In a strategic dance between international powers and the attract of untapped sources, Chinese language Bitcoin miners are orchestrating a mass migration to Ethiopia. Drawn by the siren name of the nation’s staggeringly low electrical energy prices and a shocking embrace of Bitcoin mining, Ethiopia has change into an surprising haven for cryptocurrency corporations, setting the stage for a novel partnership within the coronary heart of East Africa.

Ethiopia’s Bitcoin Wager: Geopolitical Complexity Unfolds

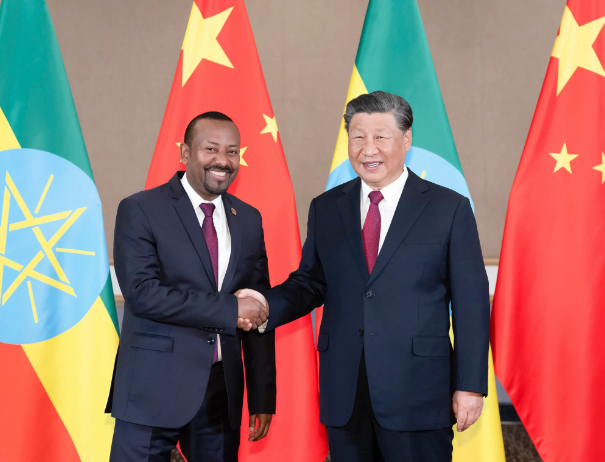

The collaboration unfolds towards the backdrop of Ethiopia’s ban on cryptocurrency buying and selling, paradoxically juxtaposed with the federal government’s open-armed welcome to Bitcoin mining since 2022. A fancy geopolitical ballet, this transfer aligns with Ethiopia’s efforts to strengthen ties with China, with Chinese language corporations, instrumental in erecting the $4.8 billion Grand Ethiopian Renaissance Dam, now set to produce energy to the surging inflow of Bitcoin miners.

As the worldwide Bitcoin mining business faces a crescendo of criticism for its energy-intensive practices, Ethiopia emerges as a shocking oasis, providing a uncommon respite for cryptocurrency corporations grappling with mounting considerations over local weather change and energy shortages. For Chinese language firms, as soon as giants within the Bitcoin mining enviornment, Ethiopia’s panorama presents a possibility to regain their dominance, stepping away from the fierce competitors discovered within the present epicenter of the business, Texas.

BTC market cap at the moment at $877.016 billion. Chart: TradingView.com

But, this daring transfer shouldn’t be with out its share of dangers, echoing previous makes an attempt by creating nations like Kazakhstan and Iran, whose forays into Bitcoin mining had been met with inside strife fueled by the business’s voracious vitality urge for food. Jaran Mellerud, the chief govt of Hashlabs Mining, provides a sobering perspective, warning of potential pitfalls the place international locations could exhaust their electrical energy sources or the place miners may discover themselves unwelcome and compelled to pack up and depart.

A prime govt at Bitmain, the Beijing-based firm that’s the principal provider of rigs, claims that in a couple of years, the African nation’s capability to generate electrical energy for the creation of bitcoin could equal that of Texas. Ethiopia’s put in producing capability expanded to five.3 gigawatts with the opening of the GERD undertaking; hydropower, a renewable vitality supply, accounts to over 90% of this capability, in accordance with the South China Morning Submit.

Ethiopia’s Bitcoin Balancing Act: Alternative Abounds

Navigating this precarious dance, Ethiopian authorities strategy Bitcoin mining with warning. Regardless of latest strides in growing vitality technology capability, the evident actuality persists: nearly half of the inhabitants lacks entry to electrical energy, making the topic of mining a delicate and nuanced subject. Nonetheless, the promise of serious international trade earnings acts as a seductive incentive for the federal government to delicately steadiness the potential financial windfall towards the backdrop of societal considerations.

Luxor Expertise, a mining companies supplier, sheds mild on Ethiopia’s fast ascent to prominence as a worldwide vacation spot for Bitcoin mining tools. The state-controlled energy utility has inked agreements to produce electrical energy to 21 Bitcoin mining corporations, with a predominant Chinese language possession, underscoring the substantial international funding affect inside Ethiopia’s burgeoning mining sector.

As the primary wave of Chinese language Bitcoin miners descends upon Ethiopia, the nation stands on the crossroads of financial alternative and potential peril. This surprising fusion of Chinese language funding and Ethiopian openness to the cryptocurrency realm paints a vivid image of the evolving dynamics within the international digital monetary panorama. Whether or not this enterprise proves to be a panacea for Ethiopia’s financial aspirations or a dangerous gambit with far-reaching penalties stays unsure, including an intriguing chapter to the continued narrative of cryptocurrency’s international footprint.

Featured picture from Adobe Inventory, chart from TradingView

_id_beb7c7a1-e3e4-4e7a-9ff2-747d82a6f8c5_size900.jpg)