Welcome to the February CryptoSlate Alpha Month-to-month Snapshot, an unique round-up designed for our CryptoSlate Alpha subscribers.

In February, our complete stories and insightful articles delved deep into the crypto ecosystem, providing a mix of market evaluation, analysis insights, and forward-looking tendencies that might form the way forward for finance and know-how.

Our February Alpha Market Experiences included an in-depth take a look at the financial implications of the Fed’s reverse repo (RRP) facility and its potential ripple results on Bitcoin, alongside a vital evaluation of credit score spreads and their significance for the crypto market.

We additionally explored why governments ought to favor regulating stablecoins over creating Central Financial institution Digital Currencies (CBDCs), providing a nuanced perspective on digital forex governance.

Analysis articles highlighted record-breaking financial funding in Bitcoin, analyzed the calm earlier than the storm in Bitcoin’s market conduct, and introduced the unprecedented stability in Bitcoin futures and choices open curiosity.

Notably, our insights identified the vital position of US exchanges in offering liquidity to the Bitcoin market and the shifting development in direction of long-term holding as trade balances dipped to their lowest since 2018.

Our prime Alpha Insights supplied a complete view of the crypto panorama, from the implications of HODL waves and on-chain metrics suggesting a speculative market and potential community well being declines to the numerous impression of short-term buying and selling volumes and institutional participation.

We dissected the true value of mining one Bitcoin, examined the speculative and resilient nature of Bitcoin traders, and offered a granular evaluation of Bitcoin’s buying and selling patterns, provide distribution, and the consequences of ETFs on market dynamics.

Be part of us as we unpack these subjects, providing our Alpha subscribers a big selection of data-driven analyses and professional commentary on the evolving crypto house.

February α Market Experiences

The financial implications of the Fed’s reverse repo (RRP) facility

CryptoSlate explores the intricacies of the RRP facility, exploring its impression on conventional monetary markets and its potential results on Bitcoin.

What are credit score spreads, why are they tight, and what does it imply for Bitcoin?

CryptoSlate’s dives into the idea of credit score spreads and analyze their present state to grasp their impression on the broader monetary and crypto markets, particularly on Bitcoin.

Why governments ought to regulate stablecoins as an alternative of creating CBDCs

CryptoSlate appears into the advantages of stablecoin regulation to discover why it could serve each personal and public pursuits higher than CBDCs.

February α Analysis Articles

File excessive realized cap exhibits unprecedented financial funding in Bitcoin

The Bitcoin community and its members have by no means been as economically invested in BTC as as they’re now.

The Bitcoin market faces a vital second amid hovering unrealized earnings

Spot ETF inflows and bullish sentiment buoy Bitcoin, regardless of potential volatility from unrealized good points.

Bitcoin’s surge to $57K didn’t lead to liquidation storm, defying anticipated development

Regardless of Bitcoin’s excessive flying, liquidations stay grounded — indicating a market that’s cautious.

Bitcoin futures and choices open curiosity soars in February

Bitcoin’s choices tilt in direction of bullish calls, regardless of a short-term uptick in defensive places

Bitcoin community congestion eases as mempool clears in February

Bitcoin’s mempool unclogs in February bringing a breath of contemporary air to transaction processing.

How do US exchanges contribute to Bitcoin’s market liquidity?

US exchanges account for a comparatively small portion of the worldwide buying and selling quantity however present 49% of the worldwide liquidity, which suggests they’ve larger market depth to facilitate bigger transactions for a smaller variety of merchants.

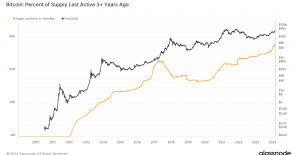

Bitcoin trade steadiness dips to lowest since 2018 as market shifts to HODLing

Bitcoin holders transfer away from exchanges in long-term holding development.

Rising stablecoin provide exhibits an inflow of capital into the crypto market

Rising stablecoin market cap exhibits elevated capital circulate into crypto and investor readiness for market actions.

On-chain information exhibits Bitcoin provide is tightening

Unspent transaction outputs and accumulation tendencies sign a tightening Bitcoin provide amid rising institutional curiosity.

