Whereas the launch of spot Bitcoin ETFs within the U.S. put Bitcoin underneath the highlight, focusing solely on its worth actions supplies a very simplified, shallow illustration of the market. It’s vital to research Bitcoin within the context of different belongings — each crypto and conventional.

Bitcoin’s relationship with Ethereum has all the time been significant. The interaction between the 2 largest cryptocurrencies usually exhibits refined market tendencies that aren’t clearly seen in worth motion.

The ETH/BTC ratio represents the connection between the 2 by displaying the worth of 1 Ethereum by way of Bitcoin. A rise within the ratio suggests Ethereum’s rising dominance or Bitcoin’s comparative weak spot, whereas a lower factors to Ethereum’s underperformance towards Bitcoin.

Earlier CryptoSlate evaluation confirmed that regardless of the numerous short-term spikes and drops within the ratio, its total volatility, measured by the usual deviation of its historic closing costs, has all the time been comparatively average. Which means that in the long run, BTC and ETH usually mirror one another’s actions and expertise parallel market tendencies. Nevertheless, that doesn’t imply that short-term volatility of the ratio needs to be dismissed.

When each expertise comparable bullish or bearish tendencies, their ratio maintains equilibrium, additional highlighting the significance of short-term discrepancies of their motion.

Since October 2022, the ETH/BTC has been in a downturn, most definitely as a consequence of a market correction following the excessive expectations set by the Merge. It additionally exhibits that Ethereum’s worth actions weren’t as pronounced as Bitcoin’s, resulting in decreased relative worth seen by the ratio.

Since CryptoSlate reported on the ratio, it has skilled a swift and notable development reversal. Between Nov. 30, 2023, and Jan. 19, 2024, the ETH/BTC ratio elevated by 10.53%. Throughout this era, the worth of ETH in USD elevated by 20.74%, whereas BTC elevated by 9.25%. Ethereum’s transaction quantity elevated by 4.59%, and Bitcoin’s grew by 27.23%.

