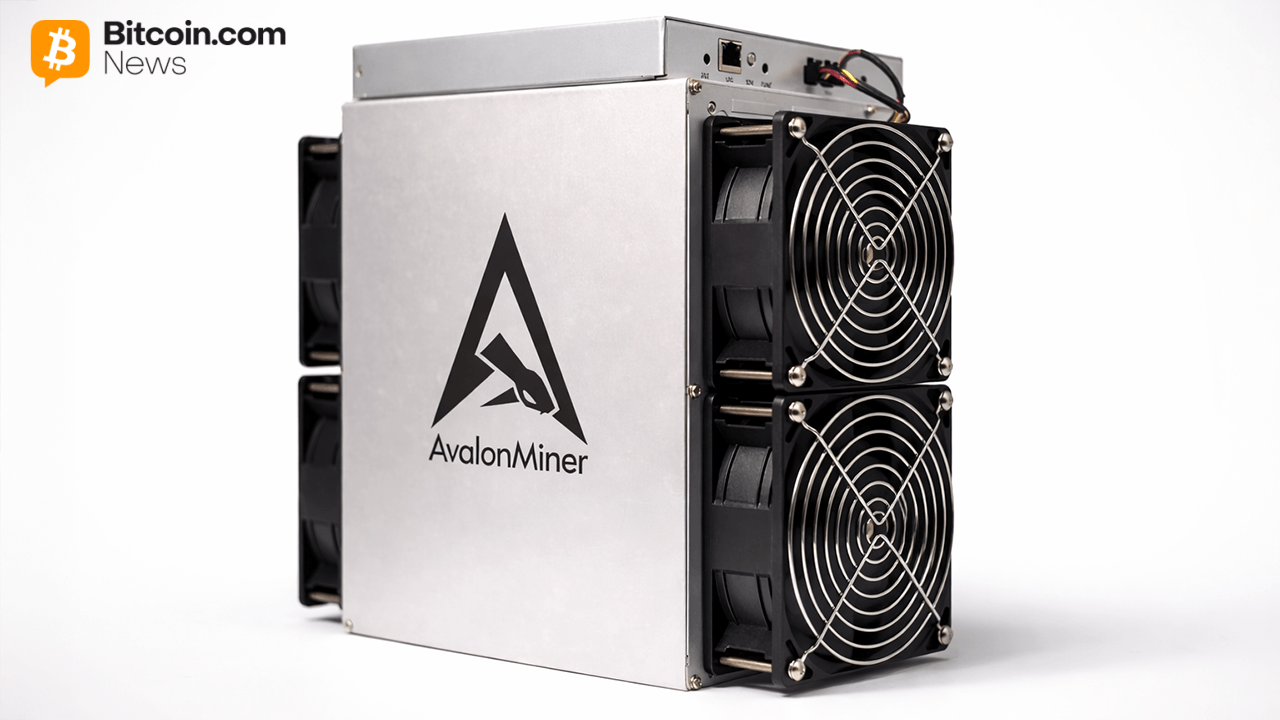

CleanSpark Inc., the third largest public Bitcoin mining firm by hashrate, has agreed to buy as much as 160,000 Bitmain S21 miners, in line with a Jan. 8 announcement.

The transfer may propel its hashrate to a formidable 50 EH/s over the approaching 12 months, marking a considerable leap from its present 10 EH/s.

Bitcoin hit a file excessive in mining problem to kick off the 12 months and, with the halving solely months away, miners are beginning to ramp up their operational growth efforts.

Fastened-rate deal

The deal entails an preliminary funding of $193.2 million for 60,000 models and a strategic possibility to accumulate a further 100,000 miners at a hard and fast charge of $18/TH/s over the subsequent 12 months. The deal is a hedge in opposition to fluctuating costs as soon as the halving kicks in.

Traditionally, Bitcoin’s value has proven an inclination to surge following its halving occasions — a function constructed into its protocol to cut back the reward for mining new blocks by half, thereby slowing down the creation of latest Bitcoins. CleanSpark’s funding is a strategic transfer to capitalize on this potential upswing.

CleanSpark CEO Zach Bradford mentioned the acquisition was a strategic resolution to arrange for the subsequent halving and guarantee long-term, sustainable progress in an more and more aggressive business. He added that the transfer highlights the corporate’s continued perception in Bitcoin. Bradford mentioned:

“That is greater than progress; it’s about guaranteeing operational effectivity and embracing market alternatives.”

CleanSpark’s operations, primarily powered by low-carbon energy sources, replicate a rising pattern within the cryptocurrency mining business, the place there’s an rising give attention to sustainability and power effectivity.

The Halving impact

Miners have been factoring within the halving into their projections for years, acknowledging its inevitability and getting ready accordingly. The main target is on enhancing operational effectivity and securing financial incentives to proceed supporting the Bitcoin blockchain.

This preparation is important, particularly for smaller miners who would possibly battle with profitability attributable to larger operational prices and fewer environment friendly gear. The halving’s affect relies upon largely on Bitcoin’s market value. A better Bitcoin value can offset the lowered block rewards, sustaining and even rising general mining profitability.

Nonetheless, if the worth stays low, the lowered rewards would possibly push some miners, particularly these with larger electrical energy prices and fewer environment friendly rigs, out of the community. This potential fluctuation within the variety of lively miners may result in a short lived dip within the community’s mining problem, making mining barely simpler and extra worthwhile for individuals who stay lively.

There’s additionally a rising curiosity in different income streams, similar to Bitcoin Ordinals, which have pushed transaction charges throughout the Bitcoin community to new heights. These Ordinals, basically metadata connected to every satoshi, create distinctive property on the Bitcoin blockchain and have opened up new revenue alternatives for miners.