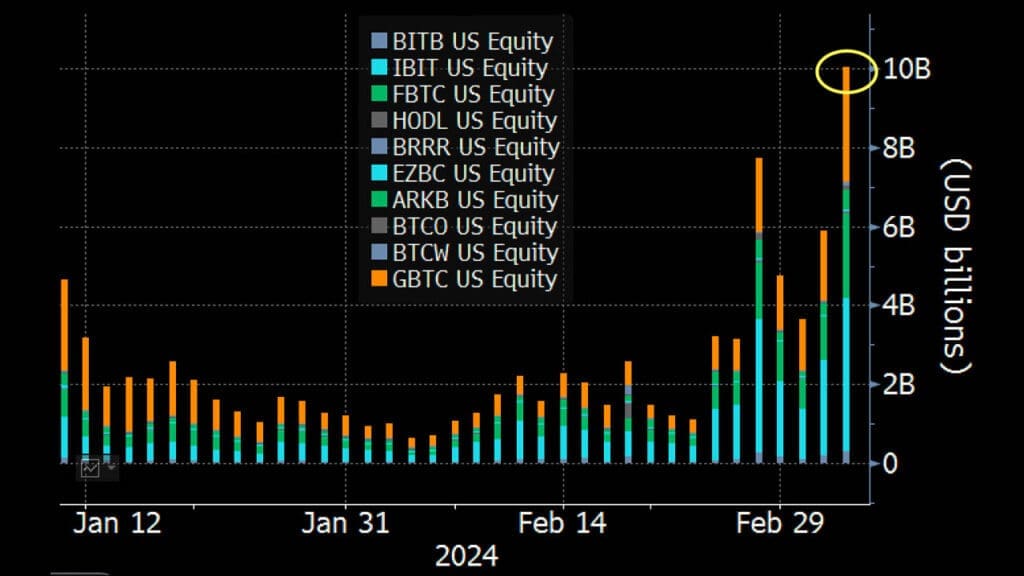

In step with the record-breaking value of Bitcoin (BTC), Bitcoin ETFs additionally achieved report buying and selling volumes. Knowledge from yesterday confirmed a buying and selling quantity of 10 billion {dollars}.

In a chunk of reports we shared with you yesterday, we mentioned the actions within the cryptocurrency markets, noting that the value of Bitcoin (BTC) was on the verge of setting a brand new report. This prediction materialized inside hours, with BTC climbing to $69,170. Nonetheless, this rise was not sustained initially. Following its sharp improve, BTC underwent a major correction, dropping to the $59,300 degree. As of the time of writing, BTC is buying and selling at $66,469.

Amid these developments, Bitcoin ETFs captured widespread consideration. It is because the U.S. authorization of ETFs allowed buyers to not directly spend money on Bitcoin. Current updates point out that report quantity ranges had been reached on March 5.

A transaction quantity of 10 billion {dollars} has been reached!

The info on Bitcoin ETFs reveals that on March 5, a buying and selling quantity of 10 billion {dollars} was achieved. The Bitcoin ETF named “IBIT” by BlackRock emerged as essentially the most favored funding fund, with 3.8 billion {dollars} being transacted by way of IBIT alone.

The continued exercise within the cryptocurrency markets is predicted to proceed driving important volatility in Bitcoin ETFs. Nonetheless, it’s vital to know that this doesn’t assure a steady upward development. BTC might expertise fast will increase and endure sharp corrections inside hours, simply because it did the day past. Consequently, this volatility may result in important fluctuations in altcoins together with BTC.

*This content material shouldn’t be thought-about as funding recommendation.

You may additionally like this content material

Observe us on TWITTER (X) and be immediately knowledgeable concerning the newest developments…

Copy URL