The combination of real-world property (RWAs) into cryptocurrency and conventional finance is rising as a major pattern, probably resulting in a brand new period of financial development. Traditionally, know-how adoption has adopted a sample of preliminary pleasure, adopted by setbacks, and at last, stabilization into intervals of sustained development, as seen within the dot-com period. Within the present section of Web3 know-how, decentralized finance (DeFi) and non-fungible tokens (NFTs) have laid the groundwork for transformative adjustments in monetary techniques, focusing totally on digital property.

Nevertheless, the subsequent development section is anticipated to revolve across the tokenization of RWAs, which may convey substantial worth into the cryptocurrency sector. Main monetary establishments and startups are exploring the usage of blockchain know-how to tokenize tangible property like commodities, artwork, and monetary devices. This motion goals to scale back the reliance on intermediaries, resulting in extra environment friendly and clear transactions.

Regardless of the potential, challenges exist, significantly in guaranteeing the reliability of tokenized property. A proposed resolution entails utilizing sensible contract-based protocols to safe commitments for industrial exchanges, paving the way in which for a extra reliable and programmable financial system. This development could lead on to what’s known as a “Turing-complete economic system,” the place programmable commerce turns into a norm. This shift in asset administration and funding alerts a major evolution in each the crypto and conventional finance sectors.

Actual-world asset (RWA) tokenization is revolutionizing how we view and work together with tangible property. By leveraging blockchain know-how, varied sectors are experiencing a paradigm shift in asset administration, possession, and funding. Let’s delve into a couple of illustrative examples of how RWA tokenization is being utilized throughout completely different industries:

Actual Property: In the true property sector, tokenization is reworking property funding. By breaking down costly property into smaller, extra inexpensive digital tokens, a wider vary of buyers can take part in actual property markets. This democratization of property funding permits for fractional possession, the place a number of buyers can maintain stakes in a property, thus diversifying their portfolios with out the necessity for substantial capital.

Artwork and Collectibles: The artwork world is embracing tokenization to deal with points associated to provenance and possession. By tokenizing paintings and collectibles, artists and collectors can guarantee authenticity and monitor possession historical past via blockchain. This not solely simplifies the method of shopping for and promoting artwork but in addition opens up alternatives for fractional possession of pricy artworks, making artwork funding extra accessible.

Commodities: Commodities like gold, oil, or agricultural merchandise are being tokenized to streamline buying and selling and funding processes. Tokenization of commodities permits for fractional possession and eliminates many logistical challenges related to bodily storage and transportation. Buyers can purchase tokens representing a share of a bodily commodity, facilitating simpler and extra clear transactions.

Monetary Devices: Bonds, shares, and different monetary devices are being tokenized to boost liquidity and market effectivity. Tokenization on this space simplifies the method of shopping for, promoting, and transferring securities, making the monetary markets extra accessible to a broader vary of buyers. It additionally reduces the time and price related to conventional securities transactions.

Luxurious Items and Collectibles: Excessive-value gadgets like luxurious watches, automobiles, or uncommon collectibles are being tokenized to permit fractional possession. This method not solely makes luxurious gadgets extra accessible to a broader viewers but in addition creates a brand new avenue for funding. As an illustration, a uncommon classic automotive may be tokenized, and shares of it may be offered to a number of buyers, democratizing the possession of in any other case inaccessible property.

Infrastructure and Public Initiatives: Tokenization can be being utilized to fund infrastructure and public tasks. By issuing tokens representing a stake in a challenge, corresponding to a brand new vitality plant or a public transport system, communities can elevate funds extra effectively. This method additionally permits for neighborhood participation in tasks that instantly impression them, fostering a way of possession and accountability.

Mental Property: Mental property, together with patents, emblems, and copyrights, may be tokenized to handle and monetize these property extra successfully. This permits creators and companies to realize funding by promoting a portion of their mental property rights, whereas nonetheless retaining management over their creations.

Debt and Loans: The tokenization of debt devices and loans is streamlining lending and borrowing processes. By issuing tokens representing debt, debtors can entry a wider pool of buyers, whereas lenders can commerce these tokens, thereby enhancing liquidity within the lending market.

Carbon Credit and Environmental Belongings: Tokenization is getting used to commerce carbon credit and different environmental property. This method facilitates the shopping for and promoting of carbon offsets and helps funding in environmentally helpful tasks, contributing to sustainability efforts.