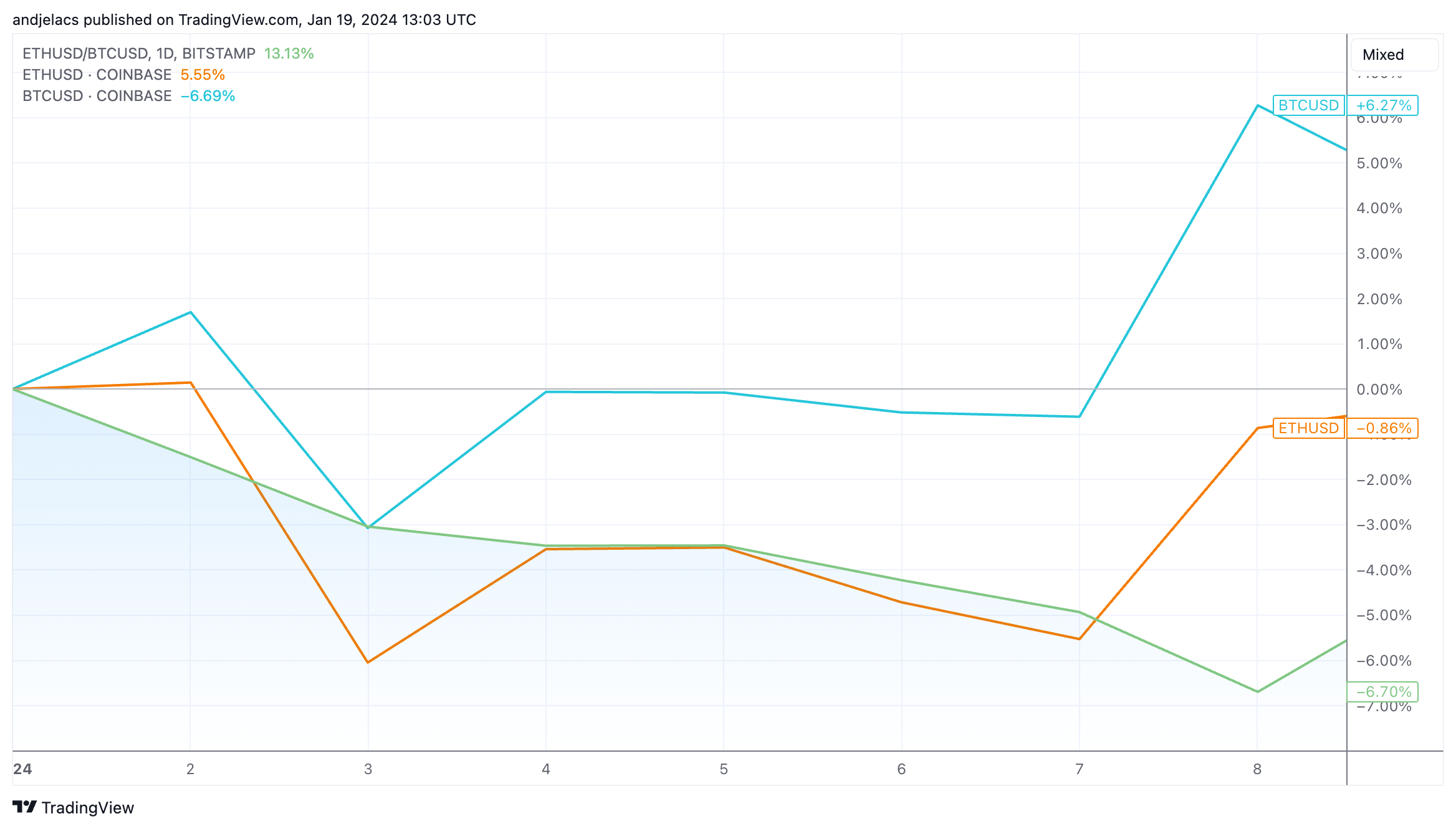

The optimistic worth momentum and quantity enhance continued into 2024. The brand new yr started with the market eagerly awaiting the approval of the spot ETFs within the U.S., the anticipation inflicting stress and pushing costs greater. The ETH/BTC ratio decreased considerably between Jan. 1 and Jan. 8, with Bitcoin’s worth enhance pushing the ratio down by 6.70%.

Nevertheless, because the approval of the ETFs grew to become imminent on Jan. 8, the market started correcting from the stress that constructed up Bitcoin’s worth. Ethereum’s worth noticed a rebound, and Bitcoin skilled a notable lower.

