The Federal Reserve, generally referred to as the Fed, performs a pivotal function in shaping the U.S. financial system by way of its financial insurance policies. These insurance policies, together with rates of interest, quantitative easing, and inflation concentrating on, have far-reaching results on varied monetary markets, together with the crypto market.

The Fed’s choices straight affect inventory, bond, and each type of foreign money markets, particularly as a result of the U.S. greenback is the de facto foreign money for worth trade.

As an example, throughout the COVID-19 pandemic, the Fed took measures to spice up the financial system by decreasing rates of interest to historic lows to encourage borrowing, spending, and investments. The result was a “V-shaped” restoration, by which the S&P 500 rebounded rapidly from a pointy drop of over 20% and reached all-time highs.

Consequently, many development shares did nicely, with excessive valuations and huge market capitalizations within the crypto sector because of the inflow of investor funds.

Nevertheless, in 2022, when the Fed raised rates of interest to deal with inflation considerations, it resulted in a notable financial contraction that met the technical definition of a recession. Curiously, this resulted in poor efficiency for the crypto and led to what’s colloquially described as crypto winter.

This underscores the interconnectedness between the Fed’s insurance policies, conventional monetary markets, and the crypto market, emphasizing the necessity for crypto traders to remain knowledgeable about broader financial traits.

This text explores the connection between the Federal Reserve’s insurance policies and crypto market traits. Our objective is to grasp the underlying elements and potential results of this relationship. This may provide invaluable insights into how modifications within the Fed’s insurance policies might affect the long run route of the crypto market.

How Do the Fed Insurance policies Have an effect on the Crypto Market?

When the Federal Reserve makes use of expansionary financial insurance policies, like quantitative easing, it provides more cash to the financial system, which might elevate costs. On account of worries about inflation, traders might search for different methods to guard their cash.

Issues about inflation throughout such durations might immediate traders to hunt different avenues for safeguarding their belongings, with cryptocurrencies typically being thought-about. This must be excellent news for the crypto market, however it isn’t all the time good; there are adverse penalties, too.

A well-liked view about cryptocurrencies, notably Bitcoin, is that they’re a hedge towards inflation attributable to their capability to retailer worth over time.

Nevertheless, when rates of interest rise, and fiat foreign money loses worth, traders might divert funds from cryptocurrencies to hunt safer and profitable choices.

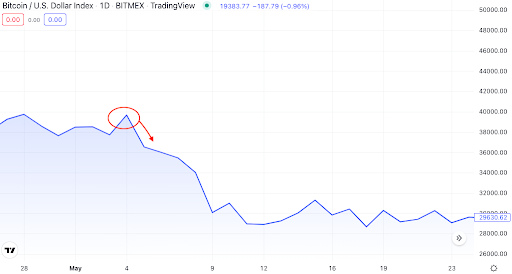

Analyzing the Fed’s actions in 2022 supplies insights into the crypto market’s response.

Within the chart above, the worth of Bitcoin skilled a pointy reversal throughout the Fed assembly held in Could 2022. This was following the announcement that there would solely be a 0.5 share level enhance within the rate of interest.

At its peak, Bitcoin’s worth reached virtually $40,000. Nevertheless, this was short-lived, because it quickly plummeted because of the adverse affect attributable to the huge sell-off of U.S. know-how shares on Could 7, 2022.

The chart above reveals a decline in Bitcoin’s worth, which occurred following the two-day assembly of the Federal Reserve on 14 and 15 June 2022. This drop in worth took place because of the Fed’s choice to extend rates of interest by 0.75%.

Adjustments within the Fed’s insurance policies introduce volatility to the crypto market. Fast shifts in market sentiment, influenced by the Federal Reserve’s responses to financial efficiency, can carry each dangers and alternatives for traders. This volatility, whereas presenting the potential for substantial earnings, additionally heightens the danger of great losses.

The Federal Reserve’s actions might also immediate elevated regulatory scrutiny of the cryptocurrency market. Because the crypto market expands, considerations about its potential affect on monetary stability might result in stricter rules. This, in flip, might pose challenges to the expansion of the cryptocurrency market.

Regardless of these dangers, the correlation between the Federal Reserve’s insurance policies and crypto market traits gives advantages. The recognition of cryptocurrencies in its place funding avenue contributes to portfolio diversification, doubtlessly decreasing total threat.

Moreover, the decentralized nature of cryptocurrencies supplies a stage of economic freedom and suppleness not present in conventional belongings, additional enhancing their attraction within the evolving monetary panorama.

How Federal Reserve Insurance policies Could Impression the Crypto Market Tendencies within the Future

The crypto market is thought for being very unstable and affected by various factors which are out of the Federal Reserve’s management. This makes it arduous to foretell how Federal Reserve insurance policies will have an effect on the market sooner or later. When considering potential impacts, varied situations warrant consideration.

If the Federal Reserve opts for rate of interest cuts and implements quantitative easing, it would spur elevated adoption of cryptocurrencies as a hedge towards inflation.

This might appeal to new traders, together with institutional gamers, doubtlessly fostering development within the crypto market. Nevertheless, such a state of affairs poses dangers, together with the potential for a market correction or crash triggered by abrupt coverage modifications.

Conversely, shifts within the Federal Reserve’s methods to deal with inflation considerations, similar to elevating rates of interest or lowering quantitative easing, may very well be detrimental to the crypto market. Traders might shift from riskier belongings like cryptocurrencies to safer choices, impacting the worth of digital belongings as traders mitigate threat publicity.

Because the cryptocurrency market expands, it could change into much less inclined to exterior shocks and fewer reactive to modifications in Fed coverage. This maturity might doubtlessly lead to a extra steady market much less vulnerable to vital fluctuations.

In Conclusion,

The connection between Federal Reserve insurance policies and the crypto market is poised to change into stronger because the crypto market continues to develop due to the U.S.’s unclear method to the brand new monetary paradigm.

Traders want to stay vigilant, as modifications in Fed insurance policies can result in substantial fluctuations within the crypto market, influencing funding choices and doubtlessly inflicting losses.

Policymakers should additionally acknowledge this connection and think about its implications for total financial and monetary stability. Balancing rules that encourage crypto trade development whereas sustaining stability is essential, acknowledging each potential dangers and advantages, similar to enhanced monetary inclusion and innovation.

If you want to learn extra articles like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

The publish Understanding the Correlation Between Federal Reserve Insurance policies and Crypto Market Tendencies appeared first on DeFi Planet.