With regards to storing your bitcoin, multisignature—or multisig for brief—is well known as some of the safe strategies. It might probably eradicate dangers related to exchanges and custodians, and concurrently addresses the most typical points with self-custody. On this article, we’re going to stroll by means of why you need to maintain your personal bitcoin keys, what normal singlesignature self-custody appears like, and the way multisig is an enchancment for long-term chilly storage.

Why Ought to I Self-custody?

Curiosity in bitcoin often begins with recognizing it in its place financial software that treatments a number of the clear risks of standard cash, akin to inflation, censorship, and confiscation. As motivation grows for transferring wealth into bitcoin, persons are instantly confronted with the choice of methods to safely retailer it.The primary piece of recommendation you may hear is to keep away from custodial options. The explanation for that is easy: custodians of fiat currencies just like the U.S. greenback (banks, brokerages, and so on) can supply sure ensures that custodians of bitcoin can’t. For instance, authorities packages just like the FDIC and SIPC present insurance coverage for when a custodian loses consumer deposits, and this obligation can at all times be met. Bitcoin has a strict provide restrict—21 million cash—and new models can by no means be arbitrarily issued to switch cash which are misplaced by an irresponsible or malicious custodian.Avoiding a custodian implies taking self-custody. On this planet of bitcoin, custody is set by who controls the non-public keys, as a result of the non-public keys are the instruments required to spend bitcoin. When you’ve got bought bitcoin on an trade and haven’t withdrawn it to your personal custody managed by your personal keys, then the bitcoin stays managed by the trade’s keys, and all you will have is an IOU, somewhat than precise bitcoin. As the favored saying goes, “not your keys, not your bitcoin.”

Holding your personal keys merely means defending secretive info, as a result of that’s what a non-public secret’s: randomly generated knowledge that ought to be stored non-public, and can’t realistically be guessed by anybody else. Producing a non-public secret’s simple, and may be completed on a laptop computer or a cellphone app, however it’s preferable to make use of a {hardware} pockets in an effort to believe your key was by no means uncovered to the web. Try a few of our different articles to be taught extra in regards to the causes to make use of {hardware} wallets, and a number of the greatest gadget fashions.It’s utterly regular to really feel apprehensive about holding your personal bitcoin keys. Individuals usually lose info akin to passwords, or bodily objects akin to sun shades and automobile keys. If you’re fearful that you just may lose your bitcoin keys and due to this fact additionally lose entry to your funds, that could be a legitimate concern! Nonetheless, multisig may help you relaxation simple figuring out that you’ve backup plans within the occasion that you just make a mistake and lose some info.

First, what’s singlesig?

To know multisig, it’s necessary to first perceive the predecessor technique of bitcoin storage: singlesig.A singlesig pockets is the only and most generally used type of self-custody bitcoin pockets. It includes only one grasp non-public key, which might generate addresses for receiving bitcoin. If bitcoin is distributed to a kind of addresses, the quantity will likely be counted in the direction of the pockets steadiness, and it might probably solely be faraway from the pockets after approval from somebody who has the non-public key.

The non-public key holder can display approval for a withdrawal through the use of the non-public key to cryptographically signal the transaction. You’ll be able to think about this like a bodily signature being utilized to a doc that specifies the transaction particulars, in a verifiably distinctive manner that may’t be cast. That is completed inside your software program pockets, or for bitcoin in chilly storage, inside a {hardware} pockets. Then the signed transaction may be broadcast to the bitcoin community, the place it would solely be acknowledged as legitimate if the right signature was utilized.

Singlesig wallets get pleasure from being easy to arrange, in addition to offering pretty fast and easy accessibility to withdrawing funds. Singlesig transaction charges also can price lower than multisig.Nonetheless, a serious downside to singlesig is that it at all times includes a single level of failure. Particularly, there are two evident points:

Vulnerability to theft: In case your non-public secret’s uncovered to another person, that individual might have what they should steal your bitcoin.Vulnerability to loss: For those who lose your non-public key info (as a result of negligence or a pure catastrophe), you may lose the power to spend your bitcoin, that means you successfully now not personal it.

Numerous mechanisms have been created in an try and mitigate these issues. Introducing instruments akin to BIP 39 passphrases or Seed XOR right into a singlesig setup may help tackle the primary situation, however they arrive with the trade-off of exacerbating the second situation. One other software known as Shamir’s Secret Sharing can create an enchancment on each ends, however a single level of failure will nonetheless exist when it comes time to signal a transaction.In consequence, many individuals flip to multisig because the gold normal for eradicating single factors of failure.

How is multisig completely different?