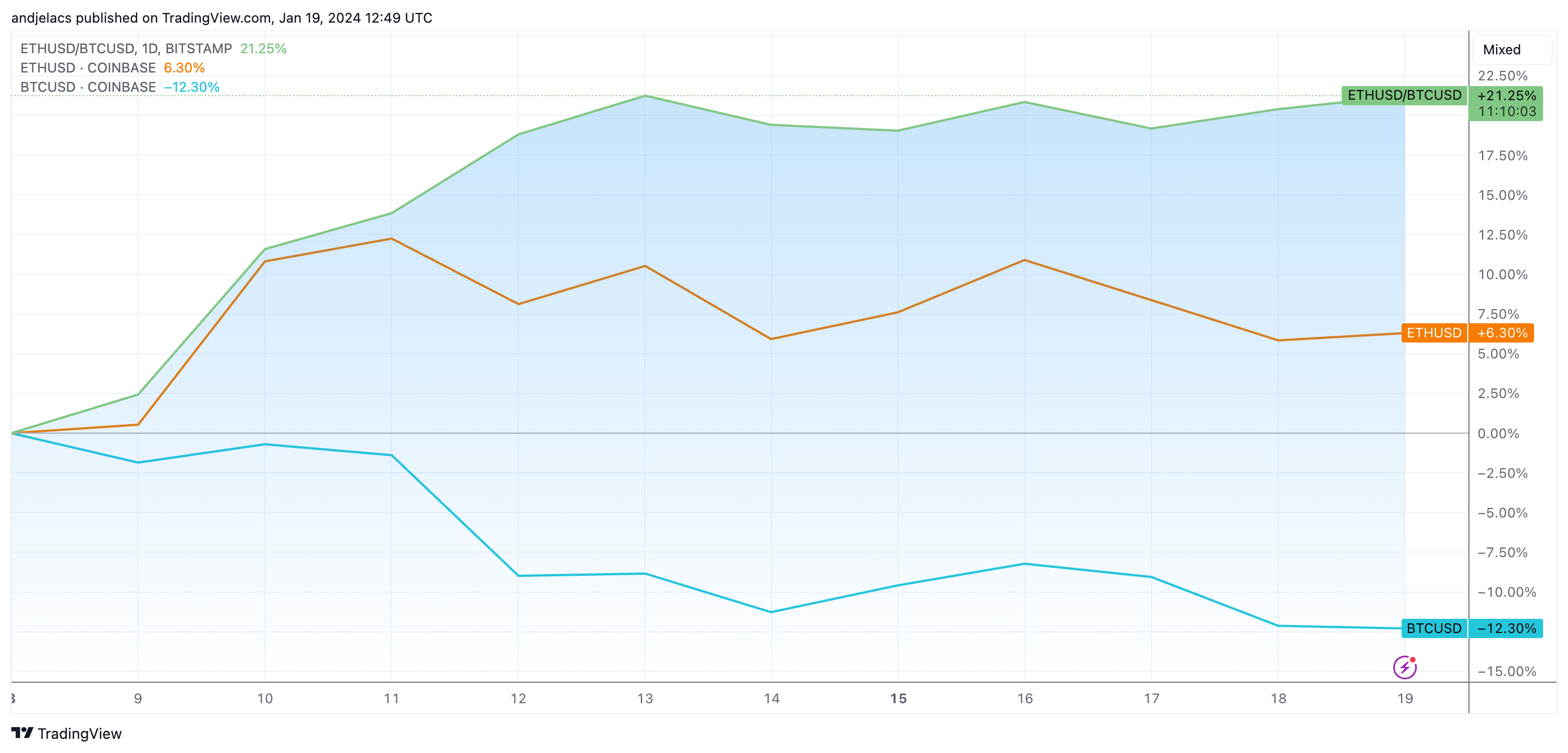

Between Jan. 8 and Jan. 19, Bitcoin’s worth decreased by 12.30%, because the launch of the ETFs failed to supply the rally the market anticipated. At the very least a few of the capital that exited Bitcoin appears to have relocated to Ethereum, as ETH noticed its worth leap by 6.30%. This discrepancy in worth will increase led to a pointy enhance within the ETH/BTC ratio, which grew by 21.25%.

This divergence in worth trajectories would counsel a rise in buying and selling quantity for Ethereum, as a leap would often comply with the worth enhance in shopping for and promoting actions on exchanges. Nevertheless, Ethereum’s transaction quantity decreased by 4.15% throughout the interval. However, Bitcoin’s transaction quantity elevated by virtually 34%.

This means that Bitcoin’s worth decline can’t be attributed solely to diminishing market curiosity. Institutional actions, possible spurred by the ETF approvals and the following spike in ETF inflows and buying and selling quantity, most definitely brought about the rise in transaction quantity. On the similar time, retail promoting pushed the worth down.

The dearth of structured Ethereum-based buying and selling merchandise implies that the current ETH spike probably originated from retail exercise. Conversely, Bitcoin’s market response appears extra pushed by institutional actions, displaying the influence of spot ETFs on each crypto and conventional monetary markets.

The submit Ethereum outpaces Bitcoin post-ETF launch as ETH/BTC ratio skyrockets appeared first on CryptoSlate.