Chris J Terry, a cryptocurrency analyst and fanatic, has revealed his insights on the worth motion of Bitcoin, predicting a steady decline within the worth of the crypto asset.

Analyst Says Bitcoin Will Proceed To Drop

The crypto analyst shared his insights concerning Bitcoin with the cryptocurrency group on the social media platform X (previously Twitter), anticipating a doable “continuation of a flat or declining pattern.”

He highlighted that the downtrend will proceed till Grayscale Bitcoin Belief (GBTC) is totally “liquidated.” In keeping with him, the liquidation might be doable with a whopping $25 billion price of promoting exercise over the following few weeks.

Terry cites Grayscale’s option to maintain Bitcoin ETF charges at 1.5% as the reason for what he sees to be the “greatest strategic error” in cryptocurrency historical past. This suggests that Grayscale’s motion may need a long-term affect on the crypto market and will forestall wider adoption.

The publish learn:

Seems just like the BTC worth will proceed flat/down till GBTC is liquidated, $25B of promoting over the following few weeks. Grayscale choice to maintain ETF charges at 1.5% will go down as the largest strategic error in crypto historical past. Grasping idiots.

His evaluation emphasizes how funding autos are interconnected and the way this impacts the state of the cryptocurrency market as a complete. Nevertheless, this has attracted disbelief from just a few well-known figures locally.

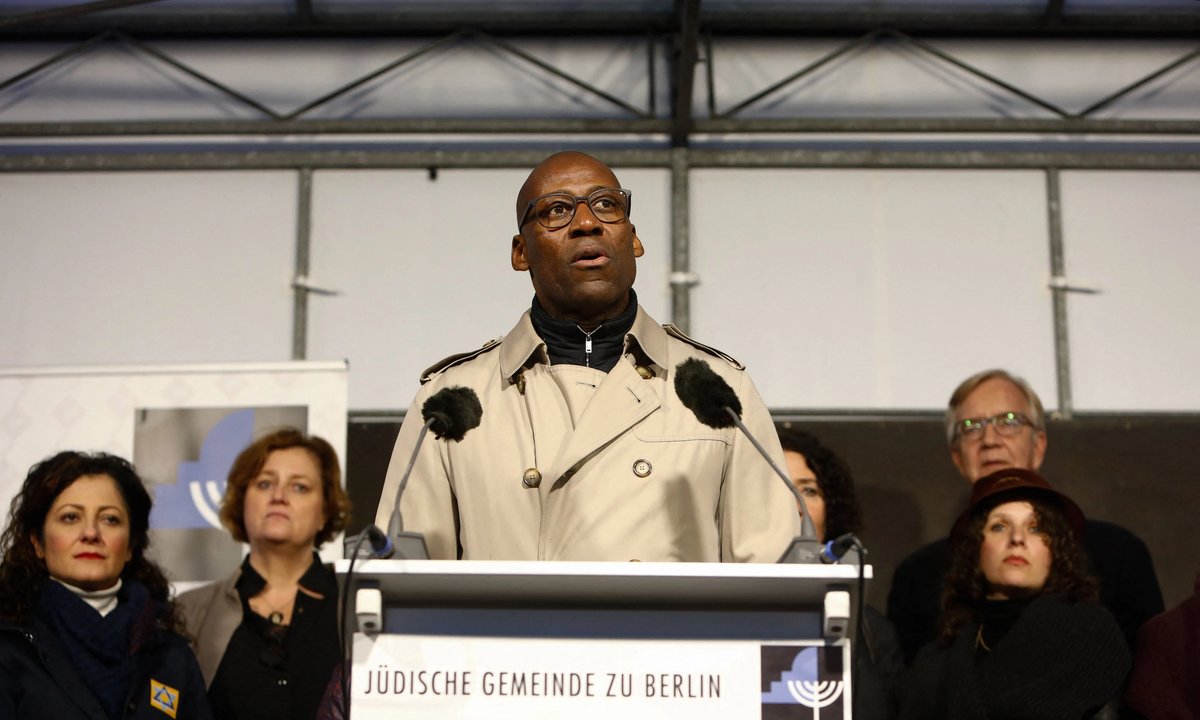

One of many figures who has expressed disbelief is Galaxy Digital CEO Mike Novogratz. He asserted that he “disagrees” with Chris Terry’s evaluation as a result of although Novogratz consultants some promoting stress exercise, he believes buyers will transfer to different ETFs, particularly supporting BTCO. Novogratz additionally identified that the Invesco Galaxy Bitcoin ETF (BTCO) is his favourite among the many merchandise.

Moreover, Novogratz highlights the importance of sustaining perspective in mild of transient market circumstances. He famous that the most recent growth will facilitate older buyers’ or boomers’ entry into the crypto panorama.

As well as, he has highlighted the potential for enhanced leverage by having 4×5 publicity to Bitcoin through BTCO. He then shared an optimistic look, noting that “BTC will go increased within the subsequent six months after this indigestion.”

BTC Sees $25 Million Outflows

A latest report from Coinshares has revealed that Bitcoin witnessed an outflow of a whopping $25 million. Coinshares shared the knowledge in its most up-to-date weekly “Digital Asset Fund Flows.”

It additionally famous an enormous $11.8 billion in BTC buying and selling quantity final week. In keeping with Coinshares, that is seven instances greater than the common weekly buying and selling exercise recorded in 2023.

There have been notable withdrawals from digital asset funding merchandise final week, totaling about $24.7 million. Notably, this spike in buying and selling exercise signifies that ETFs account for 63% of all Bitcoin volumes on dependable exchanges.

As of the time of writing, Bitcoin was buying and selling at $40,827, indicating a decline of two.16% up to now day. Regardless of the worth drop, its buying and selling quantity is at present up by over 81% within the final 24 hours.

Featured picture from iStock, chart from Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site solely at your individual danger.