The Shiba Inu (SHIB) worth has emerged from a persistent downtrend that dominated the previous two months. An in depth evaluation of the every day and weekly (SHIB/USD) charts signifies a collection of essential technical elements which can be at the moment influencing SHIB’s worth actions.

Shiba Inu Bulls Take Over

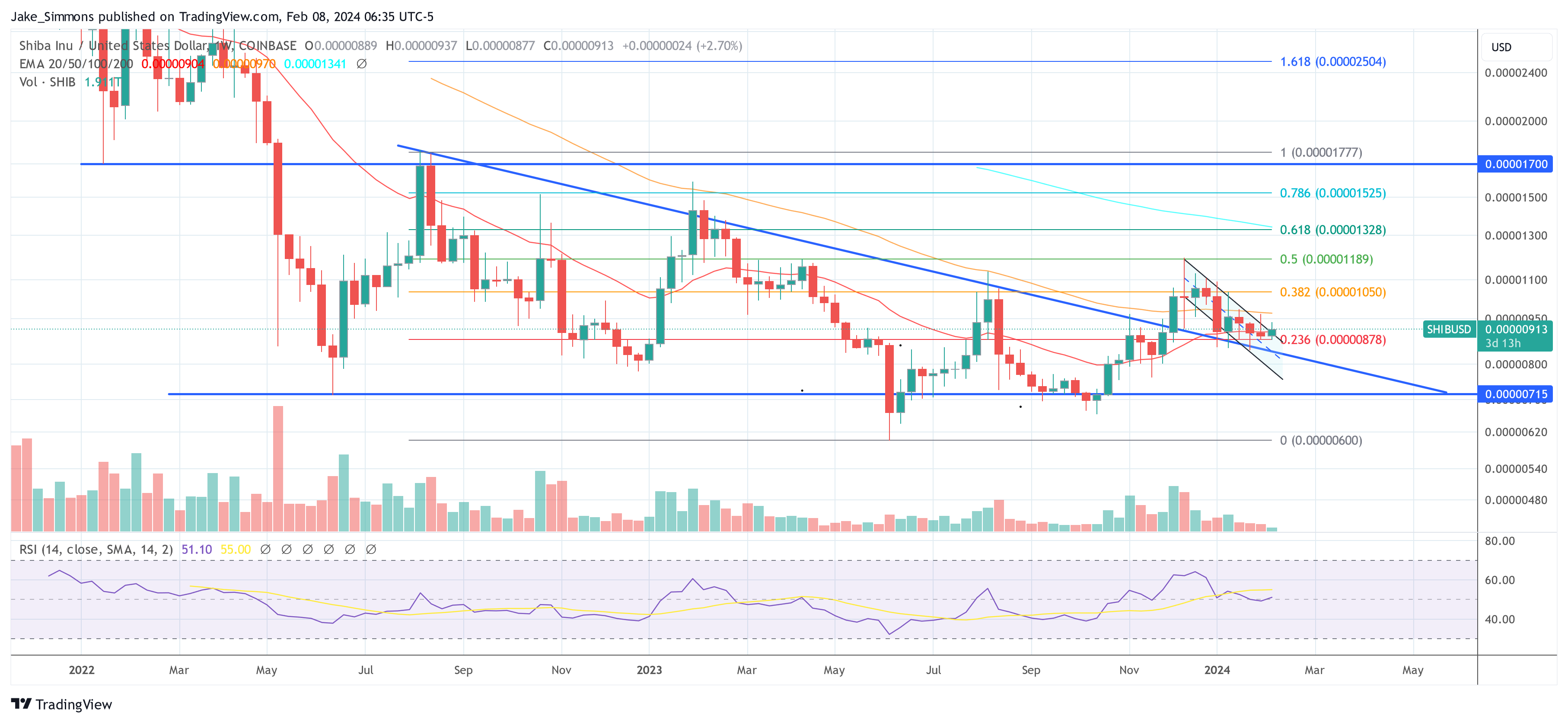

On the every day chart, SHIB has damaged by the higher boundary of the descending channel sample that had been in place for the reason that excessive at $0.00001193 reached in mid-December final 12 months. This channel, characterised by decrease highs and decrease lows, had been containing the worth motion, however a latest surge in quantity and shopping for stress has allowed SHIB to breach this confinement.

The breakout was confirmed by a detailed above the 200-day Exponential Shifting Common (EMA, blue line), which is now performing as a assist degree. Nevertheless, with the 20-day, 50-day, and 100-day EMAs converging simply above present worth ranges (between $0.00000912 and $0.00000932), the bulls nonetheless have some work to do.

Notably, the Fibonacci retracement ranges, drawn from the height to the trough of the latest main transfer, reveal the next key worth ranges: the 0.236 degree at $0.00000878 continues to be crucial assist, adopted by the 0.382 degree at $0.00001050, the 0.5 degree at $0.00001189, and the 0.618 degree at $0.00001328 as the following essential worth targets. These ranges typically act as resistance throughout recoveries and, as such, are essential targets for merchants to look at.

The Relative Power Index (RSI) on the every day chart is hovering across the 51 mark, indicating a impartial momentum with a slight bias in the direction of shopping for stress. This leaves room for the RSI to climb earlier than reaching overbought circumstances, that are sometimes thought of to be above the 70 degree.

Finish Of The Consolidation Part?

On the weekly timeframe, a bigger pattern line, which is offering assist derived from an ascending triangle sample, suggests a longer-term bullish sentiment underlying the latest bearish section. This assist line is essential because it has been revered quite a few occasions previously, making it a major degree for long-term holders.

A decisive weekly shut above the 20-week EMA at $0.00000904 this Sunday might pave the way in which for vital momentum. Subsequently, consideration shifts to the 50-week EMA at $0.00000970, signaling potential additional advances.

The amount profile on each time frames has been comparatively excessive in the course of the breakout, offering additional affirmation of the transfer. Nevertheless, merchants ought to be cautious as excessive quantity may precede volatility and potential worth retracements.

In abstract, SHIB has exhibited a transparent breakout from a two-month downtrend with rapid assist and resistance ranges identifiable by EMAs and Fibonacci retracements. Merchants and buyers ought to be intently monitoring these ranges to gauge the sustainability of the breakout and the potential for a pattern reversal.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site fully at your individual danger.