Whereas bitcoin secured by singlesig requires one signature from one particular non-public key to spend funds, that is only the start of what bitcoin makes doable. A multisignature bitcoin pockets, because the identify suggests, is a technique of securing bitcoin that may require signatures from a number of non-public keys to be able to spend the bitcoin. A subset of these keys are wanted to log out on spending any bitcoin that has been acquired into that association.This construction is popularly described as an m-of-n quorum. The “m” represents the variety of non-public keys which are required to signal for a withdrawal to develop into legitimate, whereas the “n” represents the variety of non-public keys that exist which might produce one of many required signatures.

For instance, a 2-of-2 quorum signifies that there are two completely different non-public keys concerned, and signatures from each keys are required to withdraw bitcoin that was acquired into that association. This concept could be acquainted to you you probably have ever used a security deposit field at a financial institution. Sometimes, these packing containers require two keys to be opened, one in all which is held by you, and the opposite is held by the financial institution. There are additionally historic examples of comparable approaches.

Alternatively, you may create a 1-of-2 quorum, the place just one out of the 2 keys concerned is required to approve a spend. Or you may create a quorum that includes greater than two keys, akin to a 2-of-3. This might imply that three keys exist within the setup and any mixture of two of them can log out on spending bitcoin.Multisig quorums are customizable to satisfy the wants of the consumer, so it may be prolonged to virtually any quorum you may think about—5-of-6, 2-of-9 or different advanced setups. Nonetheless, some quorums are dramatically extra fashionable than others. 2-of-3 and 3-of-5 are by far essentially the most extensively used preparations for securing bitcoin in chilly storage, for causes that we’ll cowl under.

The commonest bitcoin quorums: 2-of-3 and 3-of-5. Each strike a steadiness between complexity and safety.

Why use multisig?

Switching from singlesig to multisig means introducing extra keys, and due to this fact further complexity. Is it value it? Let’s check out a number of the benefits and drawbacks.

Upgraded safety

Earlier we mentioned a number of the greatest issues that include utilizing singlesig. These included single factors of failure, akin to your non-public key being uncovered, misplaced, or destroyed. How can multisig assist?With sure multisig quorums, redundancy is added to make sure that there is not any one factor that, if it breaks or stops working, will trigger you to lose your cash. You’ll be able to relaxation simple figuring out that if one in all your non-public keys is uncovered to somebody, they won’t have all of the items wanted to steal your bitcoin. Moreover, if one in all your keys is misplaced or destroyed, you may nonetheless get well your bitcoin through the use of the remaining keys in your possession to switch funds into a brand new pockets the place you as soon as once more have all of the items.Nonetheless, not all multisig quorums supply these protections. A “1-of-n” quorum (akin to 1-of-2 or 1-of-5) doesn’t present sufficient resistance to theft, as a result of if any one of many keys is uncovered to somebody, that individual might have what they should steal bitcoin from you (they nonetheless want the related multisig file). Alternatively, an “n-of-n” quorum (akin to 2-of-2 or 5-of-5) would indicate that if any one of many a number of keys are misplaced or destroyed, you’ll now not be capable to spend your bitcoin.Setups that slot in between these two extremes are the candy spot for addressing each classes of single factors of failure: loss and theft. The least advanced association that satisfies each objectives is 2-of-3, which can be the preferred multisig quorum for securing bitcoin in chilly storage, and the one one we use at Unchained. A 3-of-5 quorum is a reasonably fashionable association as properly, but it surely introduces extra complexity than essential for many conditions. Whereas 3-of-5 can present additional redundancy, this level may be repeated to advocate for 4-of-7, after which 5-of-9, and so forth to infinity.

If you wish to get essentially the most out of the protections provided by a multisig association, you need to retailer all your completely different keys in geographically separated areas, in order that no two keys may be misplaced or uncovered on the similar time. The simpler your multisig setup is, the simpler it will likely be to create an efficient system for preserving your keys safe and separated. You’ll be able to learn extra in regards to the trade-offs between 2-of-3 and 3-of-5 in our deeper dive on the subject.

Extra purposes

Apart from providing new custody choices for people, multisig can open the door for serving the wants of teams of individuals. By making a construction the place completely different individuals maintain completely different keys throughout the multisig quorum, some enticing potentialities develop into obtainable. Let’s briefly cowl a pair examples.

Treasury administration

If a enterprise, authorities or different group needs to carry bitcoin intelligently, multisig is all however required. Not solely due to the elevated safety, but in addition to make sure that the individuals throughout the group have the suitable stage of energy to spend funds on behalf of the group.Suppose a committee or legislative council consists of 9 individuals, and this group will likely be liable for managing a bitcoin treasury. If every member of the group secures a non-public key, they’ll customise their construction so {that a} specific threshold of members should log out on a treasury withdrawal. Spending funds may require a small portion of the group (3-of-9), or a majority (5-of-9), or perhaps a supermajority (6-of-9).Particular members of a bunch like this might additionally possess further energy to spend funds, in the event that they maintain further keys throughout the chosen quorum.

