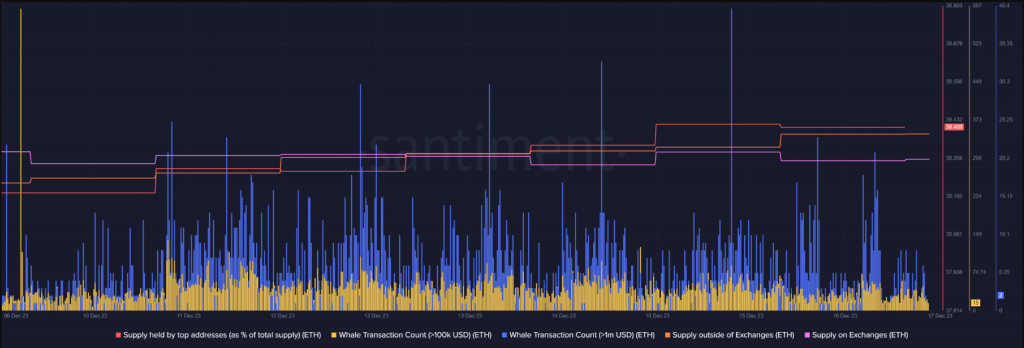

Previously week, a number of the largest Ethereum whales, these with holdings starting from 1 million to 10 million ETH, have accrued a formidable 100,000 ETH, valued at a staggering $230 million.

This lively shopping for stance by influential traders highlights their unwavering perception within the long-term potential of Ethereum, even within the face of latest worth corrections.

Regardless of the latest downtrend in costs, indications from latest Ethereum whale actions counsel a persistent confidence in a bullish market continuation.

Rich Merchants Accumulate Tens of millions In Ethereum

Subsequent to the promising begin within the preliminary days of December 2023, numerous cryptocurrency property, notably Ethereum, displayed strong efficiency.

Crypto whales have reportedly devoured a whole bunch of tens of millions of {dollars}’ value of Ether, the main altcoin, throughout the previous seven days, in response to a nicely revered knowledgeable.

A few of the largest #Ethereum whales have been on a shopping for spree, scooping up over 100,000 $ETH in simply the previous week – that’s a whopping $230 million! pic.twitter.com/jWHY6MXDgs

— Ali (@ali_charts) December 16, 2023

On the social networking web site X, cryptocurrency strategist Ali Martinez informs his 36,100 followers in a brand new thread that rich merchants have amassed tens of hundreds of Ethereum throughout the earlier seven days.

Worth rallies are often the results of heavy buying demand from rich traders, and the latest whale accumulation signifies that that is the case.

On December 7, Santiment Feed related a whale accumulation sample to ETH’s surge, which culminated in a 19-month excessive over the $2,350 worth level.

As a rule, whale exercise impacts cryptocurrency asset costs. Current exercise amongst ETH whales signifies {that a} worth rally could also be approaching.

Ethereum at the moment buying and selling at $2,235 on the each day chart: TradingView.com

Though there’s loads of shopping for strain available in the market proper now, warning is suggested as a result of the underside couldn’t have but been achieved.

RSI And Stochastic Impartial, Ethereum Uncertainty

Relative Energy Index (RSI) and stochastic are each at the moment in impartial territory, in response to knowledge from CryptoQyant. There’s nonetheless uncertainty relating to the market’s real backside however the shopping for exercise.

We appeared on the liquidation heatmap to attempt to estimate Ethereum’s potential assist ranges. Primarily based on the evaluation, there was an increase in liquidations within the $2,140–$2,170 vary.

This suggests that earlier than Ethereum’s worth initiates its subsequent bullish rebound, it’s prone to drop under these ranges. However within the occasion of a rally, Ethereum must overcome a major resistance degree near $2,380.

Supply: Santiment

Ethereum’s near-term worth adjustments are tough to forecast as a result of to the advanced interplay of market indicators and liquidation knowledge.

In the meantime, the $2,148 worth mark seems to be the asset’s short-term assist, in response to an evaluation of the ETH each day worth chart. With a view to improve the chance of yet another rise earlier than the tip of 2023, bulls will hope that this degree holds.

If there’s a break under, it could point out the development of a extra intricate bullish continuation chart sample, just like a bull flag. On smaller time frames, this sample might resemble a descending channel and undermine expectations for an additional vital rise in 2023.

Ether and different cryptocurrency values are delicate to plenty of exterior variables, together with generalized macroeconomic sentiment. Ethereum has already risen 81% year-to-date at its present worth.

Featured picture from Shutterstock

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site completely at your individual danger.