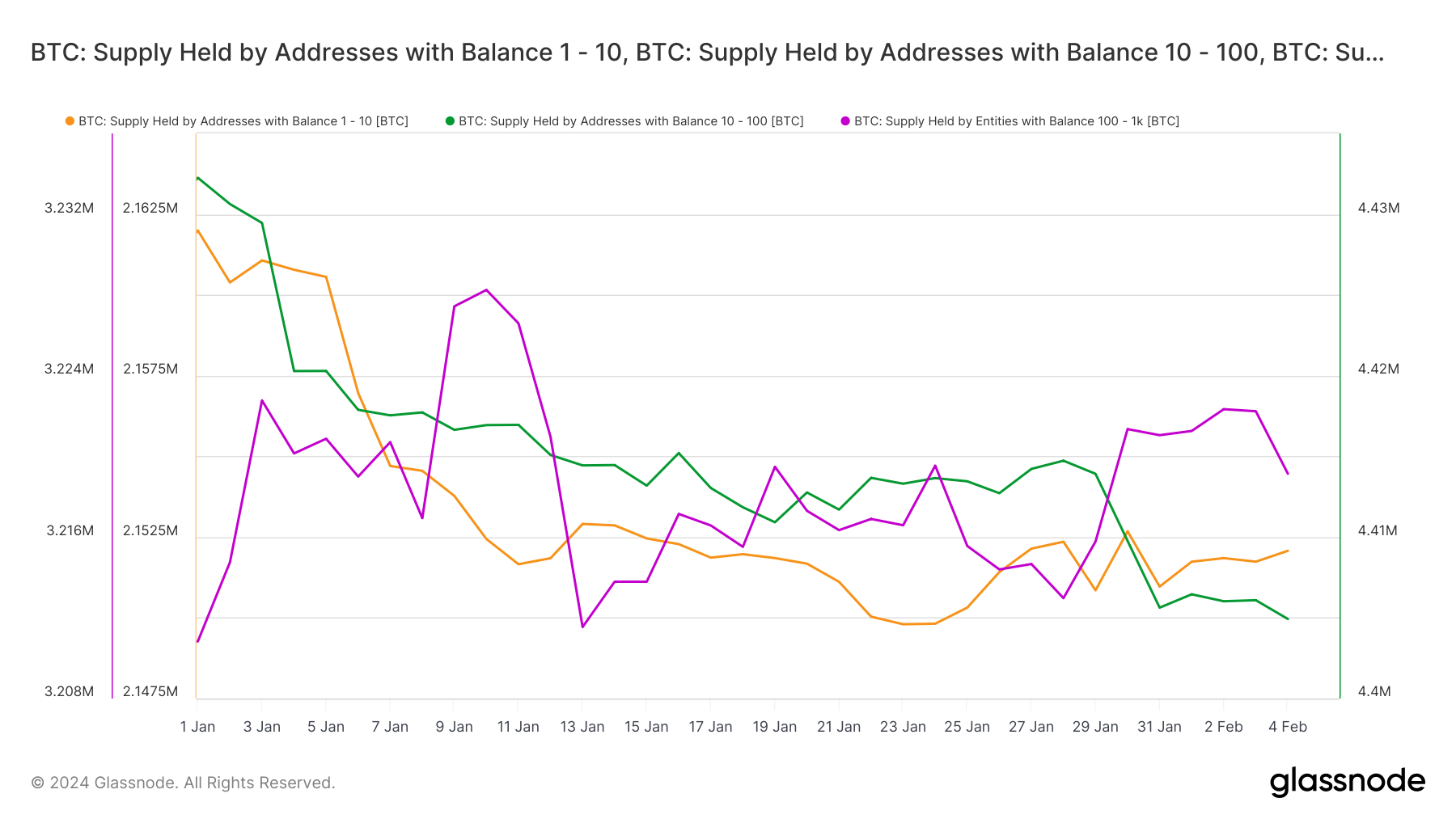

There was a major shift within the distribution of Bitcoin provide because the starting of the yr. Whereas the distribution of Bitcoin holdings is a daily prevalence and follows market cycles, the launch of spot Bitcoin ETFs within the U.S. appears to have spearheaded these adjustments.

It’s necessary to know the provision distribution throughout completely different Bitcoin holding cohorts. It gives insights into market sentiment, potential liquidity shifts, and the steadiness between retail and institutional participation. Giant actions in holdings can point out institutional exercise, strategic accumulation, or redistribution of belongings in response to market developments. Monitoring these adjustments can present early alerts of broader market developments, shifts in investor conduct, and potential worth actions.

Addresses holding between 10,000 and 100,000 BTC skilled the most important enhance in steadiness, up by 2.97% Yr-To-Date (YTD), whereas these with balances between 1,000 and 10,000 BTC noticed their steadiness enhance by 2.89% YTD.

Conversely, addresses holding between 100 and 1,000 BTC recorded the most important drop, lowering by -3.32%.

The noticed enhance in Bitcoin holdings amongst addresses with giant balances (1,000 to 10,000 BTC and 10,000 to 100,000 BTC) contrasts with the lower amongst smaller steadiness addresses (100 to 1,000 BTC). The numerous uptick in holdings among the many largest cohorts signifies institutional accumulation and strategic conduct by giant buyers. This might be pushed by the legitimization and elevated accessibility of Bitcoin by way of the launch of spot ETFs, providing a regulated and probably safer funding avenue for substantial capital inflows.

The expansion in balances of huge holding addresses may additionally mirror elevated confidence in Bitcoin’s long-term prospects, doubtless buoyed by the introduction and recognition of spot Bitcoin ETFs. This might point out market maturation and acceptance inside conventional monetary techniques.

The decline in holdings amongst addresses with balances between 100 and 1,000 BTC may point out a transfer in the direction of diversification and danger administration methods, probably influenced by the provision of Bitcoin publicity by way of ETFs. Buyers on this cohort could also be reallocating belongings to steadiness their portfolios throughout completely different asset lessons throughout the extra acquainted framework of ETFs.

One other doable cause why smaller cohorts might have skilled declines of their Bitcoin holdings is profit-taking. Elevated market liquidity following the launch of the ETFs has definitely brought on short-term and smaller holders to facilitate simpler profit-taking. Buyers with smaller balances could be extra inclined to capitalize on worth actions, particularly seeing how the ETF introduction led to short-term worth will increase.

The publish How ETFs affected Bitcoin’s provide distribution throughout cohorts appeared first on CryptoSlate.