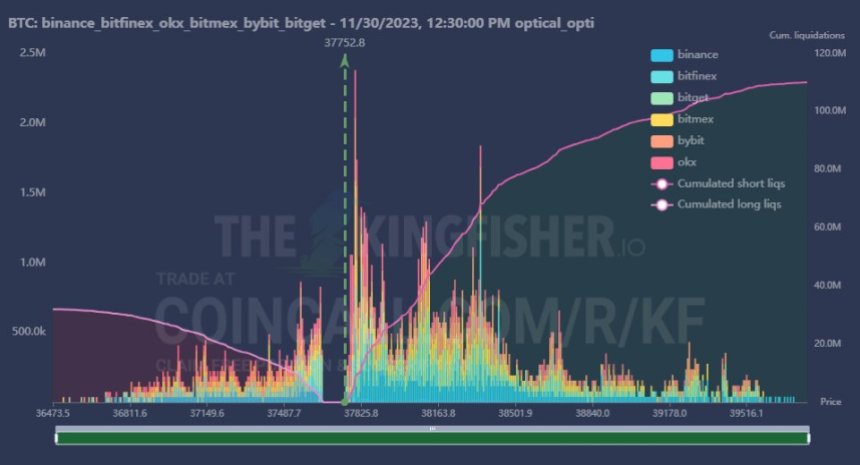

In a current market replace by the CryptoQuant writer IT Tech, short-term insights on the Bitcoin derivatives market make clear the present upward momentum and the potential for a minor pullback.

In response to the evaluation, the continuing upward momentum within the Bitcoin market closely depends on perpetual motion. The rising worth of Bitcoin has been a key driving drive, contributing to the bullish sentiment.

Nonetheless, the Crypto Volatility Divergence (CVD) Spot indicator suggests a comparatively flat motion in spot demand. This means {that a} important enhance in quick spot demand could not help the present worth surge.

Within the absence of robust spot demand materializing out there, IT Tech suggests a doable minor pullback within the close to time period.

This potential pullback might be attributed to a number of elements, together with profit-taking by merchants or a scarcity of sustained shopping for stress from spot traders.

The evaluation additionally highlights the potential of Bitcoin liquidations within the brief time period, which might point out additional upward motion to liquidate late brief positions.

This implies that extra shopping for stress could also be from those that have taken brief positions on Bitcoin. As these shorts are liquidated, it might proceed the upward development.

As of the most recent replace, Bitcoin (BTC) is buying and selling at $37,600, displaying a slight lower of 0.5% over the previous 24 hours. Nonetheless, it has maintained a achieve of 1.5% over the previous seven days, indicating a interval of consolidation for the cryptocurrency

Featured picture from Shutterstock, chart from TradingView.com