The subsequent crypto bull run, a extremely anticipated occasion within the monetary world, guarantees vital positive factors for traders in keeping with many analysts and specialists. This information explores the dynamics of such crypto bull runs, their historic impression, and the potential triggers that would ignite the following bullrun. With a give attention to Bitcoin’s influential position and professional insights into the chances for 2023 and 2024, we purpose to offer a complete understanding of what the long run holds for crypto traders.

Crypto Bullrun Phenomenon Defined

The time period ‘crypto bull run’ is greater than only a buzzword on the planet of digital finance; it’s a part of great significance. A crypto bull run happens when the market experiences a chronic interval of rising cryptocurrency costs, typically characterised by excessive investor confidence and elevated shopping for exercise.

This phenomenon is not only in regards to the upward development in costs; it represents a broader shift in market sentiment, typically fueled by varied financial, technological, and socio-political elements. Understanding the crypto bull run requires a have a look at its core parts:

Market Sentiment: The collective optimism of traders performs a pivotal position. Constructive information, technological developments, or favorable rules can increase confidence, resulting in elevated investments and better costs.

Elevated Adoption: Wider acceptance and use of cryptocurrencies, each by people and establishments, typically correlate with bullruns. As extra individuals and companies embrace crypto, demand rises, pushing costs up.

Technological Improvements: Breakthroughs in blockchain expertise or the launch of recent and promising initiatives can set off a bullrun. Improvements that resolve present issues or supply new prospects can appeal to traders.

World Financial Elements: Financial circumstances, comparable to inflation charges, foreign money devaluation, and modifications in financial coverage, can affect the crypto market. For instance, traders may flip to crypto as a hedge in opposition to inflation, sparking a bullrun.

Community Results: The growing utility and community development of a selected cryptocurrency can result in a crypto bull run. As extra individuals use and maintain a cryptocurrency, its worth typically will increase, making a optimistic suggestions loop.

In essence, a crypto bull run is a posh interaction of those elements, resulting in a sustained enhance in costs. Whereas the precise timing and length of a crypto bull run are unpredictable, understanding these parts helps traders make knowledgeable selections within the quickly evolving crypto panorama.

Understanding The Time period “Bullrun”

The time period “bullrun” within the monetary world, significantly in cryptocurrency, refers to a market situation the place costs are rising or are anticipated to rise. The origin of the time period ties again to how a bull assaults its opponents, thrusting its horns upward – symbolizing the upward motion of the market.

In distinction, a bear market is characterised by declining costs, lowered investor confidence, and customarily detrimental sentiment. These phrases – bullish vs. bearish – replicate the prevailing temper out there: bullish for upward traits and bearish for downward traits.

Historic Overview Of Crypto Bull Runs

The cryptocurrency market has seen a number of notable bull runs since its inception, every marked by vital value surges and investor enthusiasm. Right here’s a short overview:

The Early Days (2009-2012): After Bitcoin’s creation in 2009, the primary notable bull run occurred in 2011, when Bitcoin’s worth reached $1 for the primary time and subsequently peaked round $32, showcasing the potential of decentralized digital currencies.

The 2013 Surge: Two main bullruns characterised 2013. Initially, Bitcoin’s value soared to $266 in April, pushed by elevated media consideration and investor curiosity. Later within the 12 months, it spiked once more, reaching over $1,000, fueled by elements just like the popularization of Bitcoin in China and improved market infrastructure.

The 2017 Increase: Marked as one of the dramatic, the 2017 bull run noticed Bitcoin’s value reaching practically $20,000. This era was characterised by the ICO (Preliminary Coin Providing) craze, mainstream media protection, and a major inflow of retail traders.

The 2020-2021 Rally: Triggered by a mix of institutional funding, excessive ranges of liquidity in the complete monetary markets because of central banks printing extreme quantities of cash (because of COVID-19), and elevated curiosity in decentralized finance (DeFi), Bitcoin once more reached new heights, surpassing $60,000 in 2021.