Sports activities and Leisure: Within the sports activities and leisure industries, tokenization is enabling fan engagement and funding. Followers can buy tokens representing a stake in a sports activities crew, music rights, or movie tasks, permitting them to be extra instantly concerned and probably profit from the success of their favourite groups or artists.

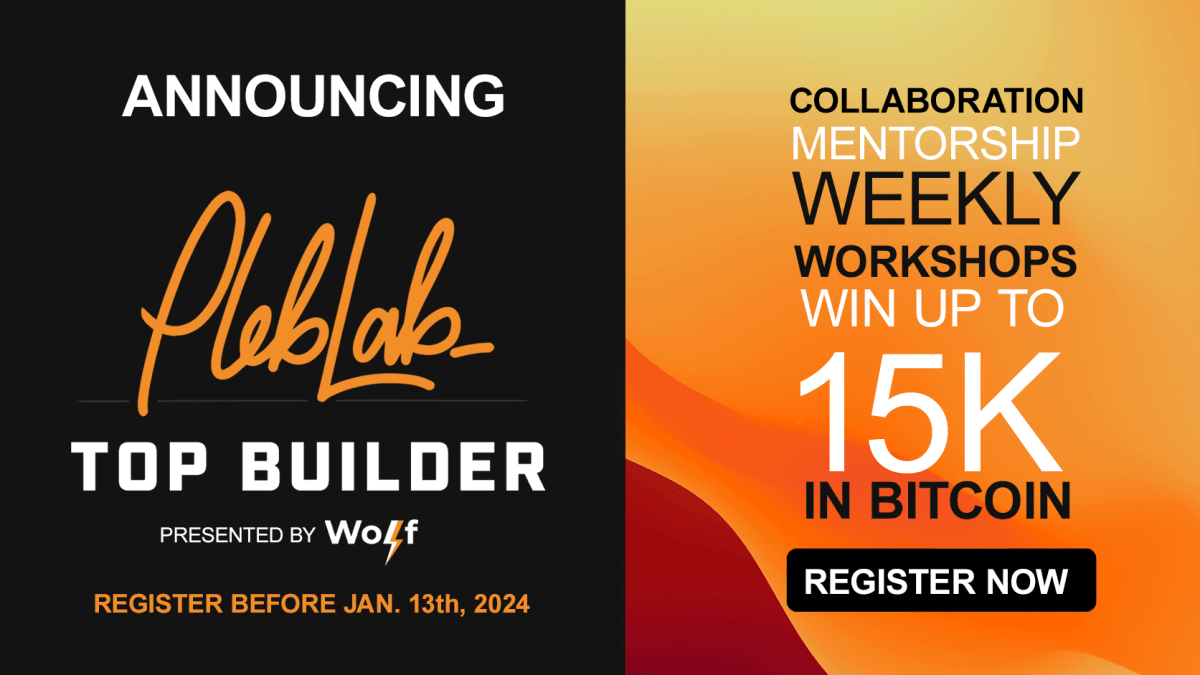

Thrilling Developments at NFTCulture: Pioneering the Future with Proprietary Contracts and Actual-World Tokenization

We at NFTCulture are thrilled to announce a groundbreaking improvement within the intersection of artwork, know-how, and asset administration. Leveraging the ability of blockchain, we’ve crafted revolutionary proprietary contracts particularly designed for real-world asset tokenization. This pioneering method not solely enhances the integrity and safety of asset administration but in addition democratizes entry to high-value investments. Whether or not it’s artwork, actual property, or distinctive collectibles, our new contracts are set to rework how these property are owned, traded, and valued within the digital age.

That is greater than only a technological leap; it’s a cultural shift, aligning completely with NFTCulture’s ethos of innovation and neighborhood constructing. We’re stepping right into a future the place tokenization brings unparalleled transparency and effectivity to asset possession and buying and selling.

For these desirous to be part of this revolutionary journey and to study extra about these thrilling developments, we invite you to attach with our crew. Attain out to @nifty_mike or @mal_nfts on Twitter for insider insights and alternatives. Keep tuned as we pave the way in which for a brand new period in NFTs and real-world asset integration!

In conclusion, RWA tokenization is not only a theoretical idea however a sensible software that’s being actively utilized throughout varied sectors. It affords a extra inclusive, environment friendly, and clear manner of dealing with property, reworking conventional funding landscapes and opening new alternatives for asset administration and possession.