Futures open curiosity hits two-year peak with Bitcoin above $50k

File excessive in Bitcoin futures open curiosity aligns with its value breakthrough.

Bitcoin’s risk-adjusted return potential skyrockets as Sharpe Sign surges

Glassnode’s new metric exhibits a promising rebound in Bitcoin’s market sentiment.

Why did Bitcoin’s market cap surge by over $102 billion whereas realized cap solely grew by $4 billion?

Whereas Bitcoin’s market cap witnesses drastic enhance, its realized cap presents a extra grounded perspective of worth.

Bitcoin above $44k spurs market confidence with spike in unrealized earnings

Profitability skyrockets amongst Bitcoin traders as market sentiment improves.

What Bitcoin’s buying and selling patterns on centralized exchanges inform us in regards to the market

CryptoSlate’s evaluation of Kaiko information confirmed that almost all of worldwide Bitcoin buying and selling takes place exterior the U.S. on Binance.

Bitcoin choices present long-term bullishness and near-term pessimism

Bitcoin choices information exhibits a bullish future outlook amidst present market hesitation.

How ETFs affected Bitcoin’s provide distribution throughout cohorts

Spot Bitcoin ETFs prompted important shifts in Bitcoin provide distribution.

Brief-term buying and selling quantity peaks as Bitcoin crosses $43,000

Bitcoin’s SLRV ratio exhibits spot Bitcoin ETFs more than likely spurred unprecedented short-term buying and selling volumes.

Whales and establishments lead the cost in Bitcoin’s trade quantity surge

Glassnode information exhibits whales and establishments as major actors in Bitcoin’s trade quantity rise.

Right here’s why Bitcoin perpetual futures market noticed excessive volatility in January

January sees merchants reassessing Bitcoin perpetual futures amidst rising ETF choices.

Marathon vs Riot: Analyzing the true value of mining 1 bitcoin

Estimating the true common value of mining a single Bitcoin for 2 of the biggest publicly traded Bitcoin mining corporations.

February High α Insights

Evaluation of HODL waves reveals a speculative market at play

Bitcoin’s journey from $25,000 to $50,000 not marked by excessive short-term hypothesis.

On-chain metrics reveal Bitcoin community’s well being hinting at potential decline

Month-to-month and yearly metrics of Bitcoin on-chain exercise reveal community well being and utilization tendencies, highlighting potential declines.

Bitcoin’s STH Realized Value nears $40,000, signaling sturdy market momentum

Analyzing Bitcoin’s dynamics: The STH Realized Value’s position in present market tendencies.

U.S. leads in Bitcoin value surge as Asia sees decline

America, with its bullish stance, leads the pack with a whopping 12,200% value change.

Evaluation challenges Bitcoin diminishing returns concept amid current good points

Bitcoin’s present cycle showcases energy with a virtually 287% appreciation from the low, difficult the diminishing returns concept.

2021 Bitcoin traders showcase long-term holding resilience

Bitcoin traders from 2021 decrease their value foundation by strategic purchases in a bear market.

After 153 days in $40k-$45k vary, Bitcoin goals to shut sixth ever month-to-month shut above $50k

Navigating above $50,000, Bitcoin suggests ongoing consolidation after breaking long-term vary.

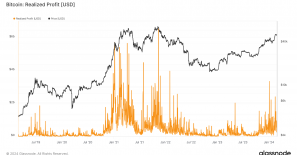

Brief time period holders despatched file $3 billion in revenue to exchanges

Spot ETF success propels Bitcoin past $58,000, showcasing investor confidence.

Bitcoin traders notice internet earnings for 128 consecutive days

Regardless of Bitcoin’s strong efficiency, 2024’s profit-taking depth fails to match the 2021 bull run’s fervor.

From file highs to notable lows: Bitcoin charges after the inscription booms

Bitcoin charges hit a brand new low, miners see fee-based income stabilize at 6%.

The publish From credit score spreads to HODLing patterns: Navigating February’s crypto market shifts appeared first on CryptoSlate.

.png?format=1500w)