Important corrections or bear markets adopted every of those bull runs, demonstrating the cryptocurrency market’s cyclical nature. These intervals have been essential in shaping the panorama of the Bitcoin and crypto market.

Bitcoin’s Function In The Crypto Bull Market: The 4-12 months Cycle Principle

Bitcoin’s affect on the crypto bull market intently ties to its 4-12 months Cycle Principle, pushed predominantly by the cryptocurrency’s halving occasions. Occurring about each 4 years or each 210,000 blocks, these occasions reduce the Bitcoin mining reward in half, thus lowering the speed of recent bitcoin era.

This halving mechanism is integral to Bitcoin’s design, supposed to create shortage and management inflation, mirroring the extraction of a pure useful resource changing into tougher over time. The speculation posits that this lowered provide, within the face of regular or growing demand, drives up the value of Bitcoin, typically resulting in a Bitcoin and crypto bull market part.

Historic information helps this principle. As an example, the primary halving in 2012 noticed Bitcoin’s value enhance from about $12 to over $1,100 within the following 12 months. Equally, the 2016 halving preceded a major bullrun, culminating in Bitcoin’s late-2017 peak close to $20,000. The latest halving in 2020 additionally led to substantial value positive factors, with Bitcoin reaching new all-time highs in November 2021.

This sample of post-halving bull runs not solely boosts Bitcoin’s worth however typically triggers a market-wide crypto bull run. Bitcoin’s market dominance and its position as a digital gold commonplace imply that its value actions considerably affect the complete cryptocurrency market.

Nevertheless, these bullish phases aren’t everlasting. Publish-halving surges are sometimes adopted by corrections, resulting in bear markets. This cyclical nature emphasizes the speculative facets of Bitcoin and the broader crypto market, underscoring the significance of market timing and danger administration for traders.

Key Triggers For The Subsequent Crypto Bull Run

A number of concrete occasions and developments as of November 2023 may doubtlessly set off the following crypto bull run. These embrace particular milestones and regulatory shifts that would considerably impression investor sentiment and market dynamics.

Bitcoin Halving In April 2024: The Bitcoin halving, which is anticipated to happen in April 2024, is a major occasion for the Bitcoin and the broader cryptocurrency market. If historical past repeats itself, it may mark the start of the following crypto bull market.

Approval Of The First US Spot Bitcoin ETF (Anticipated January 2024): Presently, the US SEC is actively collaborating with monetary heavyweights comparable to BlackRock, Constancy, VanEck, Invesco, Galaxy, Ark Make investments, and Grayscale, fine-tuning the ultimate particulars of ETF functions for potential approval. Analysts estimate a 90% probability of no less than one spot Bitcoin ETF receiving approval by January 10, 2024.

First US Spot Ethereum ETF (Anticipated Someday In 2024): The world’s largest asset supervisor, BlackRock, filed an software for a spot Ether ETF with the SEC. Furthermore, Bitwise, Grayscale and Galaxy, amongst others, have additionally filed functions. Market analysts consider that spot Ethereum ETFs have good probabilities, given the truth that there are already Ethereum Futures ETFs within the US.

Ripple vs. SEC Case: The cryptocurrency business is intently watching the authorized dispute between Ripple and the SEC, which is inching nearer to a ultimate judgment. This case’s final result will considerably affect the regulation of altcoins in the USA.

Coinbase vs. SEC Case: The authorized showdown between Coinbase and the SEC may have notable implications for crypto regulation and the standing of assorted tokens beneath SEC purview. Thus, a victory by Coinbase is also a serious catalyst for a crypto bull run.

When Is The Subsequent Crypto Bull Run?

The query on each cryptocurrency investor’s thoughts is: When is the following crypto bull run? Predicting the exact timing of a bull run within the extremely unstable and unpredictable crypto market is difficult. Nevertheless, by analyzing present traits, upcoming occasions, and market sentiment, we are able to try to estimate when the following surge in cryptocurrency costs may happen.

Bull Run Crypto: Has It Already Began?