Belief-minimized collateral

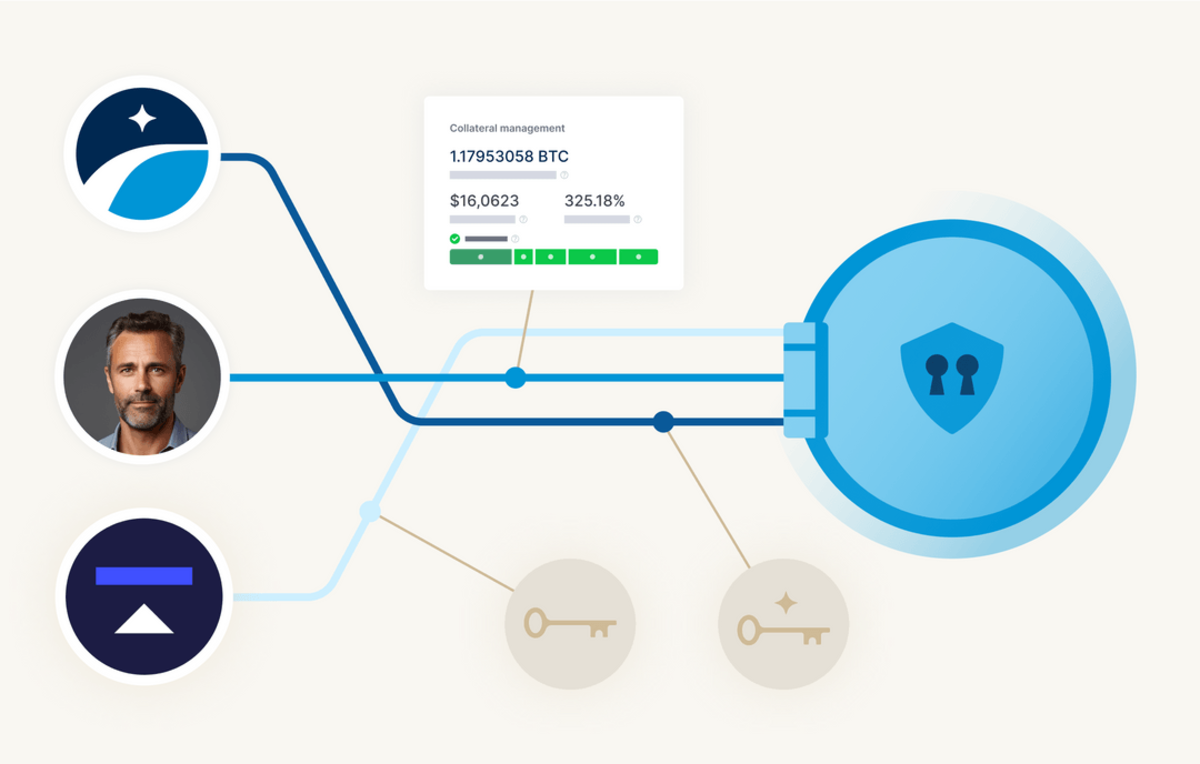

Many bitcoin holders need to train the buying energy of their bitcoin with out promoting it, which may end in capital positive aspects taxes in addition to lacking out on future will increase in worth.A preferred answer to this dilemma is a bitcoin-backed mortgage, often constructed with a 2-of-3 multisig quorum. A bitcoin holder can borrow money from a lender after depositing their bitcoin into the multisig pockets, the place the borrower retains one key, the lender holds one key, a 3rd get together arbitrator holds one key, and two keys are required to withdraw bitcoin from the pockets.

As soon as the mortgage is repaid, the borrower and lender can use their keys to log out on returning the bitcoin to the borrower’s full management. If the mortgage shouldn’t be repaid, the bitcoin may be transferred to the lender’s full management. If there’s a dispute, or both participant is noncooperative, the arbitrator can evaluate the state of affairs and help the justified get together.

With this mannequin, stealing funds must contain collusion between two key holders, destroying the reputations of each entities. This construction is known as “trust-minimized,” a considerable enchancment over placing full belief in a single custodian. It additionally ensures that the bitcoin shouldn’t be being rehypothecated and stays obtainable to be moved into the complete custody of the rightful proprietor at any time.Bitcoin-backed loans are a service provided by Unchained, and you may find out about specifics right here.

