After the Bitcoin spot ETF approval, Ethereum Traditional (ETC) has been ripping up, as its worth has shot up greater than 35% during the last 24 hours.

Ethereum Traditional Takes Off Following Bitcoin ETF Determination

The US SEC has lastly accredited all of the Bitcoin spot ETFs and thus far, the occasion hasn’t confirmed to be a sell-the-news one, because the market has reacted somewhat positively to it, with cash throughout the sector taking pictures up.

One asset that has instantly stood out even amongst these flying altcoins has been Ethereum Traditional. ETC is a tough fork of Ethereum and its essential goal has been to protect how the ETH blockchain initially was.

In contrast to Ethereum, which has transitioned towards a proof-of-stake (PoS) consensus mechanism, Ethereum Traditional remains to be working on proof-of-work (PoW). The latter mechanism, the place validators known as miners deal with the processing of the blockchain, can be utilized by networks corresponding to Bitcoin and Litecoin.

PoW has typically been the primary level of criticism towards these cryptocurrencies, nevertheless, as mining entails the utilization of a excessive quantity of computing energy, which might pose unfavorable results on the planet’s atmosphere. This is among the the reason why ETH switched in direction of an environment-friendly kind in PoS.

The final time ETC had seen some vital renewal of curiosity was within the buildup to Ethereum’s Merge, the occasion the place the blockchain’s mainnet made its flip to PoS.

Ethereum Traditional couldn’t sustain its rally then, nevertheless, because the asset plunged again right down to earth after the Merge truly went by means of. It could seem that the buyers have all of a sudden began listening to the coin as soon as extra now, as its worth has shot up about 46% up to now day.

The asset’s worth seems to have exploded within the final 24 hours | Supply: ETCUSD on TradingView

With these vital income, Ethereum Traditional has emerged as one of the best performer amongst not less than the highest 100 cryptocurrencies by market cap and has touched ranges not noticed since September 2022, the month of The Merge.

Now, the query on the minds of the buyers should be: can ETC sustain this run? Some underlying metrics could present some hints, not less than within the quick time period.

Ethereum Traditional Buying and selling Quantity Has Shot Up, Sentiment Is Nonetheless Impartial

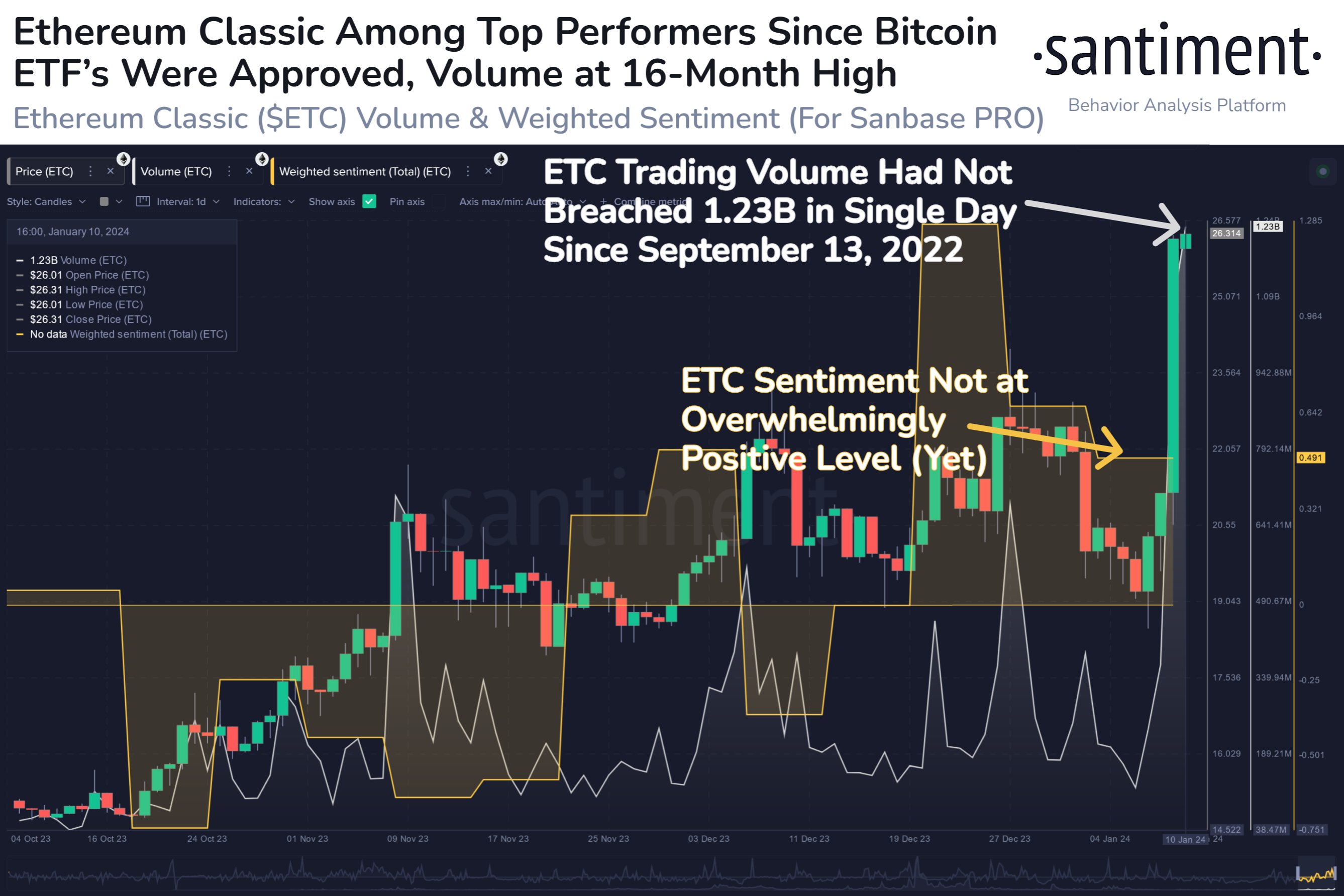

In a brand new put up on X, the analytics agency Santiment has shared some knowledge relating to Ethereum Traditional following its sharp rally. The primary indicator of relevance right here is the “buying and selling quantity,” which retains observe of the quantity of the asset being concerned in trades on the centralized exchanges.

As is clear within the chart beneath, the ETC quantity has surged to some fairly excessive ranges up to now day, an indication that buyers are displaying excessive curiosity within the cryptocurrency:

The pattern within the buying and selling quantity and weighted sentiment of ETC | Supply: Santiment

A excessive quantity could not essentially indicate the continuation of the bullish pattern by itself, as promoting strikes additionally equally contribute in direction of the metric, however it’s nonetheless typically a requirement for any rally to be sustainable.

The opposite metric Santiment has hooked up to the chart is the Ethereum Traditional weighted sentiment, which principally tells us concerning the sentiment across the coin on social media platforms.

This metric is simply at barely constructive ranges at present, which will be an optimistic signal, as an excessive amount of constructive sentiment has traditionally been one thing that has resulted in tops.

Featured picture from Shutterstock.com, charts from TradingView.com, Santiment.web

_id_beb7c7a1-e3e4-4e7a-9ff2-747d82a6f8c5_size900.jpg)