Amid anticipations surrounding the potential

approval of a spot Bitcoin exchange-traded product by the Securities and

Change Fee (SEC), Chair Gary Gensler’s latest cautionary statements

have solid a highlight on the inherent dangers inside the crypto panorama.

Gensler’s thread on social media underscored the

vital issues round crypto investments. He emphasised the volatility of digital belongings and their susceptibility to fraudulent schemes.

Gensler warned in opposition to the dangers inherent in

cryptocurrency investments. His social media thread, albeit not explicitly tied

to the awaited spot Bitcoin ETF approval, sheds mild on the broader issues surrounding

crypto investments.

2⃣ Investments in crypto belongings additionally could be exceptionally dangerous & are sometimes unstable. Various main platforms & crypto belongings have turn into bancrupt and/or misplaced worth. Investments in crypto belongings proceed to be topic to vital threat.

— Gary Gensler (@GaryGensler) January 8, 2024

Gensler’s cautionary assertion issues asset managers

probably bypassing federal securities legal guidelines with their crypto funding

choices. The SEC’s Chairman commented on the chance that sure

funding belongings could not align with established regulatory frameworks,

prompting a name for traders to be vigilant and to conduct due diligence.

Maintain Studying

Gensler’s remarks revolved round

inherent volatility and vulnerability in crypto investments. His feedback highlighted the sector’s

susceptibility to market fluctuations. Moreover that, he emphasised the necessity for traders to

train warning, notably given the prevalence of fraudulent actions in

the crypto area.

Spot Bitcoin ETF Speculations

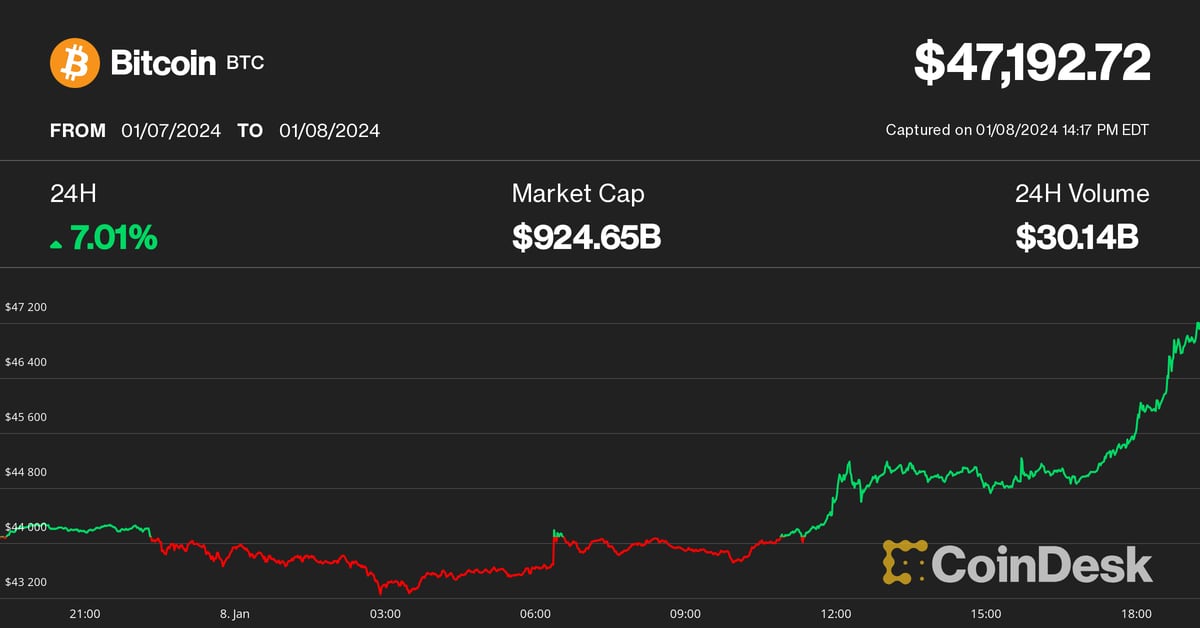

Not too long ago, the value of Bitcoin soared previous $45,000

amid immense anticipation for the approval of the primary spot Bitcoin ETF.

In line with a report by Finance Magnates, analysts are anticipating the SEC to

probably approve the spot Bitcoin ETF between January 8 and 10, with the

total crypto group eagerly awaiting this determination.

This occasion has led to a strategic shift in

the market, with traders withdrawing their digital belongings from exchanges. This pattern alerts a

long-term dedication as corporations put together for the

impending information.

Opposite to expectations, analysts predict restricted

draw back after the ETF’s approval as a result of reducing provide of BTC on

exchanges. Quite the opposite, a rejection of the spot Bitcoin ETF by the SEC may trigger a shift out there, probably turning bullish sentiments

bearish and forcing merchants to readjust their methods.

Amid anticipations surrounding the potential

approval of a spot Bitcoin exchange-traded product by the Securities and

Change Fee (SEC), Chair Gary Gensler’s latest cautionary statements

have solid a highlight on the inherent dangers inside the crypto panorama.

Gensler’s thread on social media underscored the

vital issues round crypto investments. He emphasised the volatility of digital belongings and their susceptibility to fraudulent schemes.

Gensler warned in opposition to the dangers inherent in

cryptocurrency investments. His social media thread, albeit not explicitly tied

to the awaited spot Bitcoin ETF approval, sheds mild on the broader issues surrounding

crypto investments.

2⃣ Investments in crypto belongings additionally could be exceptionally dangerous & are sometimes unstable. Various main platforms & crypto belongings have turn into bancrupt and/or misplaced worth. Investments in crypto belongings proceed to be topic to vital threat.

— Gary Gensler (@GaryGensler) January 8, 2024

Gensler’s cautionary assertion issues asset managers

probably bypassing federal securities legal guidelines with their crypto funding

choices. The SEC’s Chairman commented on the chance that sure

funding belongings could not align with established regulatory frameworks,

prompting a name for traders to be vigilant and to conduct due diligence.

Maintain Studying

Gensler’s remarks revolved round

inherent volatility and vulnerability in crypto investments. His feedback highlighted the sector’s

susceptibility to market fluctuations. Moreover that, he emphasised the necessity for traders to

train warning, notably given the prevalence of fraudulent actions in

the crypto area.

Spot Bitcoin ETF Speculations

Not too long ago, the value of Bitcoin soared previous $45,000

amid immense anticipation for the approval of the primary spot Bitcoin ETF.

In line with a report by Finance Magnates, analysts are anticipating the SEC to

probably approve the spot Bitcoin ETF between January 8 and 10, with the

total crypto group eagerly awaiting this determination.

This occasion has led to a strategic shift in

the market, with traders withdrawing their digital belongings from exchanges. This pattern alerts a

long-term dedication as corporations put together for the

impending information.

Opposite to expectations, analysts predict restricted

draw back after the ETF’s approval as a result of reducing provide of BTC on

exchanges. Quite the opposite, a rejection of the spot Bitcoin ETF by the SEC may trigger a shift out there, probably turning bullish sentiments

bearish and forcing merchants to readjust their methods.

_id_beb7c7a1-e3e4-4e7a-9ff2-747d82a6f8c5_size900.jpg)