Bitcoin has seen a rebound again above the $43,000 degree through the previous day. Right here’s a potential motive behind this reversal within the asset.

Bitcoin Has Rebounded Again In the direction of The $43,000 Mark

Simply earlier, Bitcoin had plunged to a low of $40,500 because the market had witnessed some important promoting strain. Previously day, nonetheless, BTC has already turned itself round, because it has recovered again above the $43,000 degree.

The beneath chart exhibits the rollercoaster the cryptocurrency has gone by means of in the previous few days:

Seems to be like the value of the asset has sharply surged through the previous 24 hours | Supply: BTCUSD on TradingView

As is normally the case, the opposite property within the sector have additionally adopted within the authentic cryptocurrency’s lead and turned themselves round, seeing surges of their very own.

On account of this sharp market-wide surge, the futures facet has seen a considerable amount of liquidations, because the beneath desk shows:

The entire quantity of futures liquidations within the final 24 hours | Supply: CoinGlass

Shorts have naturally taken the vast majority of the hit on this mass cryptocurrency liquidation occasion, as $95 million of the $126 million whole has come from contract holders of this sort. Bitcoin shorts alone have contributed about $41 million to those liquidations.

Now, what’s the trigger behind this sudden revival out there? Knowledge shared by the on-chain analytics agency Santiment might maybe present some hints about it.

Cryptocurrency Merchants Confirmed Deeply Damaging Sentiment Earlier than The Rebound

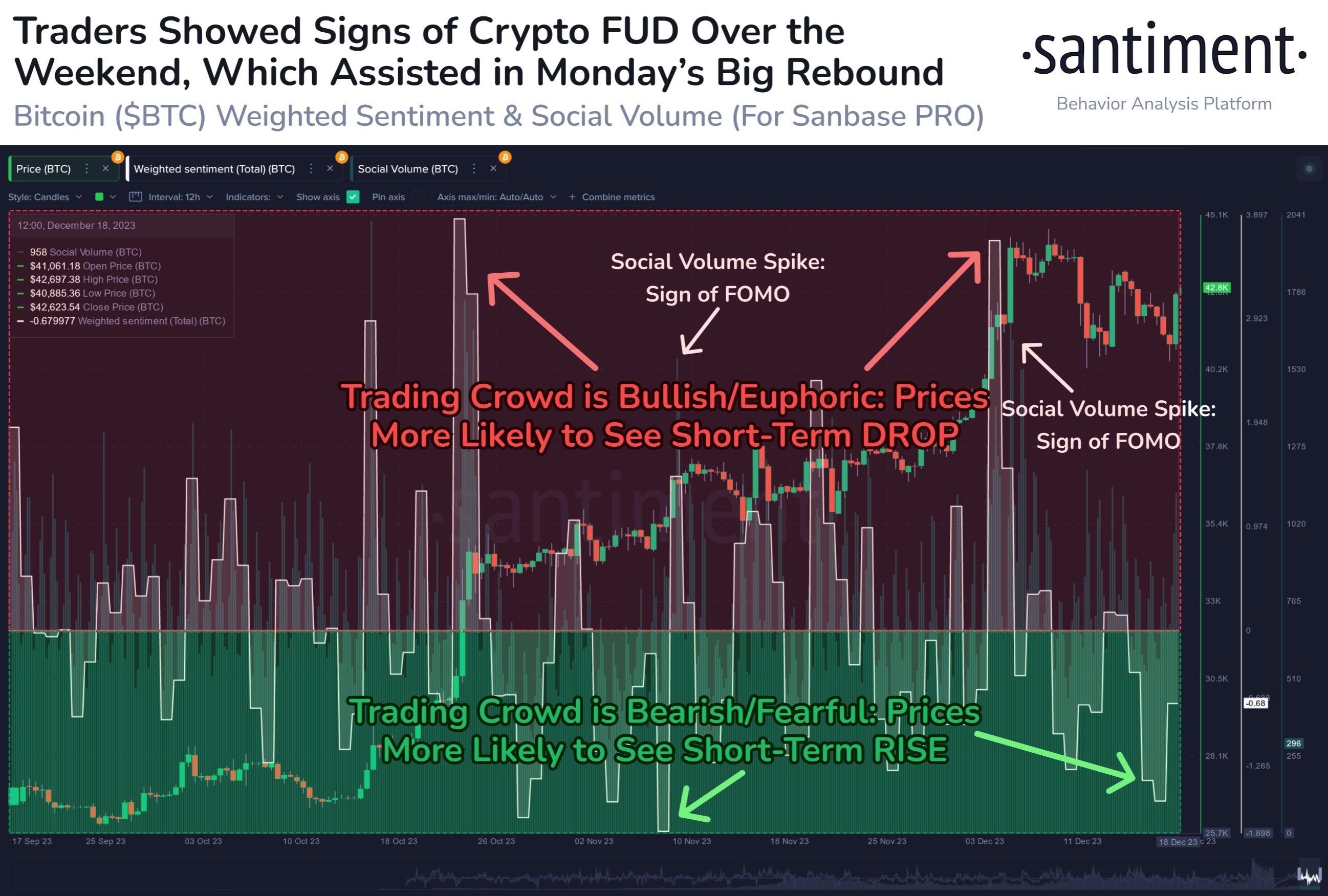

As defined by Santiment in a brand new publish on X, cryptocurrency merchants have proven concern on social media throughout the previous few days. The indicator of curiosity right here is the “Weighted Sentiment,” which itself is predicated on two different metrics referred to as the Sentiment Rating and Social Quantity.

The Sentiment Rating measures the sentiment shared by the vast majority of the merchants on the key social media platforms. To separate between the optimistic and unfavourable sentiments, the metric makes use of a machine studying mannequin skilled by the analytics agency.

The opposite related indicator right here, the “Social Quantity” retains monitor of the overall quantity of debate a specific subject is receiving on the key social media platforms.

Now, what the Weighted Sentiment does is that it takes the Sentiment Rating and weighs it towards the Social Quantity. Which means the metric’s worth solely registers a spike when each the sentiment is leaning in direction of one facet and discussions are ramping up on these platforms.

Here’s a chart that exhibits the pattern within the Bitcoin Weighted Sentiment over the previous few months:

The worth of the metric seems to have been fairly unfavourable in current days | Supply: Santiment on X

Traditionally, the Bitcoin worth has tended to maneuver towards the expectations of the group. From the graph, it’s obvious that tops have coincided with the Weighted Sentiment registering extremely optimistic values (that’s when FOMO surges among the many merchants).

Equally, the indicator observing extremely unfavourable spikes is when bottoms have shaped. As is seen within the chart, FUD had taken over the minds of the traders after the current stoop within the asset, because the Weighted Sentiment had plunged.

It might seem that, as soon as once more, the cryptocurrency’s worth has thrived off concern among the many traders, because it has recovered opposite to the sentiment held by the bulk.

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, Santiment.internet