Fast Take

Bitcoin’s hash fee is presently experiencing a 6% dip from its all-time excessive of roughly 545 eh/s. On a 7-day shifting common, it stands at round 513 eh/s.

This noticeable downturn can possible be attributed to the freezing temperatures in Texas resulting in energy changes, as Pierre Rochard, VP of Analysis at Riot Platforms, noticed. To deal with these low temperatures, Texas’ pure fuel energy crops elevated their output to 50 GW. On the identical time, Bitcoin miners scaled again their operations to compensate for the low wind manufacturing, in keeping with Rochard.

Texas Governor Greg Abbott mentioned the Electrical Reliability Council of Texas (ERCOT) prevented blackouts and shortage pricing, marking a major victory. Nonetheless, these situations have inevitably affected Bitcoin’s efficiency, and steady monitoring of the hash fee and miners’ share costs can be required.

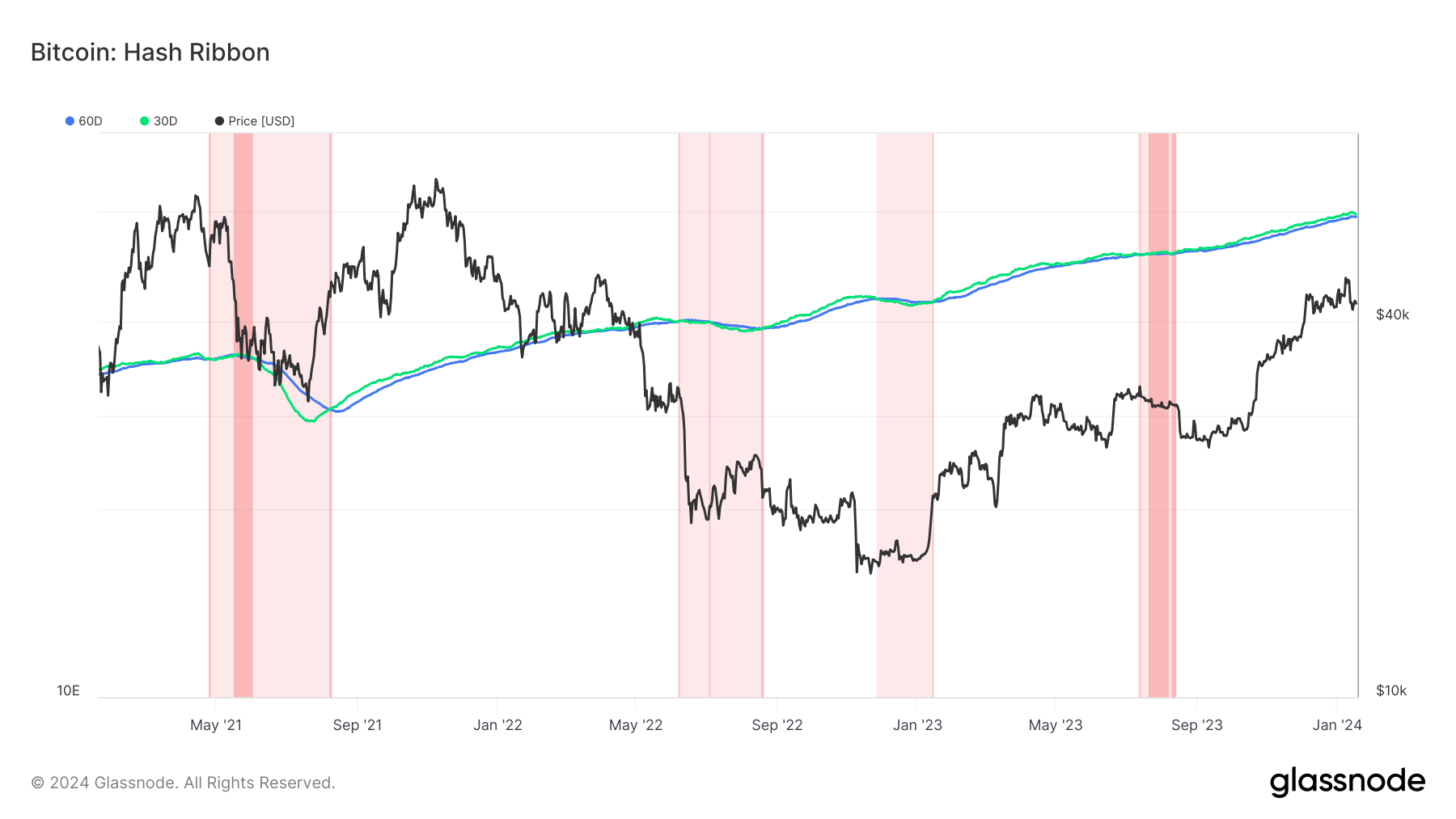

Turning to market indicators, the Hash Ribbon—a software that presumes Bitcoin hits a low when mining turns into disproportionately expensive—means that the worst of miner capitulation is perhaps over. This conclusion comes from observing the 30-day MA of the hash fee crossing above the 60-day MA. Whereas there’s no present indication of capitulation, shut monitoring of those figures can be crucial in predicting future shopping for alternatives and market habits.

The submit Texas freeze results in dip in Bitcoin hash fee appeared first on CryptoSlate.