Commerce-offs with multisig

As famous earlier, there are a few trade-offs when utilizing multisig in comparison with singlesig. First is the plain improve in complexity that comes with incorporating extra keys into the custody association. With extra keys, there are extra objects to maintain observe of, and every merchandise will ideally be stored in separate areas. This may make it extra cumbersome to withdraw bitcoin out of the pockets, which is sweet for stopping unauthorized entry, however could cause annoyance once you your self want to maneuver funds.One other draw back is elevated transaction charges. For those who obtain bitcoin right into a multisig pockets, once you later go to spend that bitcoin, it would sometimes price you greater than if it had been in a singlesig pockets. This specifics rely upon a number of different components, however on common you’ll be paying extra in charges the extra advanced your quorum is. In different phrases, singlesig will likely be cheaper than 2-of-3, and 2-of-3 will likely be cheaper than 3-of-5.On the brilliant facet, bitcoin’s taproot improve in 2021 made it doable for multisig transactions to be indistinguishable from singlesig on the blockchain. This means that they’d price the identical, and there can be no additional payment burden for multisig quorums! Nonetheless, on the time of writing, this expertise has but to be extensively adopted.A preferred technique to make the most of the safety advantages of multisig whereas decreasing its drawbacks is to carry some bitcoin inside each custody preparations. For instance, you may hold the overwhelming majority of your bitcoin in a chilly storage multisig pockets for the aim of long-term financial savings, and concurrently hold a a lot smaller quantity of bitcoin in a singlesig scorching pockets in your cellphone. That manner, you may relaxation comfortably figuring out the majority of your bitcoin wealth has most safety, whereas on the similar time you may simply ship and obtain smaller quantities in a extra handy method.

use multisig

Most individuals who arrange multisig for the primary time are shocked at how simple and easy the method is, particularly if they’re already aware of utilizing singlesig. That mentioned, there are nonetheless a few strategies value evaluating earlier than you dive in.

DIY (do it your self)

Free and open supply packages exist that can assist you arrange a multisig pockets all by yourself. Examples of such packages embody Caravan, Sparrow Pockets, Electrum, and Specter. There are video tutorials on YouTube if you need some help studying methods to use these packages.Since most bitcoin pockets expertise is constructed to be interoperable, when you use one in all these packages to arrange your multisig pockets, you also needs to be capable to load that very same pockets into one of many different packages (so long as you will have your pockets configuration file saved). This gives some peace of thoughts that if one thing goes flawed with software program you’re utilizing, your bitcoin continues to be protected and accessible.Making a DIY multisig pockets is usually a rewarding academic expertise, and it may also be a very non-public technique of getting arrange. Nonetheless, when you run into any technical difficulties down the street, it could be a headache to search out somebody reliable who may help you out. Equally, if one thing tragic occurs to you, your family members might be tasked with determining the complexities of your multisig association to be able to inherit your bitcoin, which they may discover fairly difficult.

Collaborative custody

Whereas trusting a single custodian together with your bitcoin has been proven to be harmful, collaborative custody multisig is completely different. When completed correctly, you may keep management over the keys to your bitcoin whereas having the additional benefit of specialists who can help you with technical questions or inheritance.For instance, with an Unchained vault, a 2-of-3 multisig pockets is constructed the place you maintain two of the keys and Unchained holds just one key. Which means Unchained can by no means transfer your funds out of the vault with out your permission, as a result of we will solely present one signature whereas two signatures are required for any and all withdrawals. Alternatively, because you maintain two of the keys, you may present the 2 signatures wanted for a withdrawal with out ever counting on Unchained’s key! What’s extra, signing and broadcasting a transaction is a permissionless exercise, so so long as you’re preserving your keys protected and accessible, no person can ever forestall you from shifting your bitcoin elsewhere. Much like a DIY multisig pockets, you may at all times load an Unchained vault into one other software program (utilizing the pockets configuration file) so that you aren’t compelled to depend on our web site or enterprise.

A collaborative custody vault may be precisely known as a type of self custody, as a result of you’re the just one who has full energy to spend the bitcoin in your vault. On the similar time, Unchained’s key can come to the rescue when you lose one in all your keys, or it may be used to assist streamline the method of passing down your bitcoin in accordance with our Inheritance Protocol.

Utilizing collaborative custody shouldn’t be completely non-public, as a result of your collaborative accomplice can have crew members with clearance to see your pockets steadiness whereas they’re helping you with technical questions. Nonetheless, it is very important do not forget that Unchained takes consumer privateness extraordinarily critically, and it’s not possible for Unchained to spend your funds or prohibit your entry to your funds.If you’re keen on establishing an Unchained vault, we invite you to find out about our Concierge Onboarding package deal. You’ll have as a lot time as you want with one in all our specialists personally guiding you thru each step, and ensuring all your questions are answered.

Initially revealed on Unchained.com.

Unchained Capital is the official US Collaborative Custody accomplice of Bitcoin Journal and an integral sponsor of associated content material revealed by means of Bitcoin Journal. For extra info on providers provided, custody merchandise, and the connection between Unchained and Bitcoin Journal, please go to our web site.