Although the Bitcoin value remains to be -45% away from its all-time excessive, Ethereum even -58%, XRP -82%, Solana -77% and Cardano -87%, there’s at present a bullish sentiment throughout the complete crypto market. There is no such thing as a definitive definition of when a bull market begins, which is why opinions might differ.

Nevertheless, the very fact is that Bitcoin and crypto have made large positive factors year-to-date (as of November 30, 2023): Bitcoin has risen by 127%, Ethereum by 70%, XRP by 75%, Solana by as a lot as 508%. Thus, one can argue that we’re initially of the following crypto bull run.

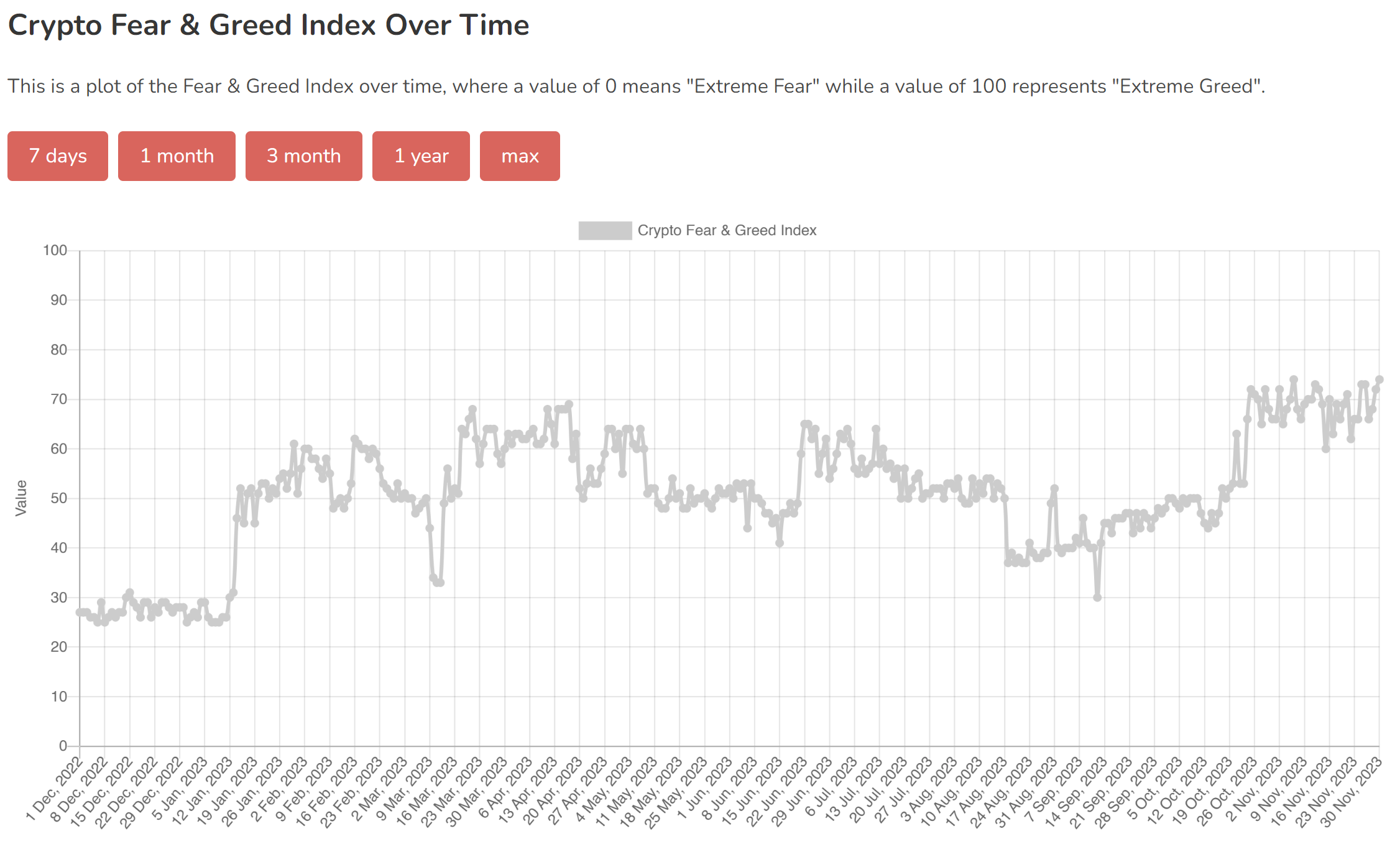

Moreover, it may be argued that the Worry & Greed Index can be utilized as a sign of a Bitcoin and crypto bull run. Sometimes, the indicator could be very excessive for a really very long time (with just a few dips) throughout a bull market. A have a look at the event over the past 12 months reveals that sentiment has clearly turned from concern to greed. On this respect, the indicator can function an indication that we’re in an earlier part of the crypto bull run.

Professional Evaluation: Crypto Bull Run 2023/2024

In a latest put up on X, famend crypto analyst Miles Deutscher remarked that altcoins may acquire power forward of the Bitcoin halving in mid-April subsequent 12 months, if historical past repeats:

Is Bitcoin dominance following the identical sample from final cycle? In 2019, dominance topped out in September – earlier than alts gained steam into the halving. In 2023, dominance seems to be exhibiting an analogous sample – which might point out a reversal into the halving.

In the meantime, crypto analyst highlighted a bullish development for the complete crypto market cap (Bitcoin + altcoins):

The full market capitalization for crypto remains to be looking for for continuation right here. Larger lows, larger highs, which signifies that dips are there to be purchased. Subsequent goal stays $1.8 trillion.

Bitcoin Bull: Projecting The BTC Value For 2023/2024

However, Bitcoin has at all times been the main indicator for the complete crypto market previously. Thus, it’s fascinating to venture how the Bitcoin value may evolve within the coming months, pre- and past-halving. Crypto analyst Rekt Capital has offered an in depth evaluation of the phases surrounding Bitcoin’s Halving, projecting potential market traits for 2023/2024:

Pre-Halving Interval: In response to the analyst, we’re at present on this part, with about 5 months left till the Bitcoin Halving in April 2024. Traditionally, this era presents excessive return on funding alternatives, particularly after any deeper market retraces.

Pre-Halving Rally: Anticipated to start out round 60 days earlier than the Halving. This part usually sees traders shopping for in anticipation of the occasion, aiming to promote at its peak.

Pre-Halving Retrace: Occurring across the Halving occasion, this part has traditionally seen vital retraces (e.g., -38% in 2016 and -20% in 2020). It typically leads traders to query the Halving’s bullish impression.

Re-Accumulation: Publish-Halving, this stage includes multi-month re-accumulation, the place many traders might exit because of impatience or disillusionment with Bitcoin’s efficiency.

Parabolic Uptrend: Following the breakout from re-accumulation, Bitcoin is anticipated to enter a part of accelerated development, doubtlessly reaching new all-time highs.

Rekt Capital’s evaluation presents a roadmap, outlining potential expectations for the approaching months by drawing on historic patterns linked to Bitcoin halvings.

Famend monetary professional Charles Edwards, founding father of Capriole Investments, additionally has a principle. In response to him, Bitcoin is at present in an early bull market part that started at round $31,000 per BTC and can finish at round $60,000. The mid Bitcoin bull part goes as much as $90,000. The late Bitcoin bull part ends at $180,000, in keeping with him.

Elements Affecting The Crypto Bull Market

A number of elements can considerably affect the trajectory of a crypto bull market. These embrace macroeconomic circumstances, regulatory modifications, technological developments, market sentiment, and institutional involvement. Understanding these elements is essential in assessing the potential and length of a bull run within the cryptocurrency market:

Bitcoin Halving Cycle: You will need to acknowledge that every cycle has had its dramatic finish. When traders take revenue on their (large positive factors), the Bitcoin and crypto bull run can out of the blue finish (whereas most influencers tout that BTC and crypto will “go to the moon”)

Macroeconomic Circumstances: World financial traits, like inflation charges, financial insurance policies, and particularly market liquidity, play a major position in shaping investor confidence and conduct within the crypto market. Following the macro setting could be essential.

