TL;DR

BTC dropped from a yearly excessive of ~48k to ~43k, publish ETF announcement, however the futures market is indicating constructive motion within the coming months.

Full Story

So, Bitcoin ain’t doing too sizzling.

(It seems just like the Bitcoin ETF approval was a ‘purchase the rumor, promote the information’ occasion).

For the reason that announcement final Wednesday, Bitcoin dropped from a yearly excessive of ~48k, to ~43k.

…and that is getting buyers excited.

Confused? Right here’s what’s occurring:

If you wish to know the place the market thinks Bitcoin costs are about to go subsequent – look no additional than the futures market.

Aka: the place the place of us wager on the long run value of Bitcoin.

Although the BTC value has taken a success lately, the ‘long-short ratio‘ of the futures market is predicting constructive value motion within the coming months.

…cool, what the hell does that imply?

Consider the ‘long-short ratio‘ as a ‘positive-negative expectation ratio.’ The upper the ratio, the extra constructive the market’s outlook is on Bitcoin’s value.

Earlier than the Bitcoin ETF approval final week, the ratio was sitting at a low of 0.86.

However as of yesterday, that quantity hit 2.86! Indicating a pointy improve within the expectation of upward value motion for Bitcoin.

So why the sudden rosy outlook on Bitcoin?

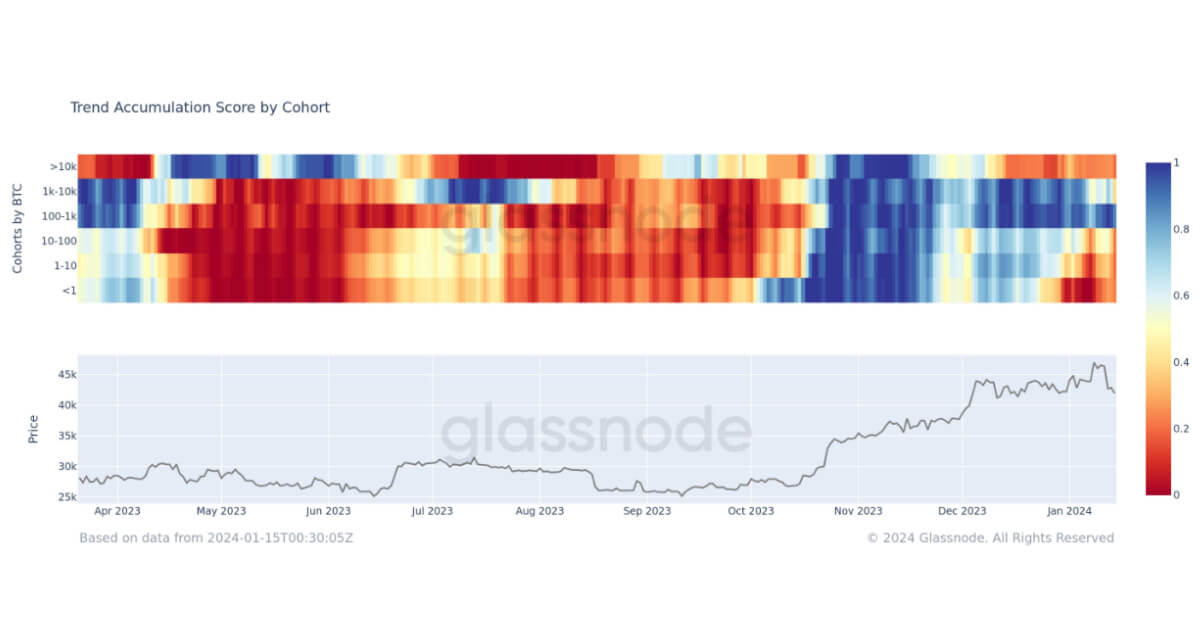

Our guess is, it’s a mixture of the Bitcoin sell-off, and gradual accumulation of Bitcoin by way of ETFs.

The thought being:

The market thinks Bitcoin is nearly finished promoting off, and from right here, what’s wanted to push the worth again up is regular shopping for strain.

Shopping for strain that the market expects to see coming from the Bitcoin ETFs over the approaching months.

Whether or not all of it goes to plan is a complete different query…

But it surely’s a constructive indication nonetheless!