Mainstream media reviews may inform you that NFTs are lifeless, however the holder of a CryptoPunks NFT stated he needed to show them incorrect—by taking out a seven-figure mortgage on one of many rarest property within the distinguished profile image (PFP) assortment.

“Right here we’re, 4 or 5 months faraway from an article in Rolling Stone saying that NFTs are nugatory,” collector and entrepreneur Gmoney stated at the moment on Rug Radio’s stay “FOMO Hour” present. “And so I used to be like, ‘Nicely, what higher strategy to present that these will not be nugatory if I can get a million-dollar mortgage towards an NFT, proper?”

Gmoney, the pseudonymous founder and CEO of linked style model 9dcc, is understood within the crypto world as somebody who has made sizable bets on high-value property. And he’s amassed a large following within the course of, making his PFP much more recognizable.

His CryptoPunk #8219 is one in all simply 24 Apes in all the 10,000 NFT assortment, and others have offered for as a lot as $10 million up to now. CryptoPunks begin at a value of practically $140,000 price of Ethereum on secondary marketplaces as of this writing, however sale costs for uncommon property within the assortment can nonetheless ship a large a number of of that.

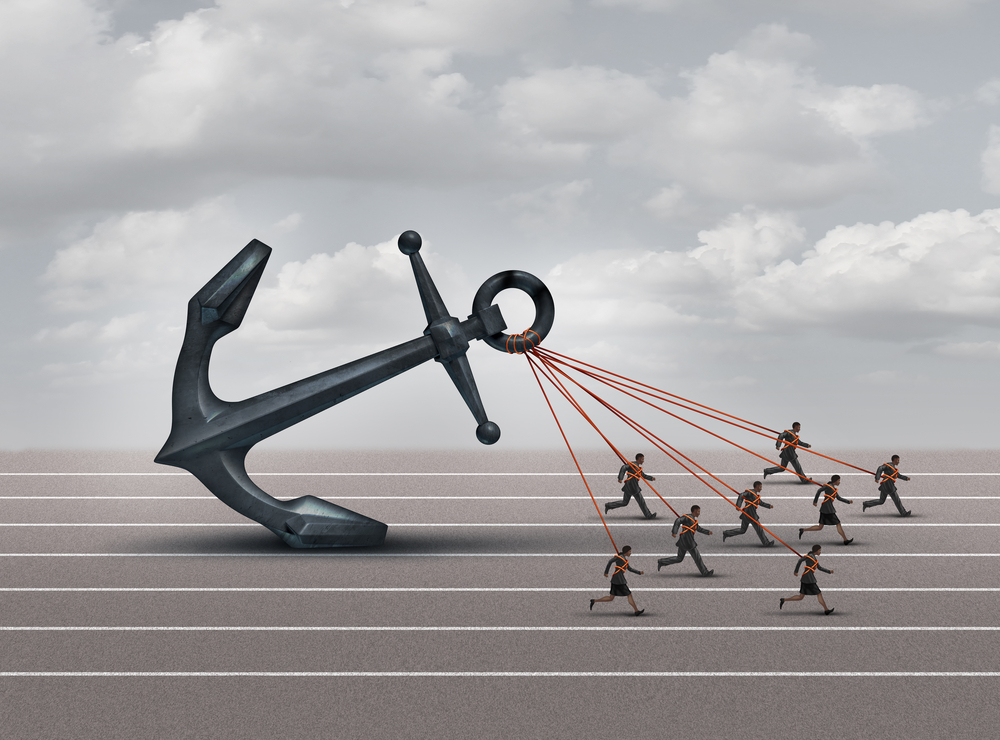

He secured the mortgage on Gondi, one in all a number of NFT lending protocols that match NFT homeowners with liquidity suppliers in a decentralized style. Holders can take out loans with the NFT itself offered as collateral, and the counterparty floating the money is taking a wager that they’ll earn some curiosity on the transaction—or possibly take the NFT itself if the mortgage defaults.

This specific mortgage was for $1 million price of USDC stablecoin with a 14% rate of interest, however for a 180-day interval—which means he’s set to pay out over $69,000 in curiosity for every six months.

It’s been hailed as the most important mortgage per date by way of an NFT lending platform.

Gmoney stated that he’s an investor in Gondi, together with rival NFT lender Arcade—however lending platforms like this don’t require any particular connection, fame, or proof of real-world id. Any proprietor of a invaluable NFT can probably take out a mortgage in a trustless style.

And he’s bullish on what the rise of NFT-backed loans can do to propel the house even additional.

“When you consider the asset appreciation we had final cycle—that was with out credit score, proper?” he stated. “What occurs once you introduce credit score into the system? You begin to see some fairly loopy stuff occur.”

Edited by Ryan Ozawa.

Keep on high of crypto information, get every day updates in your inbox.