Regulatory Panorama: Regulatory selections and insurance policies concerning cryptocurrencies can dramatically have an effect on market sentiment and investor participation. Constructive regulatory like a victory by Coinbase or Ripple Labs in opposition to the US SEC can provoke or additional bolster a crypto bull run. Nevertheless, regulatory crackdowns can even convey a bullrun to an abrupt finish.

Technological Developments: Improvements in blockchain expertise, scaling options, and new functions (comparable to DeFi and NFTs) can appeal to new traders and increase market development.

Market Sentiment: Public notion (Worry & Greed Index), media protection, and general investor sentiment can drive market traits. Constructive information and investor optimism typically gas bull markets.

Institutional Involvement: The entry of institutional traders into the crypto area can convey vital capital, legitimacy, and stability to the market, doubtlessly driving a bullrun. If extra corporations like MicroStrategy add Bitcoin (or altcoins) to their stability sheet on a bigger scale, or extra international locations like El Salvador use it as a nationwide reserve, this may strengthen the market and certain drive costs larger.

Subsequent Crypto Bull Run Predictions: Value Targets

As we strategy the anticipated Bitcoin halving in April 2024 and with rising pleasure round Bitcoin ETFs, varied specialists and monetary establishments have supplied their predictions for Bitcoin’s value in 2024:

Pantera Capital predicts an increase to roughly $150,000 post-halving, primarily based on the stock-to-flow mannequin.

Commonplace Chartered Financial institution forecasts Bitcoin may soar to $120,000 by the tip of 2024.

JPMorgan estimates a extra conservative goal of $45,000 for Bitcoin.

Matrixport suggests Bitcoin may attain $125,000 by the tip of 2024.

Tim Draper maintains a bullish prediction of $250,000, presumably by 2024 or 2025.

Berenberg predicts a worth of round $56,630 by the point of the Bitcoin halving in April 2024.

Blockware Options presents an formidable forecast of $400,000 through the subsequent halving epoch.

Cathie Wooden’s (ARK Make investments) presents an formidable projection of Bitcoin reaching $1 million

Mike Novogratz (Galaxy Digital) predicts a possible surge to $500,000.

Tom Lee (Fundstrat World) sees Bitcoin presumably climbing to $180,000.

Robert Kiyosaki (Wealthy Dad Firm) anticipates an increase to $100,000.

Adam Again (BlockStream CEO) additionally predicts a $100,000 valuation for Bitcoin.

These various predictions spotlight the numerous expectations from completely different sectors of the finance and crypto business, reflecting the speculative and dynamic nature of crypto bull market.

FAQ Subsequent Crypto Bull Run

When Is The Subsequent Crypto Bull Run Predicted?

The subsequent crypto bull run is troublesome to foretell exactly. Nevertheless, specialists level in direction of late 2023 to 2024, aligning with occasions just like the Bitcoin halving in April 2024 and potential regulatory developments.

When Is The Subsequent Bull Market In Crypto?

Predictions for the following bull market in crypto range, with many analysts eyeing 2024 put up the Bitcoin halving, assuming favorable regulatory and market circumstances.

When Is The Subsequent Crypto Bull Run Anticipated?

Expectations for the following crypto bull run are significantly excessive round 2024, pushed by the Bitcoin halving and potential ETF approvals.

When Will The Subsequent Crypto Bull Run Be?

Whereas precise timing is unsure, the following crypto bull run may doubtlessly begin build up in late 2023 and acquire momentum by way of 2024.

When Is the Subsequent Bull Market?

The subsequent normal bull market, together with crypto, may coincide with improved macroeconomic circumstances and institutional adoption, presumably round 2024.

When Is the Subsequent Bull Run?

Featured picture from Shutterstock, chart from TradingView.com