Former Bloomberg Intelligence analyst Jamie Coutts says an alt season might take longer to reach in comparison with earlier market cycles.

Coutts says that regardless that many altcoins are having breakouts, Bitcoin (BTC) continues to dominate the crypto market based mostly on its share of whole market capitalization.

He says that Bitcoin’s dominance might last more than earlier cycles if spot market Bitcoin exchange-traded funds (ETFs) are authorized as a result of huge capital would circulate into them, boosting the crypto king’s dominance.

“Whereas altcoins are breaking out from their basing sample, it’s nonetheless a Bitcoin-dominant market. But, the shift in direction of altseason feels imminent. Contemplating the numerous capital flows anticipated from BTC ETFs subsequent 12 months, possibly it takes longer this cycle. Often altseason hits inside one to one-and-a-half years from the cycle low which is round Q2 2024.”

He additionally says that when the alt season arrives, some initiatives will emerge stronger than others because the adoption of their blockchain know-how continues to develop.

“Whereas human habits stays a continuing, with the rotation fueled by BTC earnings, FOMO (worry of lacking out) and greed, we are going to see the emergence of some clear long-term winners on this cycle; alt-L1s (layer-1s), L2s (layer-2s) and DApps (decentralized functions) with product market match and rising adoption. Blockchain adoption is in a structural uptrend. Strap your self in.”

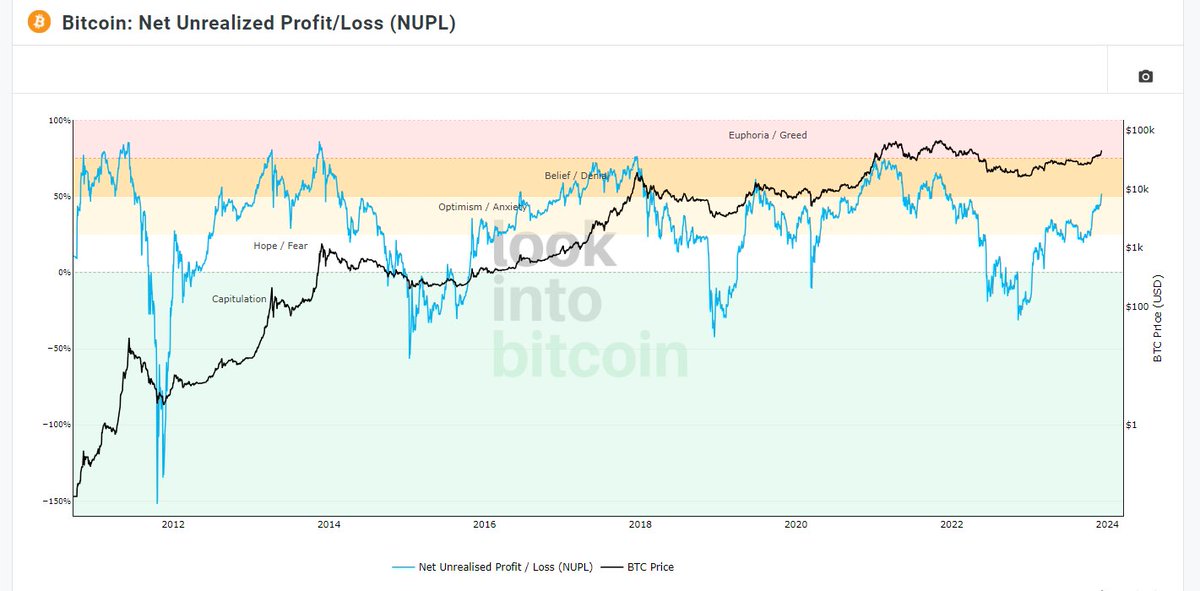

The crypto analyst additionally warns that Bitcoin might see a sudden correction based mostly on the web unrealized revenue/loss (NUPL) metric, which divides Bitcoin buyers’ unrealized revenue or loss by the BTC market cap.

“Bitcoin is coming into perception/denial zone. That is when 25%-30% pullbacks can begin showing usually. Make no mistake, the compulsion to promote will inflict itself on each holder. Nevertheless, on-chain, we are able to see, based mostly on metrics like illiquid provide/long-term holders and so on. that this bull market began from a a lot larger base degree of conviction than ever earlier than.

This has so much to do with a much more knowledgeable inhabitants. There was an explosion within the examine and evaluation of central banking, liquidity and macro evaluation. Because of the contributions of many nice thinkers and educators, ideas/information purposely obfuscated are actually illuminated and comprehended.”

Bitcoin is buying and selling for $43,383 at time of writing, up 3.1% up to now 24 hours.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Verify Newest Information Headlines

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any loses you could incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/Comdas/INelson