Apecoin (APE) is experiencing a rollercoaster experience in 2024. After plummeting to an all-time low of $1.01 in October 2023, the Bored Ape Yacht Membership governance token has skilled a dramatic turnaround, buoyed by strategic whale shopping for and a current partnership with the Arbitrum community.

Nevertheless, with a 13% pullback previously two days and lingering profit-taking considerations, questions stay about whether or not the bulls can defend key help ranges and push the value again in direction of its former glory.

On the time of writing, APE was flashing inexperienced, buying and selling at $1.73, which is a 0.6% and seven.5% improve within the 24-hour and weekly timeframes, information from Coingecko exhibits.

APE value motion. Supply: Coingecko

Using The Arbitrum Wave

The turning level got here on February sixteenth, when the Apecoin DAO voted to launch ApeChain, a devoted blockchain, on the Arbitrum community. This partnership, geared toward tackling scalability points and fostering ecosystem progress, sparked a 21% surge in APE value, pushing it to a six-month excessive of $1.90.

APE seven-day value motion. Supply: Coingecko

APE seven-day value motion. Supply: Coingecko

Whales Maintain Agency, Retail Cashes Out

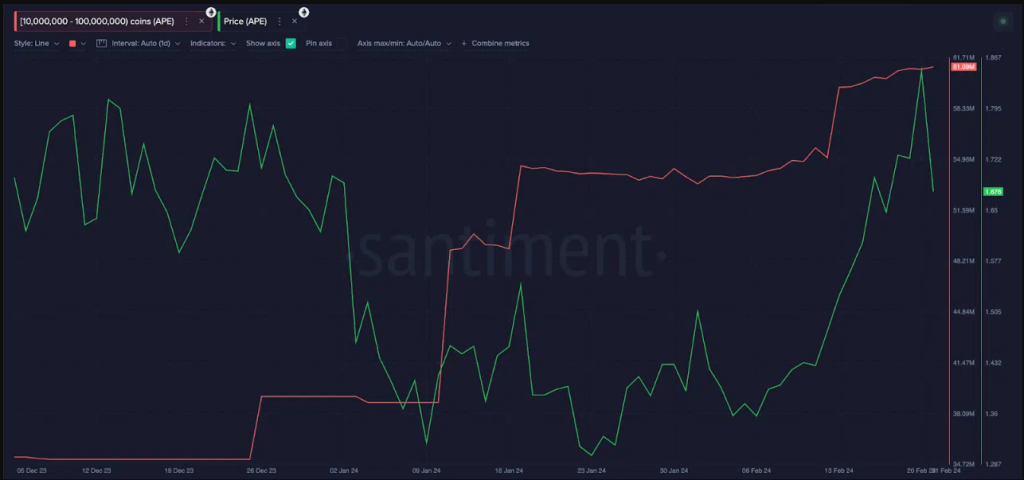

On-chain information paints an interesting image of contrasting investor habits. Whereas retail buyers and swing merchants had been fast to lock in earnings after the rally, “whales” – these holding a minimum of 10 million APE tokens – have displayed unwavering confidence.

Apecoin whale pockets balances up practically 22 million tokens between Jan. 1 and Feb. 21. Supply: Santiment

Since January 1st, these giant buyers have acquired a further 22 million APE tokens, representing a staggering $40 million funding and bringing their whole holdings to 61 million APE. This unwavering conviction suggests long-term optimism within the undertaking’s potential.

Can The Bulls Maintain The Line?

Regardless of the bullish whale exercise, a current pullback has solid a shadow on the optimistic outlook. The value dipped 13% previously two days, testing the essential $1.50 help degree. A breach of this help may set off additional decline in direction of $1. Nevertheless, a big shopping for cluster at $1.50, representing 9,630 buyers who bought APE at that value, may act as a major barrier to a deeper fall.

APEUSD buying and selling at $1.66 on the 24-hour chart: TradingView.com

Eyes On $2, However Hurdles Stay

Technical evaluation and market sentiment counsel a possible early rebound in direction of $2 within the coming weeks. Nevertheless, this hinges on two key components: defending the $1.50 help and overcoming additional profit-taking waves. Moreover, broader optimistic developments within the NFT sector may present tailwinds for APE value.

Trying Past The Quick

Congratulations to @apecoin DAO on its determination to develop ApeChain using the Arbitrum tech stack!

With $APE serving as each the gasoline and governance token for ApeChain, Arbitrum Orbit’s customizability empowers @ApeCoin DAO with true possession and management over this…

— Offchain Labs (@OffchainLabs) February 15, 2024

Whereas the Arbitrum partnership and whale help are encouraging, a number of hurdles stay. The broader macroeconomic local weather, nonetheless grappling with inflation and rate of interest considerations, may influence investor sentiment throughout the cryptocurrency market. Furthermore, the success of ApeChain itself stays to be seen, and any unexpected challenges may dampen enthusiasm.

With a possible $2 mark tantalizingly shut, Apecoin faces a vital juncture. Whether or not the bulls can overcome the rapid hurdles and propel the token to new heights, or if profit-taking and broader market headwinds prevail, stays to be seen.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site fully at your personal danger.