In a latest complete evaluation of the cryptocurrency panorama, a report by CoinGecko has unveiled disconcerting insights into the destiny of digital currencies, revealing that greater than 50% of the 24,000 listed on the platform since 2014 have met their demise.

This equates to a staggering 14,039 cryptocurrencies being labeled as “lifeless” or “failed,” both on account of extended intervals of inactivity or an inherent lack of viability as efficient mediums of trade.

Market Turmoil: 2021 Cryptos Face Demise

The report presents a vivid portrayal of a market fraught with challenges and uncertainties, with a notable correlation between bull runs and mission failures. The exuberant surge in costs and speculative fervor throughout the 2020-2021 increase resulted within the highest variety of casualties, as 7,530 cash, representing 53.6% of all defunct cash, succumbed to the following correction.

This era additionally witnessed the proliferation of meme cash, characterised by an absence of strong technological foundations and clear use circumstances, resulting in their meteoric rise and subsequent downfall.

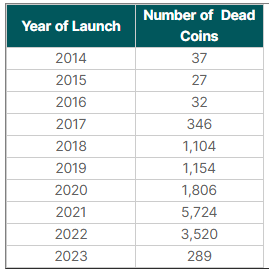

With 5,724 lifeless as of January 2024, cryptocurrencies launched in 2021 have fared the worst. 2021 was the worst yr for mission launches, with over 70% of cryptocurrencies listed on CoinGecko dying.

The 2022 listed cryptocurrencies come subsequent; 3,520 of them have already crashed, representing a price of about 60%.

Cryptocurrency ‘deaths’ by yr of launch. Supply: Coingecko

Cryptocurrency ‘deaths’ by yr of launch. Supply: Coingecko

In 2023, 289 of the cash listed by CoinGecko went extinct. With over 4,000 cash listed, this displays a failure price of lower than 10%, a major lower from prior years.

Amidst this sobering evaluation, a glimmer of hope emerges within the information for 2023. The failure price for cash launched on this yr stands at a considerably decrease 10%, with solely 289 out of over 4,000 assembly their demise up to now.

As of at the moment, the market cap of cryptocurrencies stood at $1.476 trillion. Chart: TradingView.com

Traders Adapt: Favoring Stronger Crypto Initiatives

This optimistic pattern could also be attributed to varied components, together with a possible shift in the direction of extra well-structured initiatives with stronger worth propositions and a maturing investor base participating in additional thorough analysis and due diligence.

The report identifies a number of key causes for the deactivation of a cryptocurrency on the CoinGecko platform. Extended inactivity exceeding 30 days tops the listing, adopted by media stories or credible proof exposing scams or fraudulent exercise.

Moreover, the dissolution of mission groups, rebranding efforts, or rendering tokens unusable are additionally cited as components necessitating deactivation.

Finally, the CoinGecko report serves as a cautionary story for buyers navigating the turbulent waters of the cryptocurrency market. With such a excessive failure price, the crucial for thorough analysis and discerning analysis of particular person initiatives turns into evident.

Featured picture from Shutterstock