With 2024 already underway, the anticipation in crypto circles is hitting a fever pitch as everybody braces for Bitcoin’s halving – an occasion that would reshape its market panorama. It deserves to be appeared into as traditionally this occasion sparked transformative waves throughout the crypto scene. Understanding what we have discovered from earlier halvings, we’re set to steer forward with a eager eye, ensuring our strikes are formed by these insights. However is that this upcoming halving any totally different? Let’s determine it out.

From Digital Gold to Uncommon Platinum: Bitcoin’s Story of Rising Shortage and Worth

Bitcoin design is all about making BTC much less and fewer accessible over time, maintaining inflation in test. There’s a set cap of 21 million Bitcoins to ever exist, and we’ve already hit the 19.62 million mark. The shortage of Bitcoin, with its strictly restricted launch into the market, is a serious motive why individuals name it “digital gold” – as each these property have that “arduous to come back by” high quality.

Considering of the Bitcoin blockchain as a ticking clock, we are able to see that halving happens each 210,000 blocks, or about each 4 years, with the reward for mining new blocks getting chopped in half. It’s been this fashion since Bitcoin’s kick-off in 2009, beginning at 50 BTC per block and heading down to three.125 BTC in 2024.

The Inventory-to-Move ratio, which compares current provide to new cash coming in, exhibits Bitcoin is about to get rarer than a platinum album. By 2032, after the 2024 and 2030 halvings, Bitcoin’s shortage will soar, so will probably be much more of a gem than gold.

Bitcoin’s Submit-Halving Development Patterns

Let’s take a stroll down Bitcoin’s reminiscence lane. After every halving, Bitcoin’s worth has skyrocketed. Submit the 2012 halving, simply 100 days later, the market cap exploded by 342%. Much more spectacular, the height worth hit a staggering $1,152 the subsequent yr, an 8,761% leap. Flash ahead to 2016: rewards halved from 25 to 12.5 BTC, and the value soared to $17,760 the next yr, a 2,572% bounce. The newest halving in 2020 noticed the reward drop to six.25 BTC, and Bitcoin’s worth did not disappoint, hitting $67,549 the subsequent yr, marking a stable 594% progress.

If we play armchair mathematicians for a bit, we are able to have a look at how Bitcoin’s progress fee decreased after previous halvings – by 70.64% from halving one to 2 and by 76.91% from two to 3 – and common out these decreases to land at a progress fee lower of 73.78%. We then slap this onto the 594.03% progress put up the third halving and – voila – we get a speculative progress fee of 155.79% after the 2024 halving. This implies Bitcoin may probably hit round $111,807 between one to 1 and a half years after the upcoming halving. However let’s be clear: this all is merely hypothesis and positively not one thing to base your funding selections on.

Miners’ Survival of the Fittest

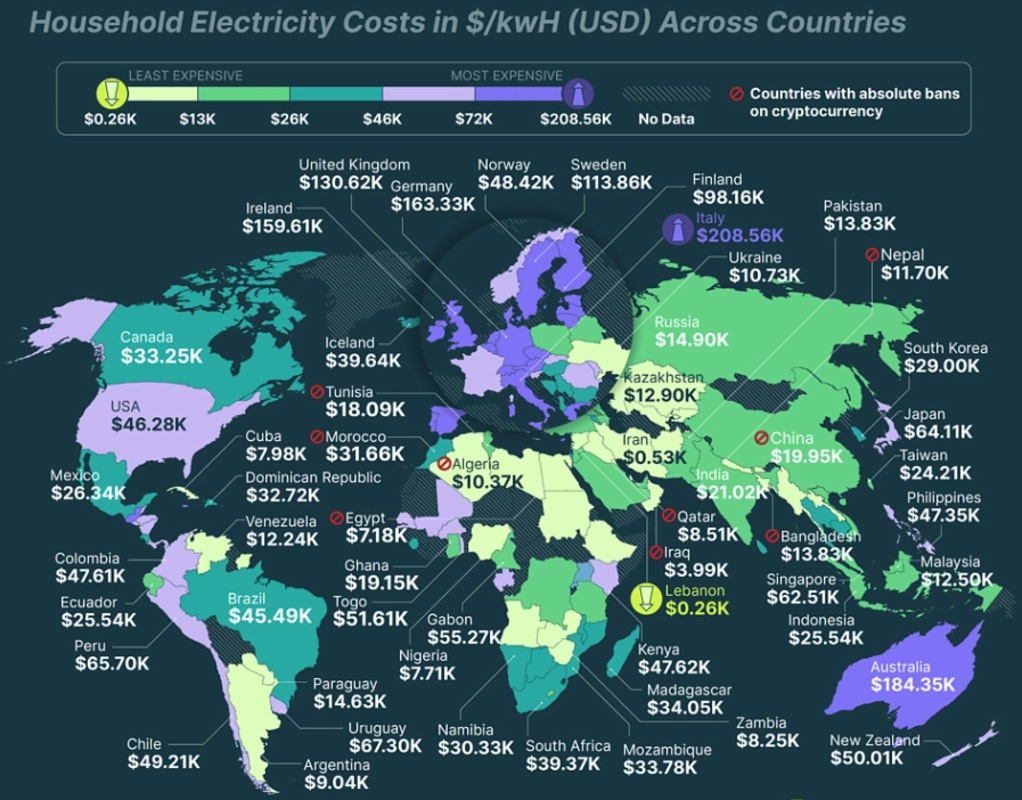

For Bitcoin miners, the 2024 halving will likely be an uphill battle. With rewards slashed in half, miners working with outdated gear and going through excessive electrical energy payments will likely be caught between a rock and a tough place. In Italy, for instance, mining a single Bitcoin can attain as a lot as a luxurious Lamborghini Huracán or a Porsche 911 Turbo S, with prices hovering as much as $208,560.

The 2024 halving will rework the mining panorama right into a scene harking back to ‘The Starvation Video games,’ the place solely the strongest miners, armed with essentially the most environment friendly know-how and entry to reasonably priced power, will survive. This halving will likely be like the last word enviornment, a check of technique and resilience, the place solely these geared up with savvy cost-effective ways will emerge as victors within the aggressive battleground.

Closing Ideas

So, the 2024 Bitcoin halving is poised to significantly shake issues up, with main modifications in mining operations and a possible massive swing in Bitcoin’s worth. The forthcoming halving occasion mingles hard-hitting financial theories with cutting-edge tech strides, all wrapped up in that unmistakable crypto attract. Whether or not you’re mining, hodling, or simply watching from the sidelines, seize your popcorn – this can go down within the books!

It is a visitor put up by Maria